If you’re self-employed like me, it can be a pain to prepare for taxes since you don’t have an employer to do it for you. And because you don’t have an employer to pay half, you’re footing the whole bill. Here’s how to handle self employment tax in 2019 and beyond.

Step One: Calculate Your Estimated Withholding

If you were working for another company, your employer would take care of this for you. You can get an idea of how much you should be saving on your own, thanks to online calculators. You’ll pay a 15.3% self-employment tax on your total business profits – plus any additional federal and state income taxes you may owe based on that profit amount. The amount you’ll pay in taxes also depends on your filing status and the number of dependents – so if you’re married and have children, you can generally get away with saving a smaller portion of your income for taxes – it just means you’ll have a smaller refund when it’s time to file.

Step Two: Set Aside a Portion of Each Payment in a Savings Account

When I first started freelancing, I’d set aside 20 to 25% of each payment (after fees) that came into my accounts into a separate savings account. Sometimes, I was able to save the full 25%, but other times because of the way payments fell, and when my bills were due, I couldn’t always save that much. It also took a lot of discipline to do this – and not to touch the savings account. After a while, I opened a SmartyPig account and set an annual goal so that I could not borrow the money from myself.

Step Three: Track Estimated Payments

If you earn enough to owe at least $1,000 in self-employment taxes when you file your return, you are expected to make quarterly payments to the IRS. When you file your annual return, if you’ve paid too much into the system, you’ll get a refund. If you have not paid enough, you will be responsible for paying the balance due. Further, if you haven’t paid enough in taxes and were required to make quarterly payments, you may pay extra in underpayment penalties.

You’ll need to sign up to make payments every quarter – due January 15, April 15, June 15, and September 15 every year. If you use software like Quickbooks Self Employed to help manage your books, it can give you an estimated payment amount and assist you with actually setting up the payment from your bank account.

Make it Easy with Catch.co

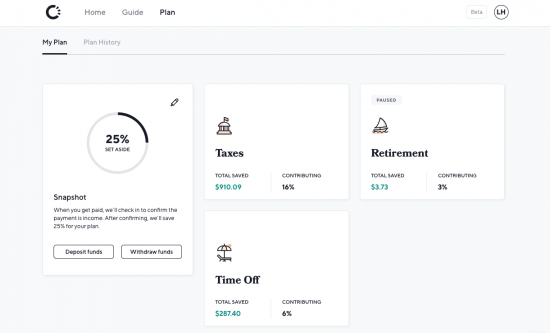

Catch.co is a relatively new service for the self-employed. With it, you connect your bank account and tell it how much you want to set aside for taxes, time off, and retirement. Catch opens accounts on your behalf, and then when a deposit hits your bank, it asks if it’s a paycheck and if you want to set aside anything from it. Then, you can make a withdrawal every quarter to make your payments. Here’s what a snapshot of my account looks like:

To be fair, I started retirement savings recently, and have it paused because I’m moving funds from other accounts to put everything in one place.

My child tax credit always took care of any owed from independent side hustles, but this is the first year I won’t be claiming her. She was 3 when we divorced, and we agreed that I would claim the next 8 years and he would claim the next 7 after that. So I’m going to need some education on this issue, because I am especially stepping up the side hustles this year…