by Hope

I have struggled with my relationship with money my entire life. It began as ignorance…seriously, I graduated from college, move to a big city (Chicago) and even bought a couple of cars and had absolutely no idea how money works. No clue that credits scores existed, never heard of debt to income ratio and the list goes on and on. I was wholly unprepared to be a financially responsible adult. Wholly!

I have written about that before, how I believe our schools should have a required curriculum on basic personal finance concepts. But I digress.

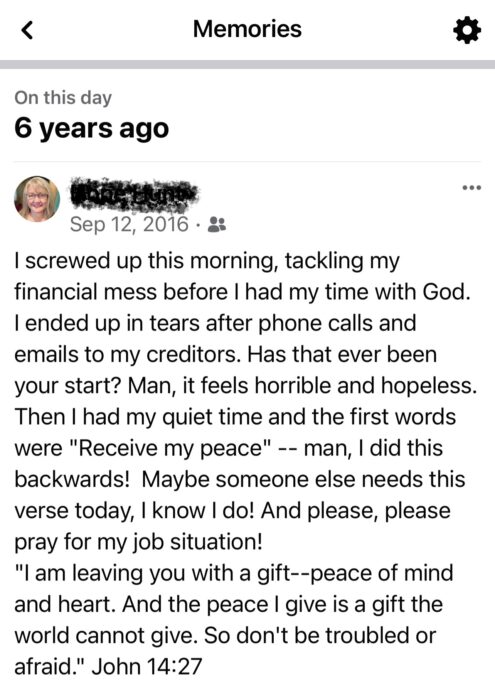

Even 6 years ago, I was struggling, not only with my terrible decision making, but also just know what financial concepts were and how they worked together.

I found myself reverting to “old” thinking the other day. And I quickly squashed it.

Many BAD readers will remember that my budgeting process was kind of backwards. I would compile all my line items. And the plan to make the amount of money I needed to meet all my needs and wants. Yes, I know stupid.

The last two years with a healthy regular income, really helped me turn the corner. I knew how much I was going to bring in and I knew the cadence. But I’m back to contracting…and while I do have regular pay and a regular pay schedule. I find my mind returning to “the old ways” – planning a budget outside of my means.

As of this week, I am in negotiations to turn my contract work into a full time job. I have asked for a bit more money than I am making now. So we shall see how it goes. I haven’t decided if I will remain here if they won’t budge on salary. But we will see. Wish me luck!

Hope is a resourceful and solutions-driven business manager who has spent nearly two decades helping clients streamline their operations and grow their businesses through project management, digital marketing, and tech expertise. Recently transitioning from her role as a single mom of five foster/adoptive children to an empty nester, Hope is navigating the emotional and practical challenges of redefining her life while maintaining her determination to regain financial control and eliminate debt.

Living in a cozy small town in northeast Georgia with her three dogs, Hope cherishes the serenity of the mountains over the bustle of the beach. Though her kids are now finding their footing in the world—pursuing education, careers, and independence—she remains deeply committed to supporting them in this next chapter, even as she faces the bittersweet tug of letting go.

Since joining the Blogging Away Debt community in 2015, Hope has candidly shared her journey of financial ups and downs. Now, with a renewed focus and a clear path ahead, she’s ready to tackle her finances with the same passion and perseverance that she’s brought to her life and career. Through her writing, she continues to inspire others to confront their own financial challenges and strive for a brighter future.

So, what do you think ?