Since bloggingawaydebt.com is about getting out of debt, we wanted to get together and lay out a comprehensive roadmap with the basics for getting out of debt, all in one place. If you do have a lot of debt, here is a rough overview of the questions and things you should be thinking about:

- What debts do I have?

- What are my rights, as someone who has debts?

- Are these debts mine to pay?

- Can I reduce the principal of my debts, or the interest rates?

- I need more money to be able to pay off these debts

- What’s the best way to pay down my debt?

- Staying motivated

- Should I be in a hurry to pay off lower interest loans? What rate is “low” enough to where I should just pay the minimum?

- Remember, there are no shortcuts

- Additional resources

What debts do I have?

If you’re just getting started with your debt repayment plan, make a list of all the debts that you have. On that list, also note the interest rate, monthly payment amount, or any other fees that you may be paying (for example: overdraft fees, or annual credit card maintenance fees). A good example would be something like this:

| Name/Type of Account | Interest Rate | Monthly Payment Amount And Fees | Remaining Balance Owed |

| Auto Plus Car Loan | 12.50% | $265.80 | $7,236.23 |

| Great Lakes Student Loan | 6.25% | $115.00 | $3,259.00 |

| Capitol One Visa | 18.90% | $167.00 | $8,890.59 |

| Macys Store Card | 22.00% | $43.00 | $860.13 |

| Total Monthly Payments: | $590.8 | ||

| Total Balance Owed | $20,245.95 |

The main idea here is that once you have all the information about what you owe, you can use it as a basis for figuring out how to pay off your debts.

If you are not sure what you owe and to whom:

- Get a free copy of your credit report. Under Federal law, you are entitled to one free copy of your credit report every year from each of the big three credit reporting companies. You can get your credit report online from annualcreditreport.com, the only officially authorized website for 100% free credit reports, or call 1-877-322-8228. You will need to provide specifics like your name, social security number, address and date of birth.

- The National Student Loan Data System has data about your Title IV loans and/or grants. The site displays information on loan and/or grant amounts, outstanding balances, loan statuses, and disbursements.

What are my rights, as someone who has debts?

In the US, debt collection agencies have to adhere to the Fair Debt Collection Practices Act. That means that you have some rights. Know the basics so that you can take advantage of them, if necessary.

Are these debts mine to pay?

Sometimes people claim you owe debt that you don’t actually owe.

- Mistakes. Sometimes honest mistakes are made, and someone charges you for something that you shouldn’t have been charged for. You should try to resolve the issue with the vendor first. If the initial point of contact can’t help, you may ask to speak with a supervisor. Make notes of the conversation, including the names of the people you talked to. If that doesn’t help, you can often contact a regulating agency and complain about the company. For example: the FTC can sometimes help, your local Better Business Bureau can sometimes be effective, and the Consumer Finance Protection Bureau is a good option.

- Identity fraud. Sometimes, identity fraud happens, and someone used your information to get money – and left you to pay the bill. Reddit has a good FAQ on identity theft that’s worth reading.

- Parent PLUS loans. These loans are held in the parent(s) name and cannot be transferred to the student under any circumstances. You have no legal obligation to pay Parent PLUS loans if you are the student, although you may feel an emotional obligation to do so.

- Very old debts. There’s a statute of limitation on most debts in the US. The term depends on the kind of debt and on what state you are in. Debt collectors are allowed to try and collect debts that are past the statute of limitations, but you are not obligated to pay these debts once the statute of limitations has passed.

- “Inherited debt” – Debt is not inherited from generation to generation. If someone tells you that you need to pay on a deceased family member’s debt, this is generally untrue. Debts of the deceased that aren’t cosigned are paid out of the deceased’s estate. If you feel you are being held responsible for a deceased family member’s debt that you aren’t responsible for, consider consulting an attorney. Inheritance laws may differ from state to state, so you’ll want competent legal assistance.

Can I reduce the principal of my debts, or the interest rates?

You can always try! Some ideas:

- Negotiate the amount that you need to pay. This can work for medical debts, especially if you can prove that you have a low income or offer to pay a reduced amount in full. It can also work for other debts. For example, you can ask if there’s a discount when you can pay the full amount within a few days. It can also work for older debts, because sometimes the debt collector will know that it’s better to get $500 from a $900 debt from you now, than to keep fighting to get the full amount from you.

- Negotiate the interest rate. This can work with credit card companies. You can call them and ask for a lower interest rate. However, you should always pay your credit card bills off in full, every month, no exceptions. If you do this your effective interest rate is 0%.

- Refinance or transfer your debt(s). Zero percent introductory interest rate credit cards and balance transfers can help you manage your credit card debt (note: there’s often a fee for transferring the balance, so make sure the fee is worth it). The caveat is that if you miss a payment or don’t pay off the entire balance by the end of the promo period you will be charged back interest as if the promo period never happened. Other options that may give you a lower interest rate, are: a personal loan with your bank, a HELOC on your house, a loan with a P2P-lending companies (Prosper, Lending Club, etc.), or refinancing student loans through a third party.

- Some student loan servicers offer a slight discount on the interest rate if you set up auto-pay.

Please be aware that these tactics may help you pay down the debts quicker, but some use these tactics as an excuse to borrow more money. Please use these tactics to reduce your debt burden as much as you can, but after you’ve paid up stay out of debt for good.

I need more money to be able to pay off these debts

If you need more money, it’s time to budget. Look at all of your assets: are you able to sell some to make some more money? Can you increase your income? There may be options to get financial aid from the government or from charities. If so, take all the help that you can get. You may be able to pay it forward later, if you want to.

How can I save more money?

Where most people run into trouble with their budget is by starting with their current expenses.

Instead, start your new budget with your target savings rate: the percentage of your money you want to put toward paying down debt. Once you’re debt-free, you can invest that money to build wealth, but for now your priority is to rid yourself of expensive debts once and for all.

Your extra debt payments should be the first and most important expense listed in your budget. Everything else comes secondary and should come under scrutiny for cutting.

List every single monthly expense, starting with regular monthly expenses (like your housing payment and your car payment), then irregular monthly expenses (like groceries), and finally occasional-but-inevitable expenses that you incur every year but not every month (like gifts and insurance premiums). Nothing is sacred – where can you trim or eliminate entirely?

Keep in mind that your largest expenses offer the largest opportunity for savings. Per the BLS, the average American spends roughly 70% of their budget on their top three expenses: housing, transportation, and food. Focus on those three first.

In particular, look for ways to reduce or eliminate your house payment by house hacking. House hacking involves finding a way to offset your housing payment with other people’s money. Options include bringing in housemates, renting out rooms on Airbnb, buying a multifamily and renting out the neighboring unit(s), or even hosting a foreign exchange student. See this breakdown for more house hacking ideas, to effectively score free housing.

You can use this FREE tool from Undebt.it. They provide a mobile-friendly snowball/avalanche calculator app to help you live debt free. The payment is easy-to-follow so you can finally eliminate your debt!

What’s the best way to pay down my debt?

The first thing to do is figure out what you owe – the worksheet above is a good example of how to start this process.

There are two main strategies for paying off debt.

- In the avalanche method, debts are paid down in order of interest rate, starting with the debt that carries the highest interest rate. This is the financially optimal method of paying down debt, and you will pay less money overall compared to the snowball method. The major disadvantage is that it sometimes doesn’t take psychological and motivational factors into account.

- In the snowball method, popularized by Dave Ramsey, debts are paid down in order of balance size, starting with the smallest. Paying off small debts first may give you a psychological boost and improve one’s cash flow situation, as paid off debts free up minimum payments. The downside is that larger loans (that may be at higher interest rates) are left untouched for longer, costing more in the long run.

In both cases you should make the minimum payments on all of your debts before choosing which method to devote extra money to. As an example, Debtor Dan has the following situation:

- Loan A: $1,100 with a minimum payment of $100/month, 5% interest

- Loan B: $3,300 with a minimum payment of $300/month, 10% interest

- Sudden windfall: $1300

Dan needs to first pay $100 + $300 = $400 to make the minimum payments on loans A and B so the payments are recorded as “on time.” The extra $900 can either go towards Loan A (smallest balance, snowball method) or Loan B (highest interest rate, avalanche method).

What’s the better approach. Most people would default to the avalanche method (The avalanche method is always the financial optimum), but do not underestimate the psychological side of debt payments. If you think that the psychological boost from paying off a smaller debt sooner will help you stay the course, do it! You can always switch things up later. The important thing is to start paying your debts as soon as you can, and to keep paying them until they’re gone. There are also a number of good free debt reduction tools available that can help you get an idea of how long each method will take, and how much interest you’ll be paying overall.

If you struggle with understanding why the avalanche method is optimal, consider that you should not be comparing which loan is currently costing you the most interest total. It is not a question of “shall I pay off this $1,100 loan or shall I pay off this $3,300 loan?”. You don’t have a magic fairy who says she will pay off one of your loans, no matter its size. The right question is: “Given a specific amount of money that I can put towards the loans, which loan(s) should I pay down/pay off to save me the most on interest”. So, if Debtor Dan has got that extra $900, putting it towards the 5% loan will save him $45 per year in interest, while going to the 10% loan will save him $90 per year.

You can use this FREE tool from Undebt.it. They provide a mobile-friendly snowball/avalanche calculator app to help you live debt free. The payment is easy-to-follow so you can finally eliminate your debt!

Staying Motivated

A lot of people make a plan, get started on paying off their debt and never end up getting clear of their obligations. So, you’ll want to build your debt payoff strategy to a) stay motivated and b) avoid relapse. Here are some points to consider:

- After you’ve paid off your first debt, consider saving up $1,000. This way if an emergency happens (your car dies, you or your family need medical care, or the roof starts to leak), you won’t have to borrow. This is Dave Ramey’s recommendation. Its good. It works.

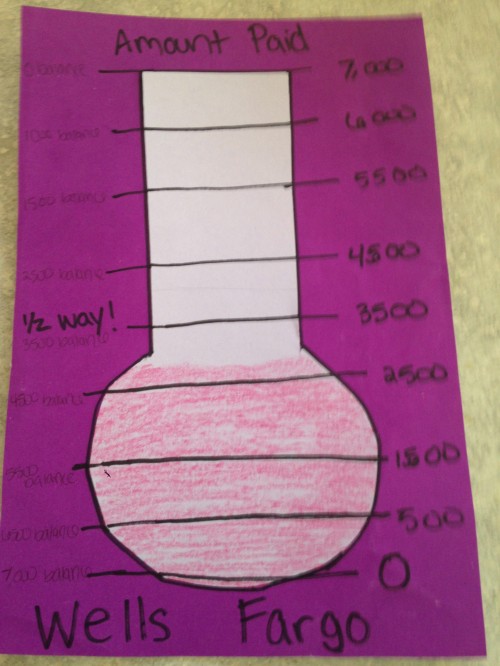

- Second, you’ll want to stay motivated. A good way to do this is using a visual aid, something like this debt thermometer.

- Reviewing your debt repayment worksheet weekly can also help you focus (Hint: it goes great on the fridge or you can put it someplace to remind yourself of your goals.

Should I be in a hurry to pay off lower interest loans? What rate is “low” enough to where I should just pay the minimum?

Depending on your attitude towards debt, you may want to stop paying off loans with low interest rates once you have paid all other loans above that threshold. A common argument is that the long-term return from investments in the stock market will likely exceed the interest rate from a low-interest loan. While this has been true in the past, keep in mind that paying down a loan is a guaranteed return at the loan’s interest rate. Stock performance is anything but guaranteed. A fairly common consensus is that loans above 4% interest should be paid off in the debt reduction phase, while anything under that can be stretched out.

Remember, there Are No Shortcuts.

When it comes to getting out of debt, there are no shortcuts, you’ll need to do the work. You can’t hire a hacker; Santa isn’t going to make you debt free for Christmas and there isn’t a special program the government is offering that will magically erase your credit cards or car loan. You’ll have to put in the work and go through the struggle.

Additional Resources:

Level Up Your Online Community

It’s hard to form new habits on your own, especially if you’re lacking a community of supportive friends or family. If you don’t have folks who are going to collaborate with you on your debt freedom journey, consider finding some. Online forums are good place to start:

https://www.debtconsolidationcare.com/forum

https://forums.moneysavingexpert.com/forumdisplay.php?f=76

https://www.savingadvice.com/forums/forum/financial-chit-chat/debt

Increasingly online communities are migrating to Facebook and away from website based forums. So, here are a couple of smaller Facebook groups entirely focused on getting out of debt.

https://www.facebook.com/groups/YourDebtFreedomFamily/

https://www.facebook.com/groups/debtfreelifebudgeting/

Gurus Who Won’t Take You for A Ride

Consider reading Dave Ramsey. A lot of people don’t like his advice, but Dave Ramsey’s work has been widely adopted and found effective for millions of people. Suze Orman isn’t a bad resource as well.

Free Debt Reduction Tools

There are at least four good and completely free debt reduction tools available for US borrowers.

These are:

- unburyme: A compact online calculator that lets you evaluate snowball versus avalanche repayment strategies. Best on bigger screens

- CNN’s Debt Calculator: This is a joint venture between CNN and Money Magazine. Its not a flexible as unbury.me, but its 100% free. Also best on bigger screens.

- Debt Payoff Assistant: Found at the Apple app store, this basically let you tally up your debts and lets you model how quickly you could pay them off using various strategies.

- Credit Card Payoff: This is a simple debt payoff app for phones running the Android operating system. It has charts and can help you run some basic “what if” scenarios.

Posted: 6/13/2019

Ashley L. and James Hendrickson