by Elizabeth S.

Transferring card balances to a low interest loan

I’ll preface this post by saying that it is more emotional than rational. Debt can be very emotional! It felt so good to see those credit card balances hit $0. I know that they aren’t paid off, but the interest rates stressed me out so much! Speaking of the line of credit, I hadn’t quite understood the terms of the line of credit balance transfer. It turns out, if you opt for this low fixed rate for one year, you’re locked in for that amount and can’t add any money to the balance for the duration of the term. That’s right – I can’t touch the line of credit other than to make payments for the next year. And to be honest, I am thrilled about that. I haven’t earned the freedom yet, in my own opinion. I appreciate measures to safeguard my finances from myself, because history shows I can be impulsive. So how am I transitioning to a healthy relationship with debt?

My new purchasing and reconciliation workflow

As of Friday, I’m using my rewards Visa for all purchases and transferring the money from my checking account immediately. I had initially planned to transfer the balance weekly, but I’m still struggling with budgeting a bit and don’t want to take any chances with racking up purchases I can’t afford. I intend to give you monthly net worth updates and I’m excited to be able to demonstrate to the readers here that I am paying that Visa off and not carrying a balance. The rewards aren’t all that great, but they add up and I am hoping to be able to cash them in for a gift for someone around Christmas.

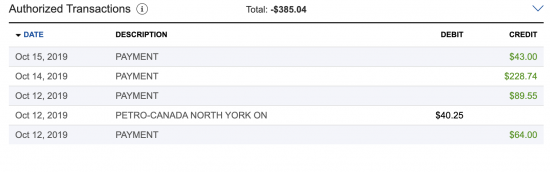

Here’s how my recent transactions look on my visa!

A healthy relationship with debt?

It feels different now. I know the stress of living with credit card debt. That feeling of utter stupidity when the credit card statement comes and I’m throwing away $100 of my hard-earned dollars to interest. The stress of running out of money a few days before payday, and realizing I need to use my credit card for foolish things I could have planned for. It’s premature to say I’ve accomplished anything (I haven’t), but I’m proud to say my mindset is noticeably different. I approach purchases completely differently than I ever did before.

I want to be solvent! I’m counting down the days until my net worth hits zero, which is a sort of funny thing to consider. But having a little chunk of savings, and room to breathe in my accounts, all of this is so motivating. It’s pushing me forward to achieve the goals I set in the summer with you, the readers. I’m buoyed by having a plan, and having a contingency plan. Why didn’t I do this years ago? Sigh.

Elizabeth is a single woman in her early 30s, working as a manager at a software company and living in the most expensive city in Canada. She hopes to blog about her journey to eliminate debt and build savings for home ownership someday. Whenever she has taken two financial steps forward, she’s always taken a step back with a bad credit card purchase (we’re looking at you, unnecessary iPhone of May 2019). Elizabeth lives alone with her fur kids, a dog and cat, and when she’s not in front of the computer, she enjoys running, camping, reading, and baseball.

Sounds good, Elizabeth!

I’m so glad to hear this! The mind is a powerful tool in getting rid of debt! Changing from “I deserve this so I’m going to buy it” to “I would rather be debt free” is a huge step!!

Thanks! The support is motivating, too 🙂