At the beginning of each new year, there seems to be a stampede of people looking to begin 52 Week Challenges. While the beginning of the year is convenient as it helps frame the 52 weeks of the challenge, there’s never a bad time to begin this type of challenge. The most famous of these challenges is the 52 Week Money Challenge which helps those who do it save $1,368 throughout the year. Before committing to this challenge, however, there’s an important question to ask yourself. Is this the best challenge to attempt considering your current financial situation? If you still have credit card debt, a better challenge might be the 52 Week Debt Reduction Challenge.

How the 52-Week Debt Reduction Challenge Works

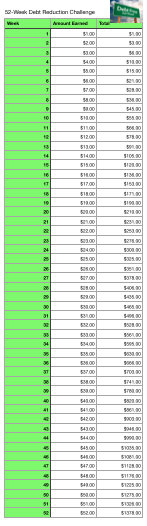

The 52 Week Debt Reduction Challenge works basically the same way as the 52 Week Money Challenge. You take the week you’re one for the challenge and put aside that amount. In this scenario, the first week you put $1 aside, in the second week it’s $2, in the fifth week it’s $5, in the twenty-fifth week it’s $25 and in the last week of your year challenge, it’s $52. The big difference is that instead of saving the money each week, you’ll put the money toward credit card debt or any other type of debt you have and are trying to pay off.

Download a PDF version of the chart here.

It may not first appear that there’s a huge difference between the two challenges since at the end of the challenge, you have put $1,368 aside in both instances. The reality is that there’s quite a significant difference between saving money and putting money towards debt, and due to this it makes sense to opt for the 52 Week Debt Reduction Challenge if you have any debt. By using the money to pay off debt rather than to save it, you’ll end up reducing the amount of interest you have to pay on your overall debt. In other words, the money put towards the debt is actually worth more than the $1,368 created because you won’t have to pay as much in interest to the credit card company. This will save you more money in the long run.

Making Extra Money to Pay Off Debt

The big question then becomes where are you going to find the extra money to put each week towards debt reduction? Chances are you aren’t sure how to do this or you would have already started to put extra money toward paying down your debt. In this case, it can be beneficial to use a random money generator which will give you ideas on different ways you may be able to make some extra money. If you spend enough time looking at different ways you can possibly make a few extra dollars here and there, you should discover a few side hustles that’ll make enough that you can put aside enough to succeed in your debt reduction challenge goal.

Probably the most complicated part of the 52 Week Debt Reduction Challenge will be making payments toward the debt. The best scenario will have you paying off the debt each week as you have the money to put towards it. This may not be possible for all types of debts. Before doing so, contact your credit card company (or whatever company has the debt you’re looking to pay off) to ask if you can make multiple payments toward the debt during the month. If not, the easiest option is to make the payment once a month added on top of your regular debt payment.

In the end, you need to decide what is more of a priority when it comes to your current financial needs. Is saving money or debt reduction more important at this moment for your finances? This will determine if the 52 Week Money Challenge or the 52 Week Debt Reduction Challenge is the best one for you to accept. Putting an extra $1,368 over the next year toward your credit cards would be a big step in getting yourself out of debt and it’s a great way to make getting out of debt a priority in your life. If you have been considering doing a 52 Week Challenge, changing the focus from saving money to reducing debt may be the exact move you need to make to get the most out of the challenge.

Other Money Challenges to Try

- 52-Week Savings Challenge

- Earn More With 52-Week Making Money Challenge

- $1 a Day Money Challenge

- 12-Week Savings Challenge

Jeffrey strain is a freelance author, his work has appeared at The Street.com and seekingalpha.com. In addition to having authored thousands of articles, Jeffrey is a former resident of Japan, former owner of Savingadvice.com and a professional digital nomad.