by Elizabeth S.

Debt Reduction

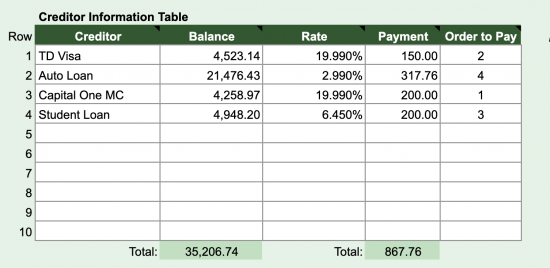

July 2019:

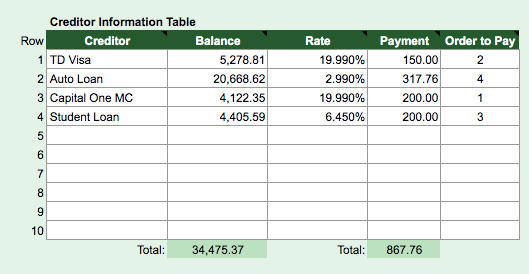

September 2019: (-$731.37)

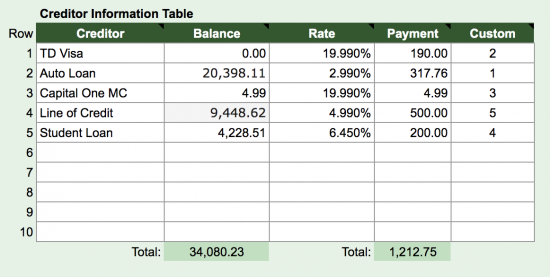

October 2019: (-$395.14)

Not so great for debt reduction at all this month. I did end up buying winter boots, a pair of black dress shoes for work, and a therapy session that won’t be covered by my benefits. This is eye opening for me, though. I plan on paying an absolute minimum of $600 a month to the line of credit now that I have some savings and my credit cards are consolidated.

Savings:

Savings account: $2350 (+$350)

I want to keep saving but I need to put a pause on this now and focus on debt reduction. I feel so conflicted about this, because I have been watching my financial stress dissipate as savings have grown.

Investment account: $506.91 (+$127.91)

This is a fun little investment account I have set up with Weathsimple.com. I’m using it because it’s easy to withdraw from and I’m planning on using this money if I owe for my taxes next year. I throw odd job money in here.

Registered Retirement Savings Plan: $13649.70 (+$382.87)

Total savings: $16 506.61(+$860.78). Frankly, this isn’t enough. I need to be saving way more for retirement.

Net worth (based on total savings – total debt):

$-17 573.62 (increase of $1255.42)

The line of credit payment comes out on the 15th and I’m planning on making a large lump sum payment each month. I want to pay a minimum of $600 a month to that, and increase my payroll deductions to my RRSP.

Yep. I need to spend less money.

Little Victories:

- applied for a no-fee credit card and no-fee checking account through Simplii (goal to close my expensive accounts by end of November)

- My credit score became Excellent, but I don’t think that will last

- I have a Rover gig in two weeks!

Elizabeth is a single woman in her early 30s, working as a manager at a software company and living in the most expensive city in Canada. She hopes to blog about her journey to eliminate debt and build savings for home ownership someday. Whenever she has taken two financial steps forward, she’s always taken a step back with a bad credit card purchase (we’re looking at you, unnecessary iPhone of May 2019). Elizabeth lives alone with her fur kids, a dog and cat, and when she’s not in front of the computer, she enjoys running, camping, reading, and baseball.