by Elizabeth S.

Hi everyone! I’m Elizabeth, and I’m a new blogger here at BAD. I’m excited and nervous to come on board, as I’ve been a reader of this blog for a couple of years, and I know the readership is scrupulous. That’s part of the reason I’ve decided to share my story – I know readers will call me out when I need to be called out, and I want to be held accountable. I’ll write my first few posts sharing my full financial story, and I’d love to hear what you all think.

Why am I here? Well, I’m in debt. My parents raised my four siblings and me with financial sense and tried to teach me to save money. My dad was a teacher before he retired, and he had paper routes, taught summer school, and even did pharmaceutical experiments to pay for our extracurriculars. I got a job at 14 and haven’t stopped working since, but I’ve always spent everything I’ve earned.

I’m 32, single, and an IT manager at a medium-sized global company. I live in Toronto, the most expensive city in Canada. 1-bedroom apartments average over $2200, and housing insecurity is pervasive. I’ve rented an old house in a cheaper part of the city (meaning I have a long commute!) for five years now, and luckily I only pay $1350 for my three bedrooms, but I do all my own repairs and maintenance. It’s a good deal, and I’m pretty handy. My yard and spare bedrooms for visitors make me happy (my family lives far away), and seeing basement apartments posted in my neighborhood for over $1400 reinforces that I’m stuck here, anyway. I don’t know what I will do if I need to move sooner, which is why one of my goals is to save for my own house.

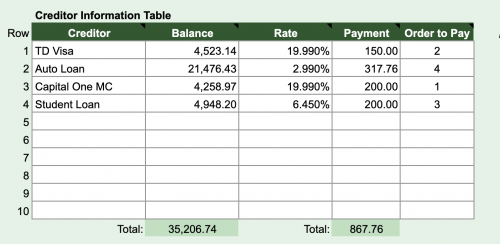

I make 82k yearly with a 10% bonus. After taxes, retirement contributions, and other (mandatory) deductions, I take home $2193.22 bi-weekly. I have been interested in personal finance for a couple of years, and I’ve managed to improve my credit score with a lot of work, but I still have over $35k of debt and nothing left over each month. That’s right, I make 82k and have no savings. I have huge lifestyle changes to make. As a result, I’m looking at snowballing my credit card debts (paying off the lowest balances first, which also happen to have the highest interest rates). I’ll share the beginnings of my debt plans in my next post. From a high level, it looks like this:

I’m making financial plans as a single person, but I don’t plan to be single forever. I’m recently out of a long relationship that was happy but financially incompatible. He didn’t care about money at all, and I became increasingly concerned about the future. I’m on my own now and don’t want to rely on anyone. Here’s what I’m saving for:

- Emergency savings. I have $321 saved for an emergency right now

- Housing. If I’m thrust into the housing market soon (always a risk as a renter), I’m in trouble

- A family. I don’t want to close doors for myself, and I’m exploring adoption (for down the road, but since it can take many years, I am beginning the process now). I wouldn’t adopt a child for a few years, after building savings and moving to a low cost of living city.

What would you like to see? I’m happy to share every detail. I’m working on a detailed budget right now. It’s funny, tools like mint.com have become so easy and automatic, I rarely sign in to check on things, and I don’t learn from ongoing trends. Consequently, I’m working on a manually-updated breakdown of my spending, but even the early numbers are scary. Does anyone have a great spreadsheet template to recommend? Bonus if it supports a bi-weekly paycheck (I’m paid every other Friday, and occasionally have months with a 3rd paycheck). I would love to be able to plug in my budget, spending, and debts all in one sheet.

Next up: The mean, green numbers. My spending and lifestyle choices, broken down for you to see. Looking forward to hearing from you all!

Elizabeth is a single woman in her early 30s, working as a manager at a software company and living in the most expensive city in Canada. She hopes to blog about her journey to eliminate debt and build savings for home ownership someday. Whenever she has taken two financial steps forward, she’s always taken a step back with a bad credit card purchase (we’re looking at you, unnecessary iPhone of May 2019). Elizabeth lives alone with her fur kids, a dog and cat, and when she’s not in front of the computer, she enjoys running, camping, reading, and baseball.

Hi and welcome! I’ve used You need a budget (YNAB) for some time and it works really well for me and also has a mobile interface. There is a price for it, however. But it’s worth it in my mind. If you’d prefer not to pay for a tool DaveRamsey.com has some free tools you can download and I’ve used those before also.

In fact, if you’re trying to take stock of your finances and stop the bleeding, you might consider the Ramsey method–it works pretty well for that. I don’t agree with all of his philosophies but using cash envelopes when it makes sense and doing a zero based budget helped me dig out of the hole I was in several years ago, then I switched it up when I was doing more saving/investing.

I use Mint and you can look at spending trends with it.

Financial incompatibly has been the downfall of many marriages, so it’s good you figured that out sooner rather than later.

The biweekly check – I would make a monthly budget using only 2 paychecks. When you have a 3 paycheck month, put all of the extra paycheck in an emergency fund or towards debt.

Hello from an American neighbor about an hour from Toronto! A huge part of your debt is an auto loan and I know toronto has a decent public transportation system. Are you that far outside of the city that a car is a necessity for now?

Honestly, the TTC is so unreliable :/ I live in a suburb, and I only got my car within the last few years – but now that I have one, I cannot fathom life on public transit ever again in Toronto.

Hey there! My commute without a car is 3 hours round trip (and can be longer with a subway outage). Yes, that is within the city! Crazy! There are people with four hour commutes within the city. I drive to the subway and my total commute is about 40 minutes each way. It’s very worth it for me for the housing cost savings.

The car is “necessary” for other reasons. I have a huge family and we live far apart, and visiting them is the most important thing in my life. It isn’t possible by transit. In addition, the city eats my soul (dramatic, I know). Anxiety builds in me with all the honking horns and crowds of people. I spend every weekend out of the city in the woods. I would make ANY other sacrifice (including moving away) before getting rid of my car. I drove my last car for 12 years and truly drove it in to the ground, finally getting rid of it in March this year. I’m not concerned about the car payment (I know, I know) – I have every intention of paying the car off early and driving it for many years. I did that with my last car. And yes…. my next car will be purchased with cash, many many years from now.

After driving a very unreliable car that left me stranded on the side of the highway more times than I can count (I needed tows monthly – bless you, AAA), I was EXTREMELY set on a brand new car. I did research for six months and had a spreadsheet with 14 tabs. I did 22 test drives. I bought that new car feeling great about the purchase and continue to have no regrets.

Just wondering, are your numbers in Canadian dollars?

They are! My banking is actually all with American banks, and other than the conversion and the health care system, there aren’t a lot of difference between our finances, I don’t think. We have most of the same tools with regards to apps. Happy to receive feedback about how I can make the information easiest to digest!

Welcome!

Welcome! I am about an hour south of Ottawa. I love that we have a Canadian blogger now.

Welcome! I’m excited to hear your story and see the progress you make.

Welcome Elizabeth! Looking forward to hearing your story and cheering you on the way to debt freedom. I am an avid budget user. I found that a simple spreadsheet I have created is best for my use. On my spreadsheet every column is a pay period and every row represents an expense. So, you basically list down “All” expenses under the appropriate column. For instance, my car insurance is one yearly payment in July. I enter every income as a positive number and every expense as a negative number. The last row is where I total things. This way, I can easily see which pay perods require additional transfers from a savings account and which pay periods will end up in the positive. This is very simple but very comprehensive. Using this simple sheet makes me think about each expense category and try ways to minimize them such as changing a mobile operator, getting rid of cable, negotiating insurance rates and etc. Good luck with your journey to success.

I look forward to seeing your budget. You have such a low emergency fund, what is your goal for the fund and how much will you fund per paycheck? I got out of debt last October and have been saving $500 per/paycheck and will reach my $10,000 goal in two weeks. It takes time, but it’s possible. My secret to getting out of debt is my income went way up and I took my credit cards out of my wallet.

I am hoping to have three months of expenses saved, but one month would be a good start, while also whittling down my debt. I have ZERO emergency savings right now, and that terrifies me. Figuring out how to have savings and pay down debt at the same time is intimidating.

Welcome! Great to see a Canadian blogger. Looking forward to following from the Maritimes :).

Welcome!

My husband and I started using YNAB this year. We’ve never used a budget before, and while our finances are good we want to get a better handle on things. So far, I love the online synchronizing – it makes it so much easier for me to keep track of where the money goes. Writing things down in a notebook never worked for me.

Just looking at what you’ve told us so far, I would suggest first saving $500-2000 in an emergency fund to cover unexpected repairs, etc. Next, I’d save up for a rental move – however much you’d think to cover moving, deposits, etc.. (For your sake I hope Toronto rental market doesn’t expect 3 months of rent upfront like they do in Boston – first, last, and security.) After that, I’d attack one debt and use the snowball method. Personally, I’d target the highest interest debt, but I’m not sure it matters in the long run.

I think that’s a really smart move! As much as I want to throw everything at debt, having no savings puts me in a precarious spot.