by Elizabeth S.

Hello again! Thank you for the lovely welcome, and I appreciate your tips for my spreadsheets! I am taking the advice of the commenter who advised to budget for my bi-weekly paycheck as two checks a month, and then when I have the third check, I can use that where it’s needed! Let’s dive into the spending!

Before we get into the nitty gritty, I’ll let you know my budget weaknesses.

- My pets. I have a senior cat with diabetes who I’ve had for 14 years. This has translated into me becoming extremely frugal, buying insulin and supplies on the black market (sourced on Craigslist). Spending for supplies runs ~$20 on syringes and ~$15 on insulin a month (purchased twice a year in bulk), and then under $40 on cat food (he can only eat canned, but I managed to find a deal with a group of people buying wholesale!). Next is my 90lb labrador-cross, age five, and she is my sun and my moon. I have insurance for her at $58 a month. I got that insurance a little late in her life and I still believe it’s necessary because I can’t afford an emergency. I feed her raw food because she has allergies and prescription vet food is a fortune. My vet supports her current diet, and I buy it all at the Chinese supermarket. There are always chicken legs for $0.79 a lb, and I can get dirt cheap chicken feet, pig liver, cow heart, etc… all things very healthy for my dog and considerably cheaper than commercial food! She gets whole eggs, berries, the odd roasted sweet potato, but mostly cheap meat and offal. I feed her for less than $60 a month. For those not keeping track, that’s $80 for the cat and $120 for the dog per month. They were my reason for getting out of bed for a long time and I consider them a mental health expense! Would I get new pets if these ones passed on today? NO. I learned my lesson. I need to save money.

- Seeing my family. I am the eldest sibling in a large, tight-knit family. My family is spread out all over, with the closest members two hours away. It’s the reason I have a car, as they live in areas I can’t get to by transit.

- Food and wine. There is no excuse for this, and I simply need to rein it in. Food is not a reward. I love to cook and entertain, and my friends can bring the prime rib over if they want me to cook it!

I truly am open to your feedback, and I won’t be defensive about the above items.

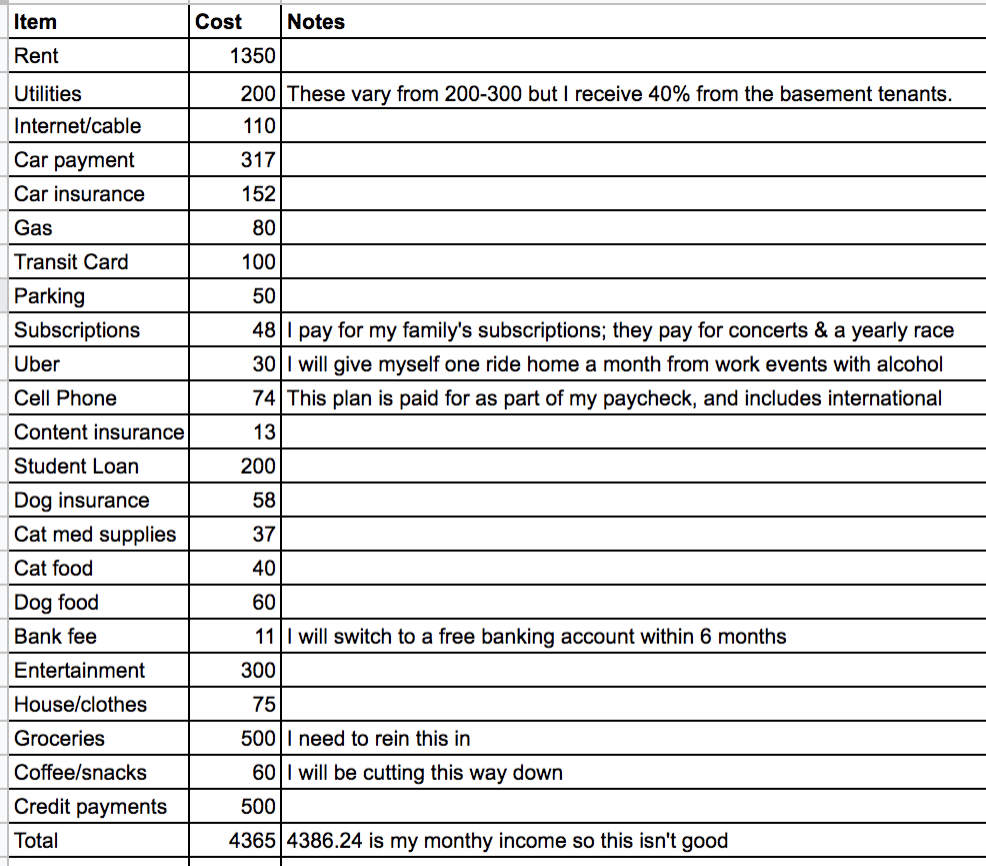

My Spending

I took the advice of some commenters and set up YNAB (You Need a Budget). As a result, I’m faced with the stunning reality of my impulse transactions! It’s kind of a pain to do this mid-paycheck, but I’m working on it. This process has resulted in me opening a ticket with their support, because once again TD and Capital One accounts are having issues syncing (I’ve been down this road with YNAB before. Mint.com always just works but I find it more difficult to budget with – anyone else?). I’ll post some screenshots from Mint and YNAB as soon as I get one of these services working the way I’d like it to, hopefully within a few days. In the meantime, here are the raw numbers:

Here’s a photo of my pup after a swim at the family cottage last week, for no other reason other than this post is too much text and dogs are cute.

Elizabeth is a single woman in her early 30s, working as a manager at a software company and living in the most expensive city in Canada. She hopes to blog about her journey to eliminate debt and build savings for home ownership someday. Whenever she has taken two financial steps forward, she’s always taken a step back with a bad credit card purchase (we’re looking at you, unnecessary iPhone of May 2019). Elizabeth lives alone with her fur kids, a dog and cat, and when she’s not in front of the computer, she enjoys running, camping, reading, and baseball.

I am amazed you are able to treat a diabetic cat so cheaply. I have friends paying almost $100 for a bottle of insulin, and that was through Chewy. The vet charged more.

I’m curious why you have both a car and a transit card.

$300 for entertainment? Think that could come down?

She’s in Canada. Insulin is MUCH cheaper there.

I buy insulin on the black market from diabetics who get it free from the government. I actually send a good deal of insulin to the states for friends with diabetic pets there. To buy insulin here, it’s over the counter (no script needed) and about $100-120 for a 5 vial pack of Lantus. I understand the same product is 3-4x more over the border.

Elizabeth, I would get rid of the coffee, only $100 per month for entertainment, and house/clothes. Food needs to be less though I think it is more expensive than here in the states.

I lived in the Southern US for a couple years. I was BLOWN AWAY with how expensive vegetables were but how cheap junk food was. I think it all evens out, in my experience. Food can be pretty cheap here, but I buy premium ingredients. I am a big time “foodie” (do you hate that word? I do). I just had friends over for lobster on the weekend. It was planned for a few weeks, and my friends treat me to the same types of dinners. I am going to need to let them know I will be budgeting fiercely for awhile (they are supportive. We were all starving students not long ago).

Your entertainment and grocery categories are the obvious place to tackle. $800 for those two categories are insane. I would suggest cutting each of these back by $100. That would still give you a healthy $600 for food and entertainment or $20 a day. I am also of the opinion that coffee and snacks should be included in your grocery/ entertainment budget. A final category that I’d look at would be household/clothes. If you cut that back to $35 than you would have $300 a month to devote to savings and debt repayment without too much hassle(which isn’t say you could not find an additional money by calling and checking to ensure you are getting the best deals.)

Thanks for your comment! Groceries, coffee, yes. I agree there big time. But my clothing and household budget is already sparse. I thrift much of my wardrobe and I have a 3 bedroom house and a huge outdoor space to maintain. I work in a company with financial and legal people who dress considerably nicer than I do. $75 doesn’t even buy a decent pair of shoes that will last a couple years, as shoes should. I am definitely looking to cut from other areas and actually make room in that one, because my clothes are pretty ratty and I could use a couple of new business basics for the fall/winter and I don’t believe in fast fashion (i.e. the garbage made in sweatshops that sells for $20 and falls apart in two months). I prefer consignment and the odd investment in something that will last, like a pair of Birkenstocks, Blundstones, a nice well-fitted pair of trousers, etc.

Hello! Groceries and entertainment are low-hanging fruit as mentioned. I don’t fault your pet expenses. I would do similar.

1. You mention basement tenants. Do you get rent from them? Can they share in the cable/internet bill?

2.. Credit cards. Can you obtain/qualify for a 0% interest card for an introductory period? Put more principle to your high interest debt?

3. I don’t know if any of the above are options in Canada, or the following, but there are some sites such as swagbucks, Amazon Turk, where you can earn gift cards for various tasks (depend on the site). This could be something you could do in your free time vegging in front of the TV at night/weekends. It’s not lucrative typically, but it could give you the occasional $25 here and there.

Honestly, with your budget as tight as it is, a part-time job/side hustle may be in order.

Hi there! They aren’t my tenants. We all pay the landlord. I haven’t heard of any balance transfer deals lately, but I will look for one. I was considering looking in to a line of credit to pay off my credit cards with at a much lower interest rate. I should give the bank a call this week.

I looked in to Amazon Turk and actually tried it last week. I made 30 cents for 20 minutes of work, so I won’t be doing that (I understand if you spend a lot of time there you can earn more but my time is worth so much more and I have so little free time). I am also on call 24/7 for my job which seriously limits what I can do with a side hustle. I am considering short-term room rentals – maybe renting out a bedroom for a few weeks here and there.

Just wondering why you have a transit card? Do you mostly drive go work or public transport? Some employers pay for those and/or are.you doing it pre tax which can be an option too.

Also, I cut the cable and got a cell phone with unlimited data so I could stream Netflix when I want. I’ve been doing it for 3 years now with no issues.

I explained in a previous post why I take transit and drive. It’s the only option where I live (very long commute, and I spend most weekends hours out of the city to see my family where there is no transit). My card is pay per ride, so I only pay for transit when I take it (which is about four days a week). Employers do not pay for transit here or at any of the American offices I have worked at, but that would be a nice perk! My phone is comped by my company by an additional line on my paycheck, and I require the unlimited plan I am on – it’s the cheapest one available.

I regularly use thousands of gigs of internet a month and need to upload and download video in real time for work, so again, that’s a tough one. I have a gigabit speed internet plan, but I negotiated it like crazy. I cut cable for awhile but require some news channels for work, and needed two streaming packages for that. When the basement tenants moved in and started chipping in for internet and tv, I renegotiated the plan. They don’t use TV at the moment, their box broke and they didn’t want to pay for a new one, so I should probably call my ISP again, but I’m getting TV for free in this plan. They always get you with the perceived “bundles”, right? Thanks for the tips, I certainly will spend a week going over all my plans and calling my providers. I’ve been a loyal client who has never missed a bill, that has to count for something!

Entertainment, house/clothes, and coffee/snacks all look over the top to me. This is where you make a choice in your life – you want to continue to have stuff and live like a carefree kid, or do you want to pay off your debts?

There are hundreds of free things to do for entertainment. You’re considering your subscriptions as offset by other items, including race fees (I’m assuming running here), so your entertainment budget is essentially 2-3 full marathons / month or 10+ 5ks, (30 marathons or 60 5ks / year!) if it helps to put that into perspective. You’re paying for subscriptions, so watch movies at home instead of the theater. Get books from the library. Find local meet up groups. Etc.

House/clothes added up over a full year gets to ~$800. That’s 4 full, high end winter coats (you really only need one, even in Canada). Or 8 pairs of good shoes, most of which should last longer than a year. People really won’t notice if you don’t have on brand new trendy clothes. Please think about using the clothes and home goods that you currently have – maybe do a Konmari to realize what you actually have already and only buy replacements when they are needed. This isn’t restricting yourself forever, but doing so to accomplish paying off debts.

Coffee and snacks should be put with food so you have a full picture of how much you spend on food. If coffee is a social activity for you, then put it into entertainment so see how much you really spend there. When you see it as ‘just $10 here, $8 there…’ it’s easy to think you’re not spending real money. But almost $4,000/year in miscellaneous “fun” is a big chunk of money. Would it be more “fun” to know that you don’t have debt bills waiting for you at home?

I don’t actually think the pet expenses are that bad. You don’t have kids, you’re paid well, it’s fine to spend a couple hundred a month on having adorable furry things in your life.

What is “content insurance”?

As folks have already said the $860 in groceries/entertainment/coffee is the clear place to start. I’d very strongly recommend going to a joint cash budget for these categories. What I did for a long time was to set a cash budget for the month, take it all out at the beginning of the month and divide it into weeks, then carry the week’s cash with me. I started with a grocery run so I always had food, and then I could use whatever was left to go to the movies or buy coffee or dinner or anything else I felt like until I ran out. It’s much easier to see what’s up with your impulse buying when you’re using cash vs credit cards.

If you do this, I’d recommend trying to start with $100/week. I use about $300/month myself but going from $860 to $300 might seem too drastic to start with 🙂 I’d also recommend going vegetarian or mostly vegetarian for a while. I cook a lot and eat really well and it’s easy to afford nice fruits/vegetables etc if I’m not buying meat. I sometimes get bacon though because I love it 🙂

My landlord pays for the house insurance, but he doesn’t know what we own or what the things are worth, so his insurance only covers the house/property. I have content insurance for my tvs, road bike, pets, computers, jewelry.

I am terrified of cutting my entertainment budget. I go out once or twice a month – seriously. I work with very wealthy people and it’s impossible to have a dinner or go for drinks in this city for less than $100. Think Manhattan, but a bit cheaper. I’m going to do my best though. I hope you guys go easy on me at first!

Assuming you can save $450/month from your joint food/entertainment spending, by the way, I’d say you should send half to debt and half to savings until you have a $1000 emergency fund. Then you can start putting it all on debt.

I saw you have three bedrooms, by the way. I’d pretty strongly recommend getting a roommate. You would still have a bedroom to use as a guest room/office. It wouldn’t have to be forever, but it would let you make much more progress MUCH more quickly if you rented a room even for a year.

The third bedroom is boiling hot and tiny, with a rock hard twin bed. I couldn’t put family in there, but I’ll sleep in it myself for a night or two when necessary. I am going to explore short term room rentals this week.

I highly recommend joining the YNAB Facebook group (if you use FB, that is). The folks there are really friendly and helpful whenever anyone posts about having troubles with the software.

YNAB is terrible. Please, please, someone prove me wrong. I have an unread email from them right now but I am so frustrated after being on the phone with them yesterday that I don’t even want to open it. I am on my third try with them, and for no bloody reason, my accounts are not syncing. It has nothing to do with being Canadian. These accounts were synced in the past. They always blame the banks but my accounts sync with other providers easily. I have zero patience for their support team’s peppy excuses right now, when everything in Mint just works. I wish Mint had the “give every dollar a job” budgeting style.

Please, please don’t give up on YNAB. Yes, I have read there have been syncing issues. I personally, manually input transactions and don’t sync, so I don’t deal with it. Have you considered doing it that way? I know it may seem a hassle, but it takes maybe 30 seconds to input a transaction in real time. Plus doing it that way keeps me 100% accountable to my category balances. Can I challenge you to try it that way for 2 weeks and see what you think after that?!?!

I would like to see a line for medical, dental, and car repairs. I would suggest cutting part of the entertainment and grocery budget by at least 100 dollars to ensure that you can afford the needed car stuff like oil changes, and new brakes. I would also like to see where you can decrease some of your extra spending to get a small amount into a no fee savings account.

Being Canadian – our medical is pretty much fully covered. With her salary she probably has benefits which cover prescriptions and dental fees. I do not budget for these and have a family of five as cost might be max 3$ for prescription dispensing fee when required.

I don’t have any medical or dental expenses (in Canada and I have a robust health spending account on top of that).

This was the spending as my spending has been, in the past. Over the next couple weeks, I will be making an aspirational budget. I’m starting with my emergency fund, and then will include a monthly deduction for car maintenance. Thank you so much for the comment, I should have mentioned that.

I use Every Dollar budgeting app. I use the free version which is not synced to my accounts so i have to manually enter everything. I am not sure how well the upgraded version works. But you might check it out!

This sounds great actually! I am having such trouble with YNAB and this sounds like an interesting alternative!

One pro to manually entering my expenses is that know when I am reaching my limit in a certain category. I look at the budget every time I enter an expense.

Perhaps you can clarify. In your last post you said your credit card payments were ~350 in addition to the car and student loans. Is $350 the minimum and $500 how much you have budgeted? If so, a little struggle with the grocery/entertainment budget wiuld get you to a respectable $350 in principal payments per month.

You also mention three bedrooms. Are you allowed to do short term sublets? My university always has visiting scholars who need housing for 6-8 weeks, and they make great roommates. Might kick start your process!

You nailed it about the spare rooms! I am 100% looking in to having short term rentals for one of my spare rooms!

Re: card payments. $350 is the minimum and $500 is what I tend to pay (some months I pay $800-900… I am all over the place but I spend a lot more than I make)

I would suggest a small miscellaneous line item, to be funded by the reduction in grocery and coffee spending. Even when you are doing your best not to spend, there are going to be odd things that don’t fit anywhere. Better a line item than pulling out a credit card. For example, do you and your family exchange gifts on birthdays/holidays? You can tell them that you’re on an austerity plan, but you still might need to spend something. Also, personal maintenance: haircuts and the like.

Finally, are there things you could sell? An extra bike or similar?

Hi Elizabeth 🙂

It’s so nice to see another Canadian in this space! You’ll do fine–that debt snowball is amazing once it finally kicks in and you get a bit of traction! 🙂 I wish Gail Vaz-Oxlade still had her site up, her magic jars made a huge difference in the lives of a lot of people. Kicking it over to cash really helped me for a while. I only used it for discretionary categories like food and clothes–I do everything else online. I have a copy of her budget form somewhere if you’d like me to forward it. It helps you figure out how much goes in each jar, and it’s amazing that you always end up with more money than month. 🙂

Toronto’s got a ridiculous cost of living, but I think most of the readers are going to have the hardest time understanding how much other things cost here vs. the states. I.e. $800 will most definitely NOT buy 4 brand name quality winter coats. Or 8 pairs of shoes. And you sure as heck aren’t going to make your fortune couponing up here, either. 🙂

One trick I did find useful to curb my coffee habit was to buy a reloadable gift-card at the beginning of my budget period and when it was gone, it was gone. It made me a lot more judicious about whether or not I really wanted a coffee. 😀 It worked well to help narrow down my grocery budget too–since I usually only shopped at a few stores. YMMV. 🙂

Nice to meet you 🙂