by Elizabeth S.

Editorial Note: This was supposed to be posted August 8th but as I mentioned yesterday, a couple of my posts got lost! I will have a real-time update for you tomorrow.

My dog (and savings) are mostly okay

The vet examined Rosie on Wednesday and it was good news. He removed the questionable lump while she was awake (saving me money on anesthesia!). He took a look at it under a microscope and said it was just a cyst that had become infected. Good news! He inspected her other lumps and said they were fine as well. This was one of our most expensive visits to date, totaling $236. The vet prescribed three medications to address her whole-body rash and the wound from the lump removal. You can see in this picture below, there is a wound on her back. She’s bandaged up now and doing great.

I am so relieved, especially about the corn cobs she ate. Those are one of the most common causes of bowel obstruction surgery. Rosie had corn cobs stuck in her belly for three and a half days, and we are beyond lucky that they came up naturally (there was one full-sized cob and two half-sized ones – that’s a lot of food to have stuck inside you for so long!).

Budget implications

Rosie has insurance, but since I purchased it, she hasn’t been sick. Typical, right? She has a $300/year deductible so I won’t get any money back from this visit, but I submitted it so that if she is sick again, we will receive coverage. I haven’t figured out if I can pull the money for this vet visit from other categories yet. I shouldn’t need any clothes, cat medical supplies, or household stuff this month, but I’ve already blown my entertainment budget and it’s only August 9th. If I can be lean with my groceries and find a bit of money from side hustles, I might be able to swing this payment without touching my savings or adding to my debt.

Spending Challenges

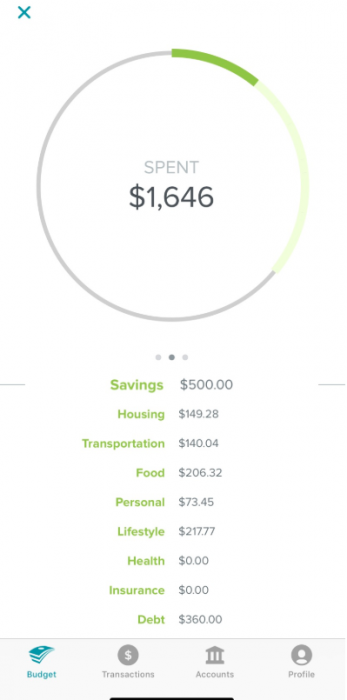

I have been tracking my spending. Why is this so difficult? Facing spending realities is really hard. I am over budget for entertainment, and already almost at my limit for groceries. I used to be a perfectionist with meal planning, but work is ruining all of that right now. I’m putting in 13-14 hour days plus commuting, and I have a house to clean and animals to take care of when I get home. I haven’t watched TV or listened to podcasts in weeks. I have no free time, and my budget is suffering for it. This is my reality for at least another few weeks, so I am going to keep tracking spending diligently. Hope has been posting money challenges. If I am being realistic, my biggest challenge this month will be not to add to my debt. Having my honest spending data in front of me will help inform my next goals. I’ve only been tracking nine days so far, and it’s already staggering.

Side hustles?

This morning I received a message for a dog-sitting gig that would pay $132. The owner is looking for someone to sleep at her house for a few days mid-month. I actually have help with my pets this month, so I can swing this gig! Fingers crossed it works out. I also have a lead on a friend of a friend who needs a room for a few weeks starting August 15th! I know this person, so it won’t be a stranger in my house.