by Sara S

Hi! I’m Sara, the newest member of the Blogging Away Debt team. I’m excited to be here—not because I’m happy to be drowning in debt, but because I know the BAD community gives hope, tough love, and motivation to each other. You are my kind of people. Plus my family and friends can only listen to so much of my financial talk, so I’m grateful to have an outlet and a place to document our progress.

So what’s my story? I’m a writer and mom to three under 10, living in the beautiful Pacific Northwest. I’m in my late 30s, and I love hiking, reading, gardening, and binge-watching Netflix while I do the dishes. Together my husband and I run a business that we love, sometimes hate, and has required a ton of loans.

Honestly, our business debts are getting paid off and they’re not the ones that worry me most. Even our $280,000 mortgage isn’t the scariest of our debts. We have no credit card debt. No car payments. No personal loans. So what overwhelms me most? Without a doubt it’s our beast of a student loan.

My husband’s career in healthcare required a serious and staggering investment in his education, and we just didn’t know how to succeed in his field without taking out loan after loan. We foolishly borrowed during his school years like it was Monopoly money.

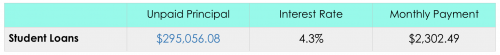

Now we have a good, growing business, but we’ve made very little progress on our student loan. He graduated seven years ago with (gulp) $358,000 of student loans. Want to know how much is still hanging over our heads?

Those numbers take my breath away! For years after school, we could only make income-based payments that barely paid off the interest. We lived frugally but with no set budget, and we just sort of assumed it’d eventually get paid off somehow. We were in denial that at the rate we were going, we’d be paying for this loan until the end of time.

About three years ago, I stumbled upon “The Total Money Makeover” by Dave Ramsey. For the first time I saw our situation clearly, and instead of panicking, I saw there was a plan. Baby steps. A way out. Hope! I saw that our debt could actually be paid off.?? My husband, on the other hand, didn’t really catch the vision until this summer. And even though we still disagree sometimes on what course to take, we’re finally making a dent.

Here’s what’s worked for us so far:

– Refinancing our student loan: we changed from My Great Lakes to Earnest in September, dropping our rate from 7.2% to 4.55% (hallelujah!)

– Budgeting with the free Every Dollar App: we can be sloppy sometimes, but we’re still more aware of our spending than we’ve ever been

– Picking up side hustles: this week alone we’ve each taken on a new side job, and we plan to put that money towards our loan

It’s a start. I look forward to the day when I can breathe easier and declare us debt-free, but in the mean time I’m going to share our ups and our downs, our good choices and our stupid mistakes. I’m thankful for this community and the chance to learn from each other.

Here we go!

Anybody else out there owe more on their student loans than their mortgage? Any advice on how to carve away at such a colossal debt?

Wow! Welcome! Glad to have you here! Tips: be honest with your spending, try not to justify splurges. It is what it is.

You’re definitely on the right track by following Dave Ramsey! I don’t know that anyone has better step-by-step instructions on how to get out of debt.

You’re clearly making good money by the fact that you don’t have personal or credit card debt. You’re right, the mortgage isn’t nearly as big a problem as the student loan debt. I’m guessing he’s a doctor.

I think the problem began though, because you’re living like you think a doctor’s family should. The best thing to do when he graduated, would have been to live like you’re still in college, and live on very little of what he’s (you’re) bringing in, to accelerate the payoff. I know that’s hard, but if you can cut back, wayyyyy back, you’ll have this debt (enormous as it is) long before the other two contributors to this site. Best wishes.

Thank you, Alice! There are definitely pressures to live a certain way, so “no” has become an important word in our family vocabulary. 😉

Just chiming in to say it’s possible. Not sure on your income. But you’re rate is pretty low. Are you positive that paying off your student loan is the most effective option? It really depends on a lot of other things like rate on your business loans, rate on your mortgage, income, retirement, etc?

We started with 240k in student loans. Paid it down to 100k and got rid of the high interest loans. And now plan on paying the minimums and investing the rest for the most efficient strategy.

Way to go, Angie! And that’s good advice. Thanks for commenting!

I was commenting on my phone and forgot to say…. Welcome!!!

With a business you’re in a great position to play around with your “salary” and solo 401k’s to get a lot of your money in tax advantaged accounts. In turn lowering your IBR calculations. Keep an open mind.

Although I totally get it if you’re wanting to improve your monthly cash flow. That payment is a huge stressor, especially if you have dependents and are on one income (not sure?). I’m interested to hear more of your story and your priorities.

Just chiming in to say it’s possible. Not sure on your income. But you’re rate is pretty low. Are you positive that paying off your student loan is the most effective option? It really depends on a lot of other things like rate on your business loans, rate on your mortgage, income, retirement, etc. how much of your loans fit under REPAYE?

We started with 240k in student loans. Paid it down to 100k and got rid of the high interest loans. And now plan on paying the minimums and investing the rest for the most efficient strategy.

Welcome, Sara! I’m looking forward to reading more of your story and following your pay-off efforts.

Thanks so much, Emily!

Welcome, Sara! That is an impressive amount of student loan debt. Still, please consider paying off loans according to interest rate. If the business loans have higher rates, I would focus on them first. After, that is, you have an adequate emergency fund in place. Do you? Even at a high earnings level, you need a rainy-day fund. Also, have you started retirement savings?

Paying off the higher interest rate loans is definitely something we’re going to consider. Thank you!

We do have an emergency fund that is just okay, not amazing. We started on our retirement savings years ago, but stopped contributing for now so we could put more towards the loans.

Thanks again!

Welcome. As you go along you might want to put out your budget to ask advice on specifics but it seems like you are on the right track. Its interesting that in seven years only a small amount of your debt came off, so you are doing the right thing by getting after it harder. Too many people just plug along carrying student debt for decades and don’t realize what a burden it actually is to their overall finance picture. Set mini-goals for yourself so that you have a sense of accomplishment since paying it off totally will take a few years. Good luck!

I love the idea of mini-goals, what a great idea. I think that’s one tough thing about having one huge loan–you don’t get the debt snowball experience of paying off smaller loans and feeling some momentum. We need to celebrate small victories along the way.

Thanks for commenting!

Welcome!

Something to ponder — when you refinanced the student loan, did you use that to reduce the monthly payment or are you able to maintain the old monthly payment? Dropping your rate by nearly 3% should save you roughly $9,000/yr, $750/mo in interest using rough numbers. An extra $750/mo towards the principal will certainly help accelerate your payoff.

Thanks! Our monthly payment did increase by a couple hundred of dollars. That took us down to a 12-year payoff schedule, but we would still love to beat that! I’m so. sick. of. student. loans.

Welcome, we are living in the same part of the country, the photo looks like Ecola State Park. We love it there.

Ecola is so, so beautiful!

Hi Sara,

Welcome! We just finished laying off medical student loans that were about 1/3 of yours, but still sizable. You’re right that the downside of the refinance is not having the snowball for small wins. I’m going to say something contrary to Dave Ramsey. With that debt and your ages you should be saving for retirement while paying off debt. I’m so glad we did. If you wait to start until your loans are paid off it will be so much harder to cat up.

Catch up,haha.

I agree with this. Do not delay retirement savings for years just to put more toward loans. This is something I have never agreed with Dave Ramsey on. Also, he himself says that debt payoff should take most people 18-24 months, so he’s only planning on a delay of 2 years in retirement contributions.

Thanks for commenting, Kate and Hannah. Fortunately we had been contributing first to a 401k and then an IRA for 7 years until we paused it this summer. We just want to gain some momentum on the student loan before we start saving for retirement again.

And thank you for the validation that Dave Ramsey’s principles don’t work for every situation. I’ve often thought that (especially for these massive loan situations), and it’s good to know I’m not alone.

Also, “cat up” is going to be my new favorite phrase.

So…that huge loan is for an education…that he isn’t even currently using?

Yikes.

That kind of debt is crazy even for a DOCTOR, and I’m guessing he’s not or you wouldn’t be having such trouble paying it off.