by Ashley

Happy 2nd of July!

Our kids’ school starts back at the very beginning of August, so July is our last month of summer vacation! I can’t believe our summer break is already more than half-way over! It’s gone so quickly! Where has the time gone?!

We’re trying to make the most of it! I’ve been packing in lots of fun (free!) kids’ activities. It’s miserably hot here in Tucson. Some people commented on my post about the girls’ birthday about how we should just do parties for free at the park. Sadly, I think park birthdays are likely out of the question for as long as we live in Tucson. This time of year just is not amenable to outdoor fun unless its very early morning or late evening. Check out our 7-day forecast!

Yikes, it’s hot out there!

But we’ve been spending time at the library, we go to the pool nearly every day, and we’ve been probably spending too much time watching TV and/or movies. It’s okay in summer, right? 😉

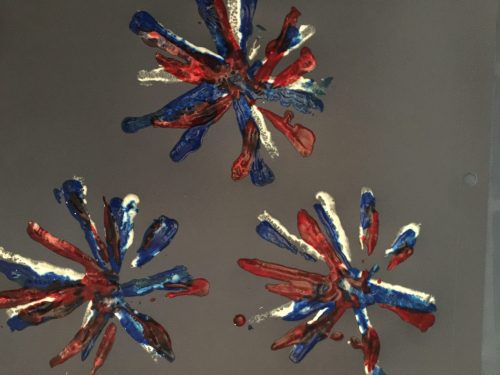

We also did a fun little paint activity I found recently online. It involved only materials we already had on-hand: red, white and blue paint, some construction paper, pipe cleaners, and glitter.

The girls had fun helping me get out our craft box and get everything set up. The set-up took longer than the craft, itself!

I followed this tutorial, but basically you just get 4 pipe cleaners and twist them together to form a handle, then spread them out to form a circular array. We made 3, one for each color of paint. These are then used basically as stamps. You dip them into the paint and press firmly onto the paper. Repeat for all 3 fireworks. Then repeat for each of the 3 colors.

Once complete, sprinkle some glitter on top. Easy-peasy, and the girls loved making their fireworks masterpieces. This one was mine (I made one with them so I could demonstrate steps as we went):

The girls went on to decorate their pictures with additional fun elements: some stick-on stars and glued-on confetti pieces that we had in our craft stash. All in all, it was a fun art project and got us all festive and in the mood for 4th of July.

Speaking of the 4th, we’re still trying to determine our plans. During the day we’ll be going to a work colleague’s house for a pool party and potluck lunch/BBQ. In the evening there are a couple of places to see the fireworks but, again, it’s oppressively hot right now. Soooooooo, yeah. We’ll see how all that goes.

At any rate, happy beginning of July to all! I hope the month is starting off well!

What are your 4th of July plans?