by Hope

There have been lots of writers here on BAD who have utilized a No Spend Month to make progress in their debt payoff journey. Here are just a few of them:

Parents Coming to Visit and No Spend Challenge

Doing it again – No Spend September

How the “No Spend Challenge” Can Help You Get out of Debt

Preparing for a No Spend Month

I have decided to try for 2 months of no spending. Of course, I had decided to try this and then my heat went out. But I do plan to move forward.

Prepared for No Spend

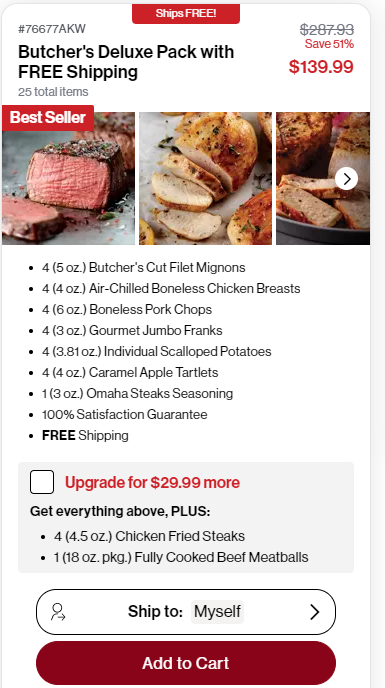

I prepared for this by reviewing my pantry to see if I have the food to last. (And my dad sent me a package from Omaha Steaks as a Christmas gift.)

Reviewed events and needs to make sure there was nothing out of the ordinary on the horizon.

And committed to NOT SPENDING for the next two months.

Setting Myself Up for Success

I believe that starting the year with this mindset accompanied by starting my new part time job are setting myself up for success on the financial front. Between my now 3 part time jobs + any additional project work I can pick up, I should be quite busy. Hopefully.

I am going to take a BAD commenter’s advice and do a weekly post about all spending which should be all bills. This will help hold me accountable.

One Setback

In addition to the heat debacle, I am facing, there has been one additional setback. The project I was to complete this over the new year holiday was put on hold…again! So the payment, a large payment I expected to receive around mid-month has been delayed again. (This has been a constant issue with this client/project that was originally contracted in August, 2023.) The timetable is once again up in the air. Which means, that the bills I anticipated covering easily for the next month-ish may be more challenging than I planned. However, there is another iron in the fire for more work that I am quite hopeful about. I will keep you posted.

Hope is a creative, solutions-focused business manager helping clients grow their business and work more efficiently by leveraging expertise in project management, digital marketing, & tech solutions. She’s recently become an empty nester as her 5 foster/adoptive kids have spread their wings. She lives with her 5 dogs in a small town in NE Georgia and prefers the mountains to the beaches any day. She struggles with the travel bug and is doing her best to help each of her kids as their finish schooling and become independent (but it’s hard!) She has run her own consulting company for almost twenty years! Hope began sharing her journey with the BAD community in the Spring of 2015 and feels like she has finally in a place to really focus on making wise financial decisions.