by Ashley

Thanks to you, readers, I just completed and submitted my PSLF application (<<<does that make anyone else think pumpkin spice latte every time you read it? Just me? Cool, cool.)

I feel like I’m fairly on-top of my student loan stuff, but this just goes to show the benefit of the community here because I fully had no idea that I could submit a request to have past payments count toward the PSLF program.

What is the PSLF program?

For anyone unfamiliar, this is a program established by the feds/US Department of Education to forgive student loans for those who work in certain public service industries. I work at a public university and that “counts” for purposes of this program.

The PSLF program allows forgiveness on loans after the borrower has made 120 qualifying payments on eligible loans while working full-time in qualifying employment. I know there were some pandemic-related exceptions, as well (e.g., I believe months counted with no payment made during the interest pause period).

Why I didn’t apply for PSLF years ago

I never applied for the PSLF program when I first started working full-time. At the time, the PSLF program was a mess (perhaps it still is? I haven’t kept abreast of this). I knew multiple people who believed they were in the PSLF program and faithfully made 10 years worth of on-time payments only to have the rug pulled out from under them. There were many excuses (e.g., they didn’t have a qualifying loan, they weren’t officially enrolled in the program, they had made some other such clerical error) but the bottom line is these people I knew – friends and colleagues – were really counting on this loan forgiveness that did not in fact pan out.

I never planned to be in debt long enough to take advantage of the PSLF program. 120 qualifying payments?! That’s ten years! Absolutely not – no, thanks. Also, I feel a sense of responsibility to pay for my loans. I signed to take these loans on. I owe the money. I need to pay it back. It was as simple as that.

All of these are reasons why I never applied for PSLF to begin with.

Why apply for PSLF now?

I started my full-time job in 2015. That means I’ve been working for 7 years in this field. Why apply for PSLF now? What changed?

First, my life changed. Sure, if everything had gone to plan, I would be totally debt-free (minus mortgage) by now. Twice over, in fact. My initial debt-free projections were for the year 2020, and my revised projection was for June 2022. Both dates have come and gone and I’m still in debt. My divorce and associated legal fees, multiple moves (first out of my marital home, then between rentals for a couple years, and finally to the home my new-husband and I purchased together), a new-to-me car, inflation…..yeah, I’ve still got debt.

Changing philosophies and world views

More philosophically, my view of student loan forgiveness has changed. I see student loans like the next housing market crash. Lenders were lending money to people who had no right to be given such huge loans. When I graduated, I had over $100,000 worth of student loans! That’s an insane amount of money, and though it allowed me to earn a higher-level degree I need for my current job, I think there are some irresponsible lending practices going on. If we really wanted to get into the nitty gritty, I’d tell you about how higher ed, in general, is broken. College used to cost $3,800 the year I was born, and now it costs around $12,000/year. And that’s just undergrad. I’ll stop myself from going on a longer rant about this topic.

Back to PSLF – I’ve been paying faithfully since I graduated college in 2013. For most of that time, my student loan payment was the single largest payment I owed. It cost more than my mortgage on my first home. We were STRUGGLING and even with making $1,000+/month payments, my loan balances were growing. They were getting bigger because the interest, alone, cost more than that. Long-term readers may remember the days back in 2014/2015 when I was focusing on other debts first (e.g., medical debt, car debt, tax debt) and still paying a HUGE SUM toward student loans, only to keep watching them grow.

I’m no economist. I’m no tax pro. I love a good budget spreadsheet, but I’m not really a pro at any of this stuff. And yet, it doesn’t take a rocket scientist to see this as a major problem. It’s not right. Predatory lending, overextension of loans, and such high interest rates that borrowers can never get out from under them (I had student loans with 8.5% interest!!!). All this to say, I think I’ve changed how I feel. I still feel like if you borrow money, you should pay it back. But student loans…the interest they generate…they’re a different beast entirely. It’s not that simple. Feel free to disagree, but I feel like I’ve paid my debt back. Both through actual monetary payments, and also through the public service I’ve given the state of Arizona.

What’s next with my loan forgiveness?

I’m enrolling in PSLF. In the meantime, I’m going to keep putting some money aside in a separate account for student loans (rather than paying toward them directly, I’m saving the money). But I’m going to focus more attention on my car loan first. It will take me likely a year and a half to pay it off. Then I can turn back to student loans. Maybe I’ll still pay them off before the PSLF would come through. I’ve got 3 more years to go before I’d qualify for forgiveness. But I at least want to be “in the system.” I want my payments and past history to count toward the 120 qualifying payments. And when I hit that 120 payment-mark if I still have outstanding student loan debt, I’ll be more than happy to graciously accept the debt-forgiveness.

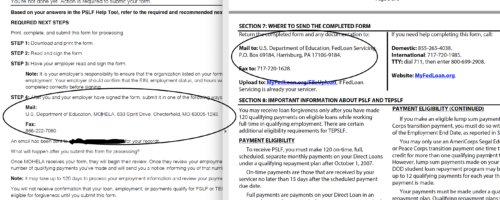

Just one little “funny” to leave with you all. When it came to completing my PSLF application forms, the Dept of Ed is living in the dark-ages and wants the forms to be snail-mailed in. True to form (the Dept of Ed, known for being a cluster*), there were two totally different addresses printed in the application materials. One was part of the application itself. The other address was on the cover page, containing all the instructions of what to do. Can’t make this stuff up, folks. Totally different addresses in totally different states and different fax numbers, to boot!

Although I assume the former is the correct address (the one on the application, itself), I went ahead and printed the application out twice and mailed one to each address just-in-case. I’m not trying to mess this up due to some clerical error and the clock is ticking. All applications are due within the next couple of months. No time to spare! So I’m crossing all my t’s and dotting my i’s and hopefully everything is in order to be enrolled into the program and have my old payments grandfathered into the plan.

Thank you, as always, for your comments, advice, and suggestions!

I want to crowdsource suggestions of some good books related to getting out of debt. Also, suggestions on investing and/or growing money would be of interest. I’ve read all the original Dave Ramsey stuff. I used to follow him religiously but have evolved and have a little bit broader world-view now. I’d love to dig into some other stuff for funsies.

Hi, I’m Ashley! Arizonan on paper, Texan at heart. Lover of running, blogging, and all things cheeeeese. Early 40s, married mother of two, working in academia. Trying to finally (finally!) pay off that ridiculous 6-digit student loan debt!

Honestly Ashley, THANK YOU for being willing to examine and reappraise situations and change your mind based on new information.

As for financial advice or gurus, I got nothing. So many are just repeating the same advice from 15-20 years ago (high interest savings account? That’s what, 2% for most of us now?) that is outdated and irrelevant.

Thanks, Kerry! With how divisive the social climate is these days, I really try to stay open-minded. Rigid ideology (regardless of issue/position/whatever) is not my thing. Life-long learning (and growing, changing, evolving, self-improvement, etc) is more my thing.

Sounds like maybe you’re in the same boat? Let’s be friends! 🙂

Good luck on the PLSF! I never enrolled for all the reasons you cited, and got excited thinking that I would be able to wipe out the last of my loans during this lenient time. Alas, several years of payments don’t qualify since they were from before PLSF was established (yeah, that’s how long this is taking) and I have so little debt left that I probably can’t refinance into a qualifying loan anyways. So I’ll just keep plugging along and maybe Biden/Congress will forgive what’s left.

I too was a Dave Ramsey follower, but no longer. Scorced earth is not for me. But I budget and am intentional with my money. A good friend’s philosophy is that personal finance is personal. Even though Dave’s plan has great success, and I would love to follow it exactly, but I’ve been doing the debt pay-off far too long, and I will work the plan as best as I can. With today’s economy, one needs to be flexible and agile with their plan.

Agreed 100%!

Are you on Instagram? There are a few people I follow who have sensible, doable advice. @brokeblackgirl @finaciallifocused @popcornfinancepodcast @farnooshtorabi @thebudgetnista. Some of them have podcasts as well.

Thank you! I’ll check these out!

Glad you decided to pursue PSLF. I felt similar to you when the waiver first came out and wasn’t sure I would pursue it because I too felt like I should pay them off and had actually been paying extra throughout 2021 (my loans were OLD (FFEL) so no pandemic payment pause for me) with the goal to have them paid off in 2023. But, then I did the math and saw that I’d already paid almost twice as much as I’d borrowed (original loan just over $49000 and I’ve been paying since 1998). So I figured it was worth a shot and I’ve worked my entire career in public service as a social worker (24 years) so maybe this was a gift for all these years in a satisfying yet under paid and often undervalued field? I made my last payment in 10/21 since I had over 120 payments with qualified employment. I was officially granted forgiveness in 2/22 and it was the best feeling, just under $24000 forgiven. So grateful that after 24 years I could move forward debt free.

A couple of suggestions, if I can offer what was helpful to me…I followed a Reddit board (or whatever they’re called) for PSLF and a Facebook group. I learned a lot and it helped me be patient with the process even though my case was pretty simple and straightforward. I learned from others’ experiences which kept me from panicking when I got form letters from FedLoan that weren’t updated. I’m not sure why you had to mail your forms in as I was able to do everything completely online, but there are so many different experiences with PSLF. I wish you all the best and hope it works out for you.

Oh my gosh, so it sounds like still a mess. I will definitely check out PSLF Reddit threads and Facebook groups – great ideas! Thank you! And many congrats to you on getting out from under that student loan debt!

After hyper-focusing on getting out of debt, I paid off my loans in 2016 – which was an amazing moment for me. As someone who has paid their loans off, I believe there needs to be more student loan relief/forgiveness/etc etc. I am extremely disillusioned by higher ed and student loans (federal and private) the current system is not sustainable! I hope everyone that can is able to sign up for this program – my sympathy is with the borrowers.

I also echo how happy I am to hear you’ve evolved – we all should! It is ok to change your mind or priorities when the times also change.

and I hope my comment about being happy you’ve evolved is understood as like hey we all change and that’s good and normal! Not you really NEEDED to change lol, You’re wonderful and I’m glad you’re back on the blog.

Thank you for the kind words! I took the comment with the spirit in which it was intended 🙂

I had my loans forgiven last month. The program started in 2007, so the first year people were able to be forgiven was 2017. It is true that the program was left to falter but they are trying to fix it, and I have heard the new serviced Mohela is good. I didn’t have to deal with them because my loans were forgiven while still with Fedloan. The waiver counted time before grad school that I worked for a qualified employer so it saved me a year and a half from being 10 years post grad school. If you have older loans, you may have to consolidate them, but that was a very easy step. The Facebook and Reddit threads helped a bunch. Good luck!

I am glad you applied! We have loans here in Canada, OSAP etc, and I know very little about them because luckily I did not take out loans – but my tuition was far less than yours. Folks seem to think anyone with college debt must pay it all off, and they get so upset at the mention of loan forgiveness – but these loans are predatory. Not to mention if you’re black or a POC. SO kudos to you!

So glad you applied! When they tally up your payments you may have more that qualify- I had some from before PSLF existed qualify (2006-2009) so every little bit helps!

Oh wow! I think my limiting factor will be my employment. I wasn’t working full-time in a qualified field until 2015. But that’s great to hear that some older payments you made were grandfathered in. I agree that every little bit helps! 🙂