by Elizabeth S.

After becoming pretty good at tucking away money, I realized it became work to prioritize debt payoff. How do you motivate yourself to pay off debt while savings and investments are growing?

I finally did it – I saved money!

Finally having some savings is a powerful feeling. At age 32, I finally achieved the milestone of keeping money in my bank account, pay cycle after pay cycle. I think a lot of readers might not realize how mentally tough it was for me to get to the first $500. After $1000, it became very motivating to put money into savings, and I became excited about the task every other week.

A large amount of stress melted away as my savings grew. Being terrified of having my life pulled out from under me was always a concern. When I was 30, I had to ask my dad for money for car repairs and it was humiliating. Having savings gave me a sense of calm and control. In The Total Money Makeover, Dave Ramsey says that women crave security much more than men. He opines that if you want a happy wife, build your savings account. His book is filled with regressive, gendered ideas like that, but I had to agree that I love the feeling of saving. I’m not sure if that has anything to do with being a woman, though.

So, should we prioritize paying off debt over big savings accounts and investments?

Debt interest is almost always higher than savings interest

Most financial advisors tell people to save money before paying off debt so that they don’t end up in even worse trouble. Logically, if you do the math, holding on to credit card debt with 20% interest is crazy when your savings return 0-3%. So, the advice is to build a small amount of savings for unexpected expenses. Car repairs, trips to the vet, a flight for a family emergency – these are all situations you don’t want to put on the credit card.

I built up almost $2400 in savings and it felt amazing! I wanted to keep going. But I’m holding on to almost $9k in consumer debt. It doesn’t make sense for me to keep throwing money into savings.

With that in mind, how can you motivate yourself to prioritize debt pay off?

Chart your progress

There are lots of virtual and real-life tools you can use to track headway made. Humans are visually motivated, and sometimes we need to actually view the changes we are making from a high-level view to see how far we’ve come. You can feel deprived when you can’t join your mom on a shopping trip to the mall, or spend the night with friends at a nice restaurant. But a big chart on the refrigerator that you can color in as you pay off debt might be a happy reminder of the work being worth it.

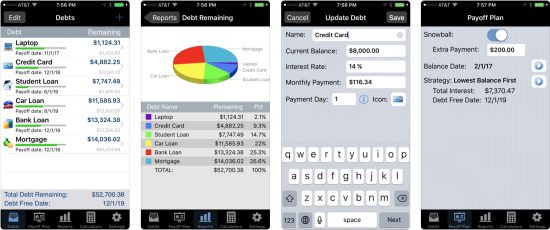

There are a good number of apps that do this as well!

Debt Payoff Assistant has some nice charts to help visualize progress. A simple bar chart goes a long way.

Mint.com does this pretty well, too.

I wish we had something like Personal Capital to integrate with our accounts here in Canada, but alas, we don’t (that I know of). I love tracking my net worth each month here at BAD! Find what it takes to motivate yourself and run with it!

Immerse yourself in Personal Finance

I used to find the topic of money very boring. Since I’ve started paying attention to my money, I’ve loved reading blogs and listening to podcasts about finance. It helps me learn about the subject. It has also introduced me to a community of people who, like me, wants to discuss best practices and new ideas. Here are some links I love:

I Pick Up Pennies – This is an old school style blog, sort of like a diary. I very much enjoy being a voyeur to people’s lives. She writes very honestly about her life and spending. As a single person with a single income, I like her financial independence.

Personal Finance – Reddit – I love Reddit. I read subreddits about finance, FIRE (Financial Independence Retire Early), Canadian Finance, all sorts of things. There are notions about Reddit being a certain kind of site, but I assure you, there is something for everyone on Reddit.

The So Money Podcast – I love a finance podcast from a woman’s perspective. This used to be a man’s domain, and women were discouraged from pursuing the topic for so long. She has the best guests in the industry on her show.

Give yourself small rewards

Plan these rewards well in advance to ensure you don’t go off the rails. Set aside money for a short, affordable getaway or for the new gadget you’ve had your eyes on for so long. If you’re paying off $20k in debt, there’s no harm in buying yourself $100 pair of jeans after paying off the first $5k. Just make sure it’s budgeted for so that you’re in control. Rewarding yourself can absolutely motivate yourself!

Motivate Yourself Regularly

Sometimes when things become a habit, they aren’t special any longer. If you find yourself becoming disengaged from the challenge of paying off debt, change it up a bit! Set little goals, try regular personal challenges, or compete with a friend!

Elizabeth is a single woman in her early 30s, working as a manager at a software company and living in the most expensive city in Canada. She hopes to blog about her journey to eliminate debt and build savings for home ownership someday. Whenever she has taken two financial steps forward, she’s always taken a step back with a bad credit card purchase (we’re looking at you, unnecessary iPhone of May 2019). Elizabeth lives alone with her fur kids, a dog and cat, and when she’s not in front of the computer, she enjoys running, camping, reading, and baseball.

Rather than general “savings” I keep a small-ish emergency fund and targeted lines for known/expected future expenses. I also budget the current month’s expenses with last month’s income (credit goes to YNAB for introducing me to this concept and helping me to achieve it), which also gives me some wiggle room if something unexpected were to come up. They key, though, is that all the money in my accounts is earmarked for something. Knowing that I have money set aside for known and unknown expenses helps me feel secure enough to know what’s “extra” and put it towards debt.

You’d probably enjoy Bitches Get Riches blog/podcast

You are right, @Honey! I’m enjoying it. Thanks.