by Hope

Last week I wrote about how my recent research into single moms and money, single moms and debt and so forth had really hit home with me. It opened my eyes to so many things.

I pride myself on being pretty smart, book smart, that is. But I’ve come to realize I am far from healthy as far as mentally and emotionally. The history of abuse, living in crisis mode and just the personality I was born with have created an unhealthy Hope as far as that goes.

But I’m proud to say, my eyes are open now, I’m aware of the problems. And don’t they say, the first step in recovery is acknowledging the problem.

Taking Baby Steps

I’ve got a lot of work to do. Work on myself, work on my finances, work on my decision making and so on. And I know I can’t do it overnight, fix it overnight.

But I’ve begun with some baby steps, some which I think will have far reaching affects.

Physical Self

I have diabetes. This is not really news, it runs in my family and bloodwork last fall confirmed it. But I’ve been ignoring it.

In fact, other than going to a neurologist for unbearable pain last fall, I haven’t been to the doctor in 10 or so years, I guess. Taking care of myself has not been a priority at all. It’s always been about the kids.

I now realize that in order to take the best care of them, and set a good example, I need to take better care of myself. So today I went to the doctor. And I told her, I need help with my diabetes.

Blood work and labs ordered, follow up appointment set. (The good news is that I am officially down 12 lbs since January, and that’s without effort other than changing my eating a bit.)

I am determined to get my diabetes under control, my weight under control and take better care of my physical self.

Mental Self

While writing about everything going on have been very cathartic. Doing it alone is not healthy for anyone. I am seeking counseling to address a number of issues…and I’m sure they will find more.

Readers here at BAD have really been instrumental in getting me to this place. Pointing out things that I didn’t recognize in myself. The tough love.

Things I know I need to work on especially are my: aversion to confrontation, being reactive instead of proactive and a slew of other issues that I have buried deep. I saw this image on Facebook this past week, and had another “aha!” moment.

Financial Self

My reality is that we are a single income family. I didn’t choose it, I didn’t prepare for it. But it’s what we are, and I MUST start learning how to embrace that, choose that and most importantly live within the constraints of that. No one is coming to save us, no one is going to bail us out.

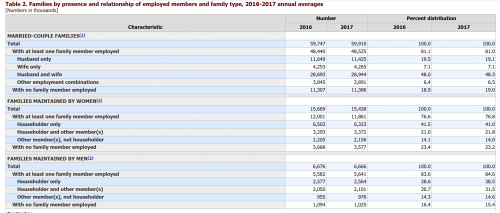

According to the Bureau of Labor Statistics, 48% of married couples are two income families. While single mom homes, only 21% have a second income and it doesn’t specify but that may part time. (Click on chart below to see full report.)

The point is that many choose to be single income families despite the hardships they may face in this economy. While I may not have had that choice, it is certainly not insurmountable.

With planning and sacrifice, I don’t have to keep living paycheck to paycheck. Barely making ends meet, and constantly robbing Peter to pay Paul. Make sense?

I need to study how they do it, succeed at it. I referenced my current studies in my recent post about Financial Realizations.

My question for you, BAD Community, is how do you prepare for something like this when you are already in the midst of it? While the experts say do X, Y and Z before you take the leap…I’m kind of working backwards from that.

What resources would you recommend as I continue to study how to live abundantly as a single income family? They say knowledge is power and I am ready to be powerful, I have lived far too long feeling weak and in fear.