by Hope

The grass is growing again.

I think I could end my post there with all the pain that thought causes me. Don’t get me wrong. I love my gardening and my yard and all that…but the weekly maintenance is a pain. Last year, you all gave me a hard time about continuing to pay for yard service.

And I am trying to do better and take your advice. So I’m taking on my yardwork, and biting the bullet and going to purchase the lawn tools I need. And I dread it all the way around.

I do not look forward to:

- Having to maintain the equipment. As good as I am with computers, I am just as bad if not worse with mechnical things.

- The weekly chore in the heat of mowing the grass, weedeating and edging, and blowing the leaves and grass.

I am just dreading it! (It is so worth the $50 every other week to have someone else handle this stuff.) But if I’m going to commit to it.

Fix it first

My grass already needs to be mowed. So when April payment gets here, I will find a lawn mower to start. But in the meantime, I have got to fix some issues with my yard.

If you have been around a while, you know I have had a flooding problem. Well, in February, my daughter’s boyfriend came over and helped me clean out the culvert in the back. That has REALLY helped. But I still have a few areas that are of on going concern and have to be address.

The larger hole is about 3 ft deep and almost 5 feet wide, and probably more than that. This same hole has reoccurred 3 times over the course of our almost 7 years here. The city has come out twice to “fix” it. And it just gets bigger and bigger. The other two are places where the cement piping below my side yard is separated and exposed. So last week, my daughter’s boyfriend (actually now ex) was home from spring break. And he graciously came to help me address these areas of concern.

He dug them out a big (pictures) and then we came up with a game plan. (My dad contributed to this plan with his expertise as well.)

For the two, concrete pipe areas, I bought some flashing which we covered with dirt to try to stop water and debris from filling the pipe that is already overflowing when it rains. I was able to find small sheets of the flashing for $8 each at Tractor Supply. Everywhere else required I buy a whole roll for $50-60 that would have also required a special tool to cut it.

Now the larger hole, we dug it out a big more, the filled it with larger “rocks” that he had access to, cost $0, then filled it with dirt. I’m hoping with the rocks in their, it won’t reoccur. So far so good, one rain down and it held.

More plans

I’ve got additional plans for the yard this year. And he has agreed to help me with them when he comes home from school for the summer. (And yes, I did confirm with my daughter that she is okay with this ask.) But I know I won’t have the budget for too much.

But first…a lawn mower. Ugh!

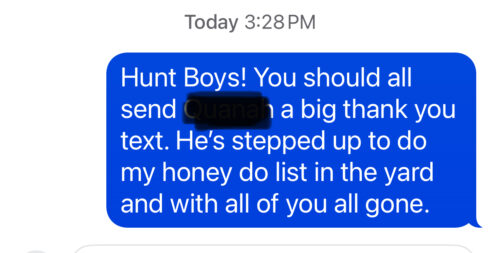

Sidenote: this is the text message I sent to my 3 sons…

Hope is a creative, solutions-focused business manager helping clients grow their business and work more efficiently by leveraging expertise in project management, digital marketing, & tech solutions. She’s recently become an empty nester as her 5 foster/adoptive kids have spread their wings. She lives with her 5 dogs in a small town in NE Georgia and prefers the mountains to the beaches any day. She struggles with the travel bug and is doing her best to help each of her kids as their finish schooling and become independent (but it’s hard!) She has run her own consulting company for almost twenty years! Hope began sharing her journey with the BAD community in the Spring of 2015 and feels like she has finally in a place to really focus on making wise financial decisions.