by Sara S

BAD folks, I need some help. Budget help, to be exact.

For a long time we were on a roll with our budget. Every Dollar’s free app was working well for us. We liked that we could each enter in our spending on our phones and easily collaborate on the budget. But somewhere in the middle of this crazy year we fell off the budgeting train big time. Like at this point I don’t even know where the train tracks are anymore.

I’ve just gone back to my previous habit of spending as little as possible and hoping for the best. So each month I’ve been determining the money that can go towards our debt purely from extra increase—income from side hustles, random rebate checks, etc. I’m not finding unused each month in our budget to put towards our debt. Not. Effective.

I think one deterrent with the app is I’m trying to be on my phone less, and I find entering things in on my iPhone to be tedious anyway.

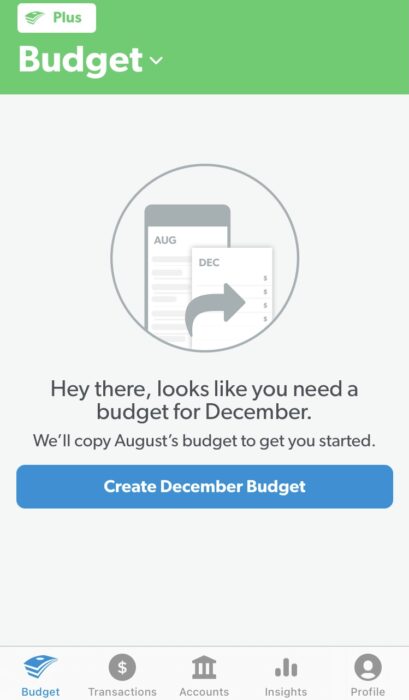

The Every Dollar App judging me and my life choices

Going Old School with a Budget Spreadsheet

My gut feeling is that I’d do better using the computer. So I want to try a good old fashioned budget spreadsheet. I’m a sucker for a good spreadsheet and graphing program anyway. I like data entry (can you imagine how fun I am at parties?!), and I already track our debt payoff with charts in Numbers, the Mac version of Excel. I like that a spreadsheet is really customizable and that it’s secure and private.

But in the past years budget spreadsheets have failed me because:

– I don’t know how to set one up effectively

– I get lost on what I’ve entered in a category and what I haven’t

How to Make it Last?

So I throw this question out to the BAD community: how do you use a budget spreadsheet effectively?

I know there are tutorials out there on how to make a budget spreadsheet. But I need help knowing how to make it usable long-term.

- Do you enter your spending/payments daily?

- Do you keep track of each receipt and payment in a category? How do you know if you’ve entered something twice or haven’t entered one yet?

- We get paid (our main salary) twice a month. Would you still do a monthly budget?

- Would it be more effective to use Google Sheets (instead of Numbers on our desktop computer) so my husband and I could each access it online and edit it?

In a dream world, I’d also like to have one file with several spreadsheets: our budget, our debt payoff tracker, out investments, and even our net worth.

There are budget tasks I like to do by hand. I use a Bill Tracker from the Budget Mom that I like (I got it back when it was free). And the debt-tracking carts from Debt Free Charts are great too. But I’d like the math and budget help a spreadsheet can offer.

I’m feeling overwhelmed these days (these… months?), and I’d love to get whatever budget help you can offer!

Just use Mint it pulls in all the transactions automatically and you can just go in and change the categories if assigned wrong. You can add custom categories, split expenses, have carryover budgets/savings, and add cash expenses. I’ve been using it 5+ years and it’s great to have all that data available on my spending trends. They’re owned by Intuit (TurboTax and Quicken brand) so I feel confident in the security of linking my accounts.

You can also export the info to a spreadsheet if you’d like to keep it long term. Instead of that I have an annual budget one-pager tab (in my mega finance spreadsheet) that I update the first of each month with the monthly totals of each budget category from Mint.

Hi Sara! I totally understand going off the rails when it comes to budgeting, as I also haven’t really looked at my finances other than ‘live on little – throw everything else at debt’. If you’re going to be setting up a spreadsheet and using the computer anyway, Every Dollar does have browser access. That can help you with not worrying about the calculations. To answer your questions:

1. I’ve done this weekly, or bi-weekly, dependent on my freedom on the weekends.

2. Not really. I’ll go through both my Mint and Every Dollar accounts to review purchases and recategorize as needed.

3. I think monthly budgets are the most friendly, even if you’re being paid bi-weekly.

4. I think this boils down to your feeling of security. I’m familiar with the big generational difference between my mom shutting down all internet access when she’s working on her spreadsheets, versus me using apps. You can also put a spreadsheet in Dropbox or something similar – Google Sheets isn’t your only option.

We use google sheets. Our file has two spreadsheets—one with the budget breakdown (fund name, amount in fund, amount budgeted, total spending, amount left) as columns. The total spending cells are updated by calls to the second spreadsheet where we enter in expense (date, amount, budget category, type of purchase—cash/cc/check, location, cleared). We update as it hits our bank account except cash—which we rarely use now. We’ve used this method for 3.5 years now. We used excel before but google sheets makes it easier to share.

YNAB. Hands down the best budgeting system out there. I prefer to use it on a computer browser; it does have an app which is fully functional but not required. I also love spreadsheets and have things running for other financial aspects of my life but I can’t see myself ever switching my budgeting over from YNAB.

I will say that YNAB is more about the philosophy of their budgeting style than it is about the tool itself. The tool is great but you don’t get the full benefits without grasping the budgeting methodology they teach. Because of that, it does have a little bit of a learning curve to adjusting your thinking but that initial hurdle is well worth the payoff (it’s why so many of its users are YNAB evangelists, lol).

I’ll second the YNAB recommendation! My husband and i have been using it for something like 5 years and we both agree it’s one of the best decisions we’ve made during our marriage. I prefer to enter each transaction myself, but you can also set it up to manually import from your bank/credit card.

I don’t have my system down perfectly, but what we are trying is separate checking accounts for each budget category. I have a Bills account, then quite a few sinking funds accounts for gifts, car repair, home repair, vacation. Then one for blow money and one for groceries. Everything starts in the bills account and then on a set day all the transfers happen to move it across the accounts for the month.

So I set up a monthly budget in excel and assign each dollar a job and adjust the transfers for the month. For us this is normally just adjusting the blow money now that we are out of debt but last year the blow money was paid to debt each month.

Then I just check the my bank online throughout the month to make sure I’m not in the negatives anywhere.

It works but our problem has been that the sinking funds haven’t been high enough when an expense happens so I end up moving money around the sinking funds to cover the overage. I need to get back to if we don’t have the money in that category we don’t buy it.

In my opinion, this is what zero-based electronic envelope budget tools handle beautifully (my preference is YNAB per my post above but they all do similar things). I let a minimal amount sit in my checking account to pay any immediate bills coming due and everything else is siphoned off to my single savings account (or to investments but those are for far-future me and are more nebulous/undefined). With the electronic envelope budget, I might have all that money in one physical pile, but I can easily see via my budget how many dollars I have earmarked for each of my priorities. If my car breaks down and I don’t have the full amount saved specifically for my car issues, it’s as simple as typing a different number on a screen instead of physically moving the money from account to account and then figuring out when I can pay out of that account and how to do so.

If your system is working well for you, then great! Don’t want to overstep and nose my way in where I’m not wanted, just offering an option if it’s of interest. 🙂

I enjoy budgeting so much that I use two methods. I use The Budget Mom planners in paper and pen for monthly expenses and planning and a spreadsheet for an annual overview and plan. Good luck!

I agree with the others with YNAB. It helps you give every dollar in your bank account a home.