by Ashley

It’s been a long time since I’ve hosted a virtual coffee date catch-up! Pour yourself a cup of joe (or tea, or water, or mimosa? – no judgement here), and let’s catch up! If you want to dive into blog archives to see how my life has changed, check out these past virtual coffee dates from: 2014, 2015, 2017, or 2023.

Health

If we were having coffee, mine would be with just milk – no sweetener. I’ve been working on cutting back on sugar and have finally trained my taste buds to enjoy coffee without the extra sweetness. Small wins, right?

This past year, I’ve gone through a bit of a fitness identity shift. After years of distance and trail team running, I’ve completely stepped away from long-distance running. I needed the break. These days, I’m into weight training, which has been great – but I miss the camaraderie. I’m toying with the idea of registering for some shorter Fall races to ease back into the running world and soak up a few more trail miles with friends without the commitment of lengthy training plans.

Kids

The girls are just a few months away from turning 13 – how did that happen?! They’re playing school volleyball this season, and it’s been such a joy watching their skills and confidence grow! They both started out shy and tentative but are really coming into their own. I’ve even found a summer volleyball camp to keep the momentum going – just once a week and only $50/month per kid. Total win!

Family

If we were chatting over coffee, I’d probably get a little somber here. It’s been a heavy year for my family. We’ve lost both my dad and my husband’s grandpa. I have an uncle in hospice and a cousin in late-stage ALS – so I expect more goodbyes are coming. Another uncle is battling colon cancer, and a rare chemo complication led to cardiac arrest. He’s still in rough shape.

On top of that, my stepdad went in for what was supposed to be routine hip surgery, but it has turned into a nightmare: three surgeries in six weeks due to implant failure and fractured femur. He’s now completely non-weight-bearing for six weeks. It’s been a huge toll physically and emotionally. If you are the praying type, we’ll take all the prayers we can get!

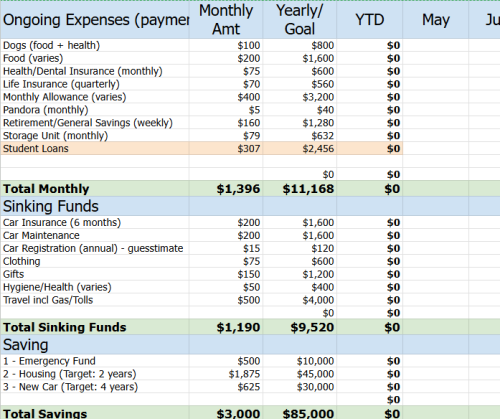

Finances

If we were really diving deep, I’d dip into the topic of finances. I’d admit that the recent market volatility has been really scary. We’ve lost quite a bit, and it’s been tough to even log into our accounts. We also recently inherited a sizable sum and want to steward it wisely. While some friends have encouraged us to splurge, we opted for a tempered splurge: turning our formal living room into a dedicated home office!

The whole project should cost about $5,000, with us acting as our own general contractor – hiring a drywall contractor, an electrician, and doing the painting and barn door installation ourselves. My goal is to have it finished by the end of summer.

You might wonder why we decided to create an office. The truth is that we were considering moving, but when dabbling in looking at real estate, we realized home prices (and interest rates) are just too high for us to compete! We could spend literally DOUBLE what we spent on our home, and end up a home that’s not even as nice as ours. So we’re staying put and making this one work better for us.

The new office will give me a proper workspace (with a view that isn’t of our trash cans) and my husband will take over the guest room/office space for occasional use. Win-Win!

Work

Work has been…..rough. Our department has had an interim head for a year now, with no permanent replacement in sight. University leadership has completely turned over – new president, provost, CFO, CIO, you name it. That means shifting strategic priorities, and a lot of uncertainty with budget models.

As a long-term planner, this limbo has been tough for me. I’ve handled it by trying to lean into side projects – mostly writing. I’m currently working on a book proposal and hope to have the proposal finished and ready to shop around to literary agents by the end of summer. Wish me luck!

Summer Plans

This summer will look very different than the past. For the first time, the girls don’t really need daily childcare. I haven’t signed them up for any traditional camps (except the once-a-week volleyball one). Instead, I’m flying them to Austin for “Mamaw Camp.” They’ve been begging for a solo trip to visit their grandparents, and this year it’s happening! The timing coincides with a work trip I have to D.C., so it works out for everyone. My mom is thrilled – after all the hard stuff with my stepdad, she really needs something to look forward to.

And the big one: we’re going to Hawaii! A literal lifelong dream of mine! My mom went to college there, and I’ve always wanted to go. We booked a package through Costco: 8 days – 4 on the Big Island, 4 on Oahu. Our top must do’s are Volcanoes National Park (Big Island) and Pearl Harbor (Oahu). We’re also planning to snorkel and attend a luau, but I know there’s so much to do there (more than we’ll have time for). If you’ve been, tell me what is not to miss!

Your Turn!

Thanks for hanging out with me and catching up! What are you up to? How’s your work, your family, your health? Got any tips for managing a home remodel or planning Hawaii adventures?

I’m grateful for the friendship/readership after all these years!

Hi, I’m Ashley! Arizonan on paper, Texan at heart. Lover of running, blogging, and all things cheeeeese. Early 40s, married mother of two, working in academia. Trying to finally (finally!) pay off that ridiculous 6-digit student loan debt!