by Sara S

After months of refusing to look too closely at our student loan debt, I finally scrutinized the numbers again this week. We are still in forbearance with Earnest, so we don’t technically owe a payment until July 22. But I was worried about all that beefy interest accruing. Since we finally had some money available again, I made a payment to slow down the insane interest train.

New Charts

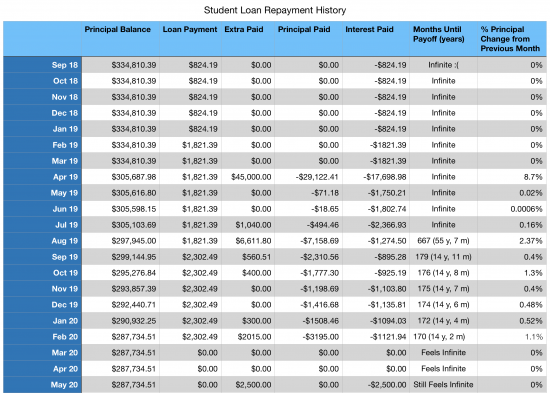

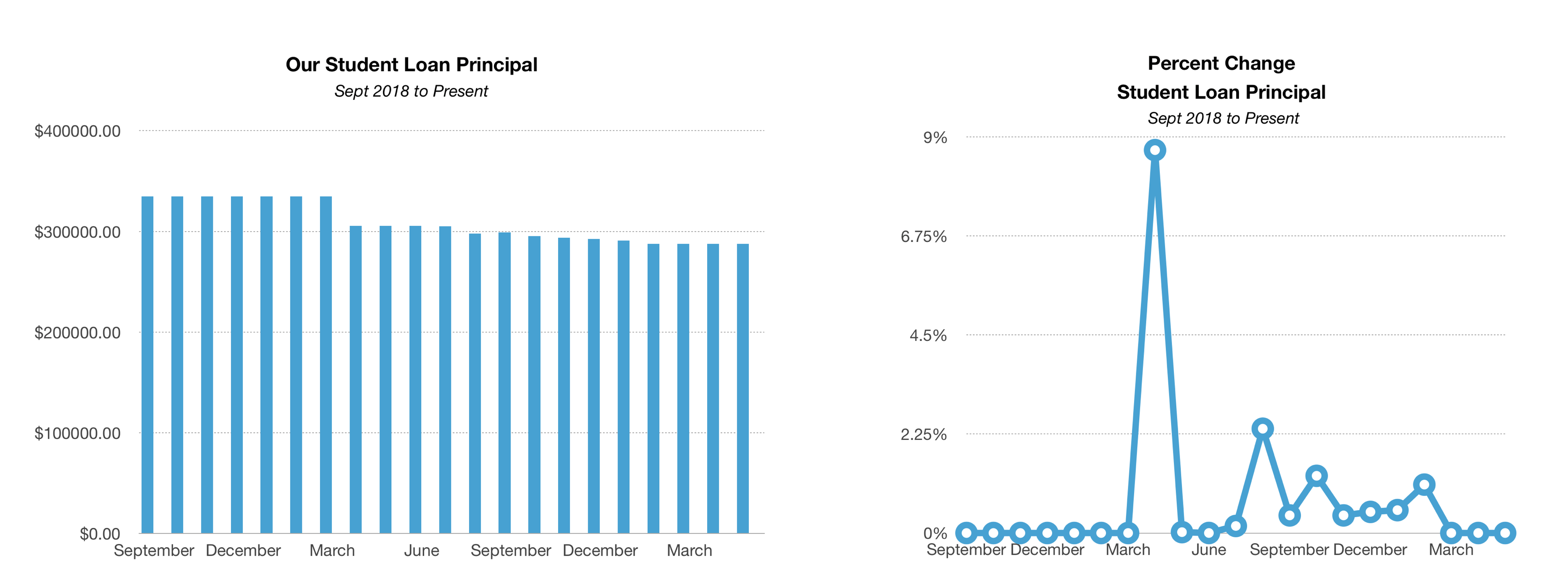

I put $2,500 towards the loan—which I feel like is a lot—and then I updated my nerdy charts I made back in February.

Talk about a BUMMER. That $2,500 only went towards interest!

No matter how I graph it, our debt progress these past few months is so sad. I hate seeing a plateau on a chart and 0% change, because it shows that our freakishly big debt principal isn’t changing. The pandemic has really taken our momentum for paying off our student loan debt and thrown it out the window. That’s frustrating.

The Interest is the Killer

So this week’s payment went towards interest—no principal at all—and there’s still interest left over from these past months to pay. Aaand it’s growing by the day. I decided to add two columns to the chart. I added Principal Paid and Interest Paid so I could break down each monthly payment and see better how it’s applied.

While doing this I noticed a few things:

- My chart was wrong! I had to correct it. While going through our papers with Great Lakes, our last lender, I realized that in the fall of 2018 and January 2019 we were not in fact paying $1,821.39… I forgot that our payments were $824.19! Guys, we were NEVER going to pay this off! What were we thinking??

- Even when we had our payments increased in February 2019, though, we were still only paying interest and never principal. Our principal was perpetually stuck at $334,810.39 for I don’t know how long. (Like literally, I do not know.) Which I can’t even handle. Thankfully we got a large tax return March of 2019, because we were finally able to lower our principal.

- Returning to paying off only interest has reminded me that I NEVER want to be in this position again. I want to carve away at principal every single month, even if it’s just a little bit. I am so sick and tired of this debt weighing us down.

There is Progress

Since last spring, we’ve been able to pay off $47,075.88 of our principal. Even with the pandemic and so many mistakes, that’s still progress. Sitting at $287,734.51 is nothing to brag about, but at least I can see we have made a difference.

I wish I could travel back in time and tell myself to face our student loan debt so much sooner. If you have debt hanging over your head, I hope you’ll stop wishing it away and start taking action. You’ll feel so much better. You may have a marathon to run like our family, but don’t give up! Cut away a little at a time, and one day you’ll be set free.

So glad you are feeling some solid footing right now. I’m curious why your April 2019 payment of 45,000 wasnt applied as a principal payment? If you have a windfall can’t you make your regular payment and then designate a large separate payment as principle only?

That’s not an option with these loans. Interest always has to be paid first. I wish it wasn’t that way!

That is massive and I can understand why you would be so overwhelmed. The good thing is that you have a plan now. It’s obviously not something that will be paid off quickly, but you have seen the errors made and are now working on correcting them. Good luck. It’s very satisfying seeing balances go down. I look forward to seeing your progress.

Thank you, Ellen!

It seems from your chart you are accruing ~$1100 per month in interest. Above that, your principal starts to draw down. (Although even with your $2500 pmt you’re around $800 behind right now). There’s also some weirdness in May-July 2019 where your monthly interest was much higher, $1800+.

I can imagine this is easier said than done especially during a pandemic and the economic disruption, but any way you can try to keep up with the interest each month? That way, at least you are running in place as opposed to falling behind. Then each ‘extra’ payment beyond ~$1100 should reduce your principal and you may feel more tangible progress when you can make those extra payments.

That is helpful to think of it as about $1100 of interest each month. It gives my brain my realistic expectations for each month, and motivation to at least pay that much during the pandemic. Thank you!!!

I may have missed it, but how much interest do you owe now before payments start going to principle?

As of today, there’s about $970 of interest left. And it’s growing… allllways growing…

ok-Im super confused, we never had student debt so Im not familiar with any of this. If the interest part of your payment is $1100, and you have a windfall and can pay $45,000. How come you have to pay far more interest instead of the $1100 in interest for that month and then the other $43,900 goes to principal? Or could you make your regular payment, then immediately make a principal only payment? I clearly don’t know how any of this works but it seems CRIMINAL that they pulling interest out of a windfall payment at that level instead of crediting it to your principal. How frustrating!?

Student loans are such a frustrating mess!

Back in March 2019 when we had that $45,000, we were craaazy behind on paying interest. Like $17,000 behind. Like for years we’d only been paying a part of the interest each month, and never principal. That’s why we had to pay $17,000 of interest first before we could pay principal.

Plus, back then our loan was with a different lender at a higher rate, so we were accruing a lot more than $1100 of interest each month… more like $1800 a month. It seems pretty standard with student loans that you have to pay interest first before principal each time, or maybe we’ve just had bad luck with lenders.

I don’t believe this is a “student loan” thing.

You should have a standard monthly payment. I tried to estimate it based on your table, your $2,302 payment looks like a 15-year loan at 4 5/8% on a balance of ~$298K. Every month you pay interest on the amount borrwed, and pay down part of the principal. Mortgages work the same way. Right now you are running up around $1100-1150 in interest (you can think of this as $37.50 per day if you want, although that could be helpful or a downer).

What is probably catching you about your your table is that when you pay less than the monthly interest, your amount due is actually increasing, but your table is not showing that. You’re showing an unchanged loan principal / balance month-to-month, but not showing ‘past-due’ interest, which you said is now around $970 and probably increases by around $37 per day. It’s that past-due interest that is not obvious in your table and causing these data anomalies.

So to get back on even kilter, you have to catch-up on the $970, and at least try to cover your monthly interest of $1100-1150. Then you are in a position that you can start to reduce your principal owed. But my opinion is this is a ‘any-loan-thing, not specifically a ‘student-loan-thing’.

Are you both doctors or lawyers?

Husband is a dentist.