by Sara S

We reached another debt milestone yesterday: we paid off our debt principal below $280,000. We’re sitting at $278,667.51 to be precise. (Oh is that all?? Gulp.)

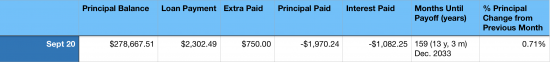

One of my September goals was to pay $750 extra instead of my normal goal of $500 extra. I used my freelance work and a refund we got when we switched our insurance. So we paid our usual $2,302.49 payment plus $750:

That means in 2020 so far we’ve paid off

– $13,770.46 of principal

– $9,771.99 of interest

Celebrating Our Small Milestones

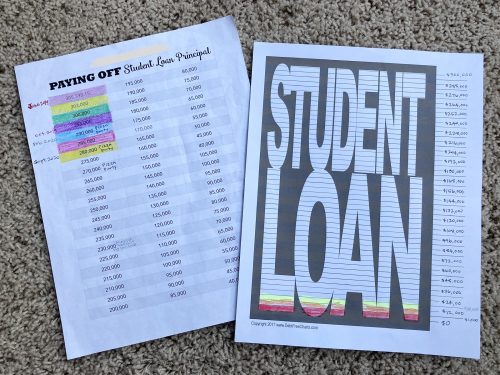

We’ve set some small milestone rewards to help keep us motivated. For every $10,000 we pay off we earn a pizza night. Our last one was in February, so it’s been a while. Like usual, the kids helped me mark off the chart I made and the one from Debt Free Charts.

Sometimes I wonder how much they’re paying attention to our milestones, but as I brought out the charts my 10-year-old asked, “Does this one get us a pizza party?” She notices.

Passing this $280k milestone is both exciting aaaaand overwhelming. I mean, we still have to pay off $280,000. How could we be working this hard, but still have so far to go?

Our 10-year-old also asked if we’d be earning a night at the beach. That was our prize if we dropped our debt principal down to $230,000 by the end of 2020. Considering so far we’ve only paid off under $14,000, I had to shrug and admit to her that’s probably not going to happen. I get frustrated having to say it out loud. (Thanks again for the memories, 2020.)

But we have to take time to celebrate our small victories. These debt milestones that we celebrate as a family are helpful. Without them, I think I’d be catatonic in the corner.

So last night we had Papa John’s and—because we’re Harry Potter nerds—butterbeer (cream soda blended with vanilla ice cream and butterscotch sauce). Our five-year-old said, “Wow, this is a party!” It really did feel celebratory.

Working Towards Our Next Debt Milestone

It’s been a year since we refinanced our student loans with Earnest. Dropping our interest rate down from 7.2% to 4.3% has been a big deal. We pay about $1,100 in interest each month, or nearly $35 a day. But in the beginning of 2019, we were only paying interest each month and not even carving away at our principal. So we’re making progress, just very slowly.

I’ve been scheming when we’ll be able to make a big payment at once towards our loans again. Those are so much more efficient. We have a tax refund and part of the sale of our house sitting in savings just in case COVID shuts down our business again—we don’t want to be caught scared and scrambling again. But if things look more hopeful with the pandemic, I want to put as much of that as possible towards our loans.

We also should have a payment coming from a state audit of our business. (Yeah, they first audited 2017, and now they’ve done 2016 AND 2018 to be thorough.) But we found out this week they owe us about $350 for 2018. So whenever that comes in, we’ll push it to our debt.

In the mean time, I’ll keep hustling with side jobs and keep trying to grow our business. And I’ll keep aiming at those debt milestones on the horizon.

Congratulations!!!! I am glad to see this for you, and the party with butterbeer and pizza sounds like heaven.

It’s been a rough year for sure, keep up the good work.

I think it’s a good thing to be open and age-appropriate with your kids about finances. My parents had financial struggles when I was growing up (circumstantial rather than anything they did), and it was kept from the kids. Except we knew, we just didn’t have any way to fill in our gaps in knowledge, so it ended up causing a lot of stress for the kids.

I’m glad you’re approaching this in a positive, age-appropriate, and constructive manner with your kids.

Way to go!! Can someone explain something to me? We have never had student loans for ourselves or our children so I don’t know how they work. However, I do know if I make a big principal only payment on my mortgage it lessens the mortgage principal by that amount. I still owe my fixed payment but my principal balance is lower. From what I read here, when people are making a big one time principal payment on their student loans, they are having to credit a huge chunk of it to interest. If you have already paid the interest owed for that months payment, why couldn’t your entire extra payment go towards principal reduction? And please feel free to be as simplistic as you want, I won’t be offended! haha!

Good job! It’s been a rough year so definitely celebrate not going backwards and continuing to move forward with paying down debt.

CONGRATULATIONS!!! This is hard and you are doing a great job!