by Hope

As you all know, I have been working diligently to pay off the smaller of my two student loans. And guys, I am so, so close. I can almost taste it. As I’ve been reviewing my finances and planning for the end of the year and even into 2021, I am so proud of myself.

Back in May, my smaller student loan balance was $14,129. By the end of 2020, despite the toilet paper storage, the crazy of COVID, kids moving in and out, working being slow and then crazy and so on, I will have paid off $14K+ in 8 months. I feel like I should be on one of the ads…woman pays off blah, blah, blah. You know what I’m saying.

I mean, seriously, if I keep this up, which I am working hard to be able too, I could be debt free in 2 to 2 1/2 years. Before Gymnast graduates, while Princess is still in school.

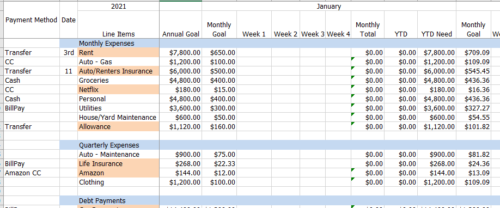

2021 Budget & Beyond

And I’ve got even bigger goals…my 5 year plan is really starting to come together. All of your feedback has really helped me focus.

I have begun working on my 2021 budget AND 5 year plan. I loved T’Pol’s feedback on the 5 year plan post about having specific goals for each year and putting them in your budget. I’m doing that.

And I appreciated how Angie brought up health, not so much as a financial goal, but because of the financial implications especially long term. This is a big one for me. I hadn’t thought to incorporate it in my planning, but the advice is spot on.

Stable Housing

My landlord was out this week to fix a few things and he made it clear that he doesn’t want me to go anywhere. We are good tenants if I do say so myself, and he also reiterated that he would like me to buy the house. Buying a house is NOT on my agenda right now. I am too wishy washy on where I want to be long term. But it was reassuring to know that he is not trying to sell the house out from under us. It is really great to have such a responsive and flexible landlord (by flexible, I mean, he lets us pretty much do what we want – paint, plant, etc. It has really allowed us to make this house a home.)

I look forward to celebrating with you about my student loan pay off but more than that, I am ecstatic what seeing the possibilities could be with my 5 years plan and budget.

We leave today for Texas. This will be my last visit with my parents until May, 2021 when we anticipate my Texas family coming to Georgia to celebrate Princess and Beauty graduating from high school. We have packed all their Christmas presents to go with us and that is a big weight off. With all that’s gone on this year, being able to celebrate the holidays together is very special.

Hope is a resourceful and solutions-driven business manager who has spent nearly two decades helping clients streamline their operations and grow their businesses through project management, digital marketing, and tech expertise. Recently transitioning from her role as a single mom of five foster/adoptive children to an empty nester, Hope is navigating the emotional and practical challenges of redefining her life while maintaining her determination to regain financial control and eliminate debt.

Living in a cozy small town in northeast Georgia with her three dogs, Hope cherishes the serenity of the mountains over the bustle of the beach. Though her kids are now finding their footing in the world—pursuing education, careers, and independence—she remains deeply committed to supporting them in this next chapter, even as she faces the bittersweet tug of letting go.

Since joining the Blogging Away Debt community in 2015, Hope has candidly shared her journey of financial ups and downs. Now, with a renewed focus and a clear path ahead, she’s ready to tackle her finances with the same passion and perseverance that she’s brought to her life and career. Through her writing, she continues to inspire others to confront their own financial challenges and strive for a brighter future.

Stay firm on not buying that house. It sounds like it has a lot of problems.

Nice budget! I was wondering about Princess and college- has she decided where she’ll attend? I know around here most applications are due soon and early decisions already completed. Are you going to be able to help her out financially? Georgia and Florida both have nice scholarships for good students- GS’s tuition was paid for with Bright Futures and I believe Georgia has the Hope scholarship. GS will graduate debt free.

Hope, I’m going to try to convince you again to NOT pay down your student loans and divert that extra cash to 401k savings again…. Hypothetically, if you had applied that $14,000 to a solo 401k, you’d be much further ahead based on tax savings and stock market gains. Hopefully I can walk you through the math.

First, you don’t have to pay taxes on the contributions. Let’s assume you only pay 10% in federal taxes, and 4% in state taxes. That’s $1,960 in taxes saved this year. Or $1,960 more you could contribute to the 401k and still have the same take home pay as paying your loans.

On top of that, let’s assume the market increased a nominal 7% (this is a widely accepted long term return rate) evenly over the year. Assuming even contributions over 8 months, you would’ve earned ~$320 in gains ($40 of that is gains on your tax savings alone!).

So by putting it in a solo-401k, your net gains (taxes and market gains) at the end of the year would be around $2,280. Meanwhile, paying down your loan only saved you $151 in interest. Now this is highly dependent on your tax situation, so modify your tax rates as necessary. Keep in mind, this is only for the first year. The amounts will compound more and more as each year goes by. I did a rough calculation, and if you kept up the same paydown rate (14,000 over 8 months), by mid-2027 your loans would be paid off and you’d have 170k in your 401k. Meanwhile, if you paid off the loans ASAP and waited to contribute to your 401k for the extra year that takes. You’d only have 110k in your 401k in mid-2027. That’s ~60k difference over 6.5 years! Compounding interest can be your friend.

Please, please, please investigate this more in regards to your personal situation. It is far more important than learning about federal rate setting and inflation which do not directly impact you.

Good for you! I saw a quote today related to paying off debt that was something like “Spend your money on your future, instead of your past.” You are getting to that point and it feels great!

I am so happy for you. Look what you can do when you apply yourself! One loan down and two more to go until financial freedom. It’s going to feel awesome when you can take this loan money and use it to apply towards your dream of home and travel with nary a guilt because you have met your obligations.