by Sara S

Over the weekend I was feeling the fatigue of paying off our massive student loans. I just wanted to eat out and buy extra presents with reckless abandon. It’s hard to stay motivated while paying off debt that doesn’t change quickly. I just wanted to feel a win by paying off and eliminating a debt.

I was also frustrated that our shovel of money to put towards debt hasn’t grown this month like we hoped. My side hustles are plugging along, but my husband’s side job (which makes a heck of a lot more than mine) will only get him one shift this month. It’s disappointing.

Thankfully, more than one of you BAD commenters encouraged us to look for small victories and to create milestones as we chip away at our total debt. It’s a marathon not a race. So after a pity party, I did two things this weekend:

Charting Our Progress

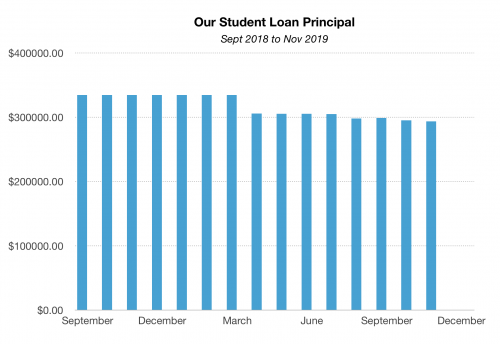

I looked over what we’ve paid off in the last year, and decided to put them into charts. I made a bar chart for the past 15 months that is both non-impressive and encouraging. Yes, that crazy-gradual drop is not eye-popping. In fact, it shows that we were stuck paying off interest only for at least 7 MONTHS from September 2018 to March 2019 (insert facepalm).

But then in April we put our tax refund towards our debt. This triggered a wake up call this summer that we could be doing a lot more to pay off our student loans. By September we had refinanced with Earnest, which initially (cringe!) bumped our principal up a bit. But then we kept making more progress with our lower interest rate and higher monthly payment.

I then calculated our percent of change. In 2019 (January to November), we’ve paid off $40,953 of our principal, a -12.23% percent change! Considering we had a 0% change for too long, it’s great to see we ARE making progress.

I also decided we needed a visual of our payoff to feel like we were accomplishing something. An adult sticker chart, if you will. I printed off a free chart from Debt Free Charts. I capped it at $300,000 so we’ve only been able to color in a teensy section so far, but somehow there’s a lot of satisfaction that comes from coloring in a line.

Setting Small Milestone Goals

I then started to brainstorm small wins for our debt payoff in 2020. There’s no debt snowball to motivate us with small victories, so we have to create our own milestones. We most likely won’t put all of our tax refund towards our debt this year (we just purchased some equipment for the business and we need to beef up the business savings account). That means we’re going to have to really hustle to keep up our momentum.

Here are my ideas for milestone goals and rewards:

- Order pizza and party when our student loan principal reaches $290,000, $280,000, etc.

- Go to the movies when our principal gets lower than our mortgage (which is currently at $279,000)

- Stay a night at the beach if we have a 20% change in principal (or get down to around $230,000) in 2020

Long payoffs are really draining. But as we track our progress and celebrate small milestones, I’m hopeful we’ll be able to keep ourselves going.

What small milestones or rewards motivate you to pay off debt?

I like the lucidity and practical nature of this post. Debt payoff requires a long steady course and finding the proper balance of milestones to celebrate is essential. I think you are doing great, and I hope this blog can help keep the momentum going in the months/years ahead!

Thanks, Joe. I appreciate that. I hope we can keep up the momentum too!

This is similar to what we did too. Our only debt is the mortgage and there’s no real smaller wins, so we created our own. We picked a goal for the year ($20 000) and drew up a colour in chart with a line for every $1000. We’ve done that for the past 2 years, and it’s pretty motivating! We are only really focusing in on that $20 000 and trying to beat our goal, but the overall mortgage falls significantly over time. It’s just demoralizing looking at the big number all the time.

That’s awesome, Ruby. We should try just focusing on the smaller amount for the year too so I don’t overwhelm myself so much! Thanks for commenting.