by Ashley

I broke my cardinal rule. I counted my proverbial chickens before the eggs have hatched. And I’m taking a bit of a risk to do this, but…..

I JUST PAID OFF MY WELLS FARGO CREDIT CARD!!!!!!

(*cue the herald angels singing and imagine my euphoric screams here*)

This was a big – HUGE – deal.

Starting to write here has changed my life (I know this sounds cliche and silly given that it’s been 2 months, but I’m for real). I swear, if I had continued just as a reader (not contributing), there is NO WAY I would be here right now. These past couple months we’ve done pretty well with pay. So we’d be sporting flashy new clothes, or perhaps taking a fun summer vacation. We would put a little extra toward debt, too, but we certainly wouldn’t be throwing every single penny possible toward debt payments and, thus, be in our current position.

You don’t know how happy this makes me! Since I’ve started here: I paid off my Capital One credit card (once maxed out at $7500, balance when I started blogging in March = $413). Next, I paid off my Wells Fargo credit card (once maxed out at over $10,000, balance when I started blogging in March = $7700). Next on my radar is my last credit card, Bank of America. With “only” a balance of $2200, it should be gone within a month.

How did I do this?

First, we’ve been cutting back (I have a whole money-saving tricks series!).

But let’s not kid ourselves, this has primarily been due to increased income (well above our “average”). And every extra cent has been thrown toward debt.

How else did I do this?

Well…..I cheated the system a little. I couldn’t help it. For those with variable incomes, this is a “do what I say, not what I do” moment…..

I have mentioned before that we have a budget (for all of our minimum expenses and debt obligations). We wait until the month is completely over to determine how much “extra” is leftover, and we apply that money toward debt in the following month (as a one-time snowflake payment).

Wellllllll…….I didn’t do that this month. It was driving me CRAZY to see my checking account balance high enough to pay off the WF CC and I didn’t want to wait until May was over to apply the funds! So, this messes up my budget a little but I ended up doing two things I would generally advise AGAINST for anyone with variable incomes (1) I spent money that will hopefully be in surplus from this month (May) to apply toward the WF balance (even though we don’t know yet exactly how much surplus we will have), and (2) I used some logic to assume that, should our surplus not be as much as I’m guesstimating….then I can “borrow” the money from myself. Our current monthly payment to WF is $900, so basically I’m using the June money and applying it toward our balance NOW instead of waiting a week until June is officially here.

I was able to do this because we currently have these funds in my checking account. If something were to go wrong (i.e., husband has work problems/doesn’t have jobs the rest of the month/terrible problem that costs money instead of making money), then it is still “okay” because I had this money available in my Capital One 360 Savings (I talked about all my assets in this first post…we don’t have a ton, but we do have some liquid cash in a money market account + CapOne 360 savings).

This is definitely “counting my chickens before the eggs have hatched” because the month isn’t over yet….so I have no way of knowing whether our income will truly be high enough to justify a huge (almost $3500) payment toward this bill.

But I did it anyway.

So hopefully when the dust settles from May I’ll discover that I made a good decision (meaning, we had enough “extra” money to cover this expense). If not, then that just means that our savings has decreased a little and – oh well. I think it was worth it to get out from under the 13.65% APR credit card debt (side note: Now all of our remaining debts are under a 10% APR. For some reason, this feels like a big threshold to cross – even though I won’t be satisfied until we have NO debts and aren’t paying ANY interest!)

Oh happy day!!!!

I am smiling from ear to ear! Bank of America….you’re next! Mwhahahaha!!!!! (<<<< I love my evil debt-paying laugh! Feels so good! ) : )

Thanks for all of your advice, suggestions, and support along the way!!!

Hi, I’m Ashley! Arizonan on paper, Texan at heart. Lover of running, blogging, and all things cheeeeese. Freshly 40, married mother of two, working in academia. Trying to finally (finally!) pay off that ridiculous 6-digit student loan debt!

A-MAZING!!!!!!

Congrats! Hope everything will work out the way anticipated.

Congrats! What a progress! Wo-hoooo! I can almost hear your evil debt-paying laughter from across the ocean. Isn’t that amazing how you recognize what you would have done if you haven’t focused on debt payment by becoming a blogger here? I am jumping up and down with joy for you.

I have literally become debt free last month. I must admit my debt was much much smaller due to an investment property I had purchased three years ago. Yet, making that one last payment was one of the best moments in my life.

Wow, that is awesome! Congrats on being debt free!!!

Congratulations!!

Congratulations Ashley — the happiness of posters like you about getting out of debt is what I stop in here for. Well done and keep up the great work!

Thanks Eviva!

Heck yes! What a life changing two months. Your resolve is remarkable.

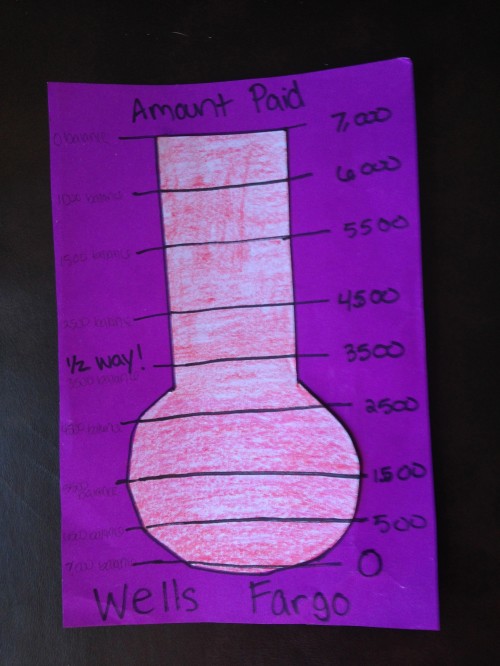

Awesome job! Although I think you did it just so you could color in your thermometer 🙂 I hope you leave it up anyways for awhile as a reminder of your sacrifices to get there and the euphoria of seeing it gone.

Not gonna lie….coloring in the thermometer was definitely a good feeling ; )

Awesome!

Congratulations! Can’t wait to see the new updated debt chart next month. I think the next things you focus on will go down even faster because of the huge snowball you have now!

You must be feeling great!

Well it happened.You’ve been bit by the debt destroying bug. Now you’ll only see debt as an entrapment to avoid like the plague.

Congrats!! It feels amazing to pay off a debt and have it GONE from your life. Keep up the good work.

I love the evil laugh at the end. Great job paying off another debt!

Ashley-

Congratulations!!! I am so excited for you! I am really enjoying reading your story, I agree with the other posters that you have really grabbed onto the debt-free goal and are going strong! I have no doubt that you will get there eventually and I will definitely be here cheering you along.

Not to be a Debbie Downer, but I do want to mention one little point, while it will no doubt be a small amount (in comparison) there may be a bit of residual interest that will cause a small balance to show on your card next month; hopefully it will be something that you can wipe out right away and officially be in the free and clear as far as this debt is concerned!

You are kicking debt’s butt with some serious firepower! I look forward to hearing that you are able to wipe out your next credit card with as much intensity and speed!

Cheers,

Meghan

P.S. Did you and your husband take your celebratory $100 yet? I’m sure I’m not the only one who would love to hear how you celebrated such an accomplishment!

I’m already anticipating the small interest bill (same thing happened with Capital One). I still “count” THIS as being paid off…..if a bill comes next month I’ll pay it immediately and pretend it never happened (because I want to remember THIS as my pay-off….not an after-the-fact interest payment). Thanks for the heads up, though, bc this definitely surprised me with the Cap One cc!

Oh, and regarding the “celebration”……we didn’t do a night out or anything intentional, but I think I count last weekend as a “celebration” of sorts. Husband had the whole weekend off (a rarity) and we spent it doing fun things together – neighborhood pool, family walk, hanging out, etc.

I loved the idea of swapping babysitting with friends and plan to try to do that at some point. We have 1 couple that would be perfect for that, but they’ve been traveling so I haven’t asked my girlfriend about it yet.

That kind of high is not one you would have ever gotten on that new wardrobe. 🙂 Great job Ashley!!! Is your husband as happy about your debt payoff progress as you are? I hope so – keep up the good work.

He definitely is. I don’t think its as “real” for him (just since I’m ALWAYS looking at the numbers, and he only deals with it once a month when we talk about the surplus at the end of the month), but he’s definitely excited. We’ve been having the talks about what we’ll do with the money when we get out of debt, how we want to proceed with future debt payments, etc. It’s fun to think that someday this money will be in our pockets (or invested, saved for a house, etc), rather than being paid toward existing debt and interest! Ick!

Congratulations! That is awesome! That has got to be a huge relief! I would have done the same thing to get that credit card paid off…I have a feeling everything will work out fine this month:)

Congrats! It’s the best feeling, isn’t it? Kudos to you and your debt-paying tenacity.

Congrats!!! This is exactly what this site is for cuz after I read your post… I looked at my debt to see where I am!!! Congrats and thanks for sharing your story!! U got me excited to kick my debts butt now too! 🙂

Yay! Happy to share this journey! Good luck to us both!

Hurrah!!! Hurrah!!!!! Congratulations on an excellent job!

I feel like a broken record: you are kicking major debt butt!

Congratulations! What a fabulous accomplishment. You should be very proud. 🙂

Whoo hoo! Good going, Ashley and family!