by Hope

Whoo, boy. I don’t even want to do a recap of 2023. So much loss. So much heartache. And so many struggles.

So that’s it, that’s all I’m going to say about 2023. We are no longer looking back. Just looking forward.

I feel confident that 2024 is going to bring so much change, so much growth, and so much joy!

In the past, I have made lists upon lists of things that I am going to accomplish in the coming year. That is not happening for 2024. If anything the past years have taught me just how true the old adage of “We plan and God laughs” is.

So instead I have a few “not going to happen” items. And then one big mindset goal…

Not Going to Happen

- I am not going to neglect my physical health.

- I am not going to let others disrupt my peace.

- I am not going to take on any additional debt!

I realize that experts would say to state my goals as a positive, but that has never worked for me in the past. I’m trying something new. These are things I will not tolerate and will not let happen this coming year.

My Mindset

- Be ready to say “Yes” to whatever opportunities are given me.

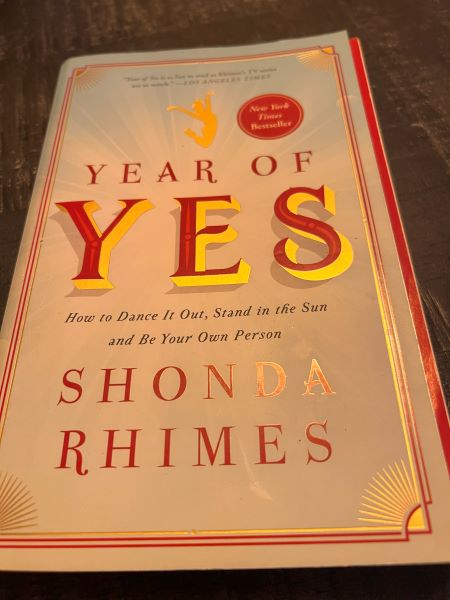

As I previously mentioned, I have been in purge mode for quite a while now. And sorting through my stacks and stacks of book has been a big one. I’ve sorted them by category, priority to read, etc. And this book gave me the motivation for this coming year’s mindset.

It’s not the only one, but the title just speaks to me in so many ways. I read this book several years ago and have been skimming through the passages I underlined and highlighted over the past couple of days.

Changes Coming in January

Here are some things I am specifically looking forward to in January.

- Hopefully, I will get a start date for my new part time job as a catering coordinator for a local fast food restaurant.

- With tax season upon us, I anticipate being able to pick up some additional hours at my current part time with the accountant.

- I am wrapping up my HUGE project, reworking the tech stack for a local winery and launching their new website next week. That payment will push me into February as far as having bills covered.

- With all the different work fronts I have going, being very intentional about my one day off a week (Sundays) is going to be very important to keep me mentally and physically healthy. Planning for that now.

- Friendship! A friend from way back that I reconnected with at my high school reunion is going to town for his birthday weekend. It will be a blast to hang out and reconnect with him. (And he knows I’m broke so this will not be a spending event, just a time spent encounter.)

I hope you have a wonderful and safe New Years! I will be snuggled up with a stack of library books and my dogs…reading in the New Year and definitely asleep before the clock strikes midnight.

Here’s to the most glorious coming year that we can not even imagine! A year of YES for me!

Hope is a resourceful and solutions-driven business manager who has spent nearly two decades helping clients streamline their operations and grow their businesses through project management, digital marketing, and tech expertise. Recently transitioning from her role as a single mom of five foster/adoptive children to an empty nester, Hope is navigating the emotional and practical challenges of redefining her life while maintaining her determination to regain financial control and eliminate debt.

Living in a cozy small town in northeast Georgia with her three dogs, Hope cherishes the serenity of the mountains over the bustle of the beach. Though her kids are now finding their footing in the world—pursuing education, careers, and independence—she remains deeply committed to supporting them in this next chapter, even as she faces the bittersweet tug of letting go.

Since joining the Blogging Away Debt community in 2015, Hope has candidly shared her journey of financial ups and downs. Now, with a renewed focus and a clear path ahead, she’s ready to tackle her finances with the same passion and perseverance that she’s brought to her life and career. Through her writing, she continues to inspire others to confront their own financial challenges and strive for a brighter future.