by Hope

In NoIt’s time for another debt update. And I’m really excited about my progress. I’m less clear on what my plan is. I’m kind of flying by the seat of my pants right now.

When I know I have the bills for the next month covered, I start putting extra income towards debt. And I was able to make some extra payments this past week.

Current Debt Load as of 9/10/18

(as of 10/14/17) | |||

|---|---|---|---|

| Student Loans | $34,587 | 2.88% | $0 (income based deferment) |

| Car | $6,162 | 7.00% | $0 (deferred until November) |

| Credit Card | $3,782 | 17.00% | $0 |

| Collections 3 (Ex-husband) | $3,804 | 6.25% | $246 |

| Collections 2 (Apartment) | $499 | $0 | |

| Self Lender | $0 | 10.57% | $0 |

| Total | $48.834 | $246 |

Debt Notes

- First off, I paid off my Self Lender loan last month. A month ahead of time – woohoo! And received my payout last month which funded my emergency fund! Even more exciting is that I’m receiving a $10 affiliate check from them shortly, someone else must have thought this was a good idea. I know the 10% interest is kind of high, but it was like a forced savings plan and that was really good for me! I would do it again (but I’m not.)

- Because I have been able to pay extra every month on my car, I was offered a 2 month deferment (September and October.) I decided to take advantage of it and pay the extra towards some other debts the next couple of months. In November, I will return to paying $400 per month.

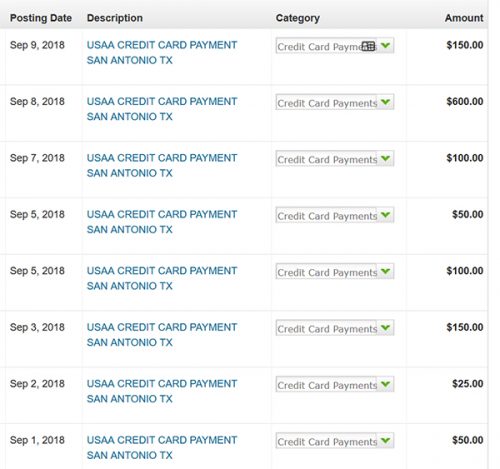

- I haven’t made any more progress on my credit card. Last month, I dropped my on-going total right at $1,300. But that doesn’t mean I’m not paying on it. I continue to use it as a rolling credit line – use it and pay it. Here’s a screenshot of the payments made in the last 10 days. (Sea Cadet is an authorized user on this card as well, his only credit card access and also uses and pays it immediately.) While the balance hasn’t dropped any more, I do not have to designate a separate line item to make the month minimum.

- As you can see, my largest debt payments this past month has been towards Collection #3. I’m thinking this is the debt I would like to target now. A change from my original plan to pay off the credit card first.

Just a side note, I did read the comment regarding my student loan, and while it is in deferment until next spring I am looking at starting to pay some on it.

I am now ready for your guidance. You can see my last debt update here. You are seeing my twice weekly anticipated and actual spending and income. I believe I’m getting back on stable ground and ready to make a plan of action to KILL my debt. WHAT should I target?

Hope is a creative, solutions-focused business manager helping clients grow their business and work more efficiently by leveraging expertise in project management, digital marketing, & tech solutions. She’s recently become an empty nester as her 5 foster/adoptive kids have spread their wings. She lives with her 5 dogs in a small town in NE Georgia and prefers the mountains to the beaches any day. She struggles with the travel bug and is doing her best to help each of her kids as their finish schooling and become independent (but it’s hard!) She has run her own consulting company for almost twenty years! Hope began sharing her journey with the BAD community in the Spring of 2015 and feels like she has finally in a place to really focus on making wise financial decisions.

I would actually get rid of the apartment collection – just for the annoyance factor! And then, YES, target collections 3!! Great progress!!!

Agree with collections 2, just to be done with it. Use next months car payment and do it! But then you have to get rid of the credit card. The balance is less than collections #3 but interest almost 3x as high. When you look at your statement how much interest are you charged each month?

Kill the collections! Then snowball whatever you can and pay down your cc before march when student loans come out of deferment.

I like this plan! Thank you!

I suspect she is focusing on that debt because she wants to free up the definitive $246 a month it is costing her, unlike the credit card that she pays here and there(and they don’t complain as long as they get their minimum.) In the long run your point that she has a higher interest rate in Amazon is a salient one(and one that has been pointed out before). In the short run she is likely looking at the card as something she is using as a revolving line of credit and does not care about th e interest too much because she charges and then pays off. It’s a dangerous game if her income drops and she no longer has the means to pay it off though and something she should be familiar with since less than a year ag o she was forced to go with minimum payments to weather financial difficulty.

i really do not believe that hope ever actually pays the credit card in full. she has never really been crystal clear on this. where would she be able to get a $3,782 for this one bill? the numbers do not add up. i think she makes charges every month and pays only that portion but not the rest.

You are right. I haven’t been able to pay it in full since last winter.

I do not believe I have claimed to pay it in full in some time.

I do use it as a rolling credit line, use it and pay it immediately.

It was just last month that I was able to decrease the on-going balance from $5,000 to $3,782. So I am making progress.

If you look at July your total was ALSO $3782 so actually this card is not where you made progress. The cost of carrying 3800 dollars at 17% for a year is over 50 dollars a month. That’s why people are concerned particularly since a $36 minimum would essentially not even cover all your interest costs which means your balance e increases. This has all been said before though.

Most deferments come with the catch that interest is still accruing so choose wisely if you direct $800 in car payments towards another debt(unlike others I would not direct it towards debt not accruing any interest like the apartment although I do agree with others that it would be nice not to see it in your debt any longer.) Also realize defering

something means you will carry that loan longer which is the opposite of why you said you made above the minimum payment amounts on the car to begin with(with the intent of paying the car off early). Usually companies are more than happy to collect interest from you for a reason.

to be honest – that was the impression you gave when you posted in the past. Now that this person has pointed this out – i can see how your previous posts are technically correct but i def. don’t think it was made crystal clear that you were just paying off new charges. I saw this because i remember an argument about whether or not you paid interest.

Anyway, i echo, get rid of that one small debt. it’s psychologically empowering. Then focus on the CC – the interest rate is outrageous. Since it seems you have been disciplined in not adding to it then once you get it to zero – it should stay there. Nothing else comes close to that in the interest rate so I think that should be killed asap

Why are you still paying your ex-H’s debt? I thought you were going to look into that. Did you?

I believe Hope indicated this is a tax related debt, which might be harder to draw lines around without a formal divorce. If my understanding is correct, I always support paying off the IRS or state tax agencies as a priority item.

Thanks, I had forgotten that.

This is correct.

I 100% agree with the other posters to wipe out that apartment collections. It’s such a small amount relative to your other debts, and it’s a nice psychological win to be able to completely eliminate something.

I agree with previous posters – get rid of the $499 apartment debt and have it be done! I’d then pay the minimum on the remaining collections account and put all other extra $ towards the CC debt with 17% interest! (17%…ack!).

Focus on reducing your monthly interest payments by doing the following:

1. Stop charging on the 17% credit card and make a commitment to pay it down first. Call to request a rate decrease, even if it’s temporary. Get another card if you want to pay your monthly expenses with a credit card instead or pay cash.

2. Make only required payments on the car loan until the credit card is paid off–you’re paying about $53/month interest on the credit card vs. $36 on the car with current balances.

3. Stick to the agreed payment plan on the tax debt until it’s paid or until your higher interest debt is repaid because it’s the lowest interest rate.

5. Ignore the $499 collection until you’re on solid financial footing.

Why should I get another credit card?

Thanks for the plan suggestion. I’m planning on really sitting down this next weekend and coming up with a plan and forecasts for my debt pay off journey. It feels good to be making real progress again.

I assume that poster’s rationale is that if you get a new card and pay off the new charges every month then you won’t pay any interest on them–you get the rest of the billing cycle and a few extra weeks (til the due date) grace period before they charge any interest. If you add charges to a card with a balance, the new charges get added to the balance and become part of your average daily balance that is used to determine how much interest you are charged. You lose that extended interest-free grace period.

This website explains it (https://www.thesimpledollar.com/how-is-credit-card-interest-calculated/) using the following example:

Let’s say you owe $500 on your credit card at the beginning of the month. Fifteen days after the new billing period begins, you charge another $500 on your card. Your card issuer determines your average daily balance for the month by multiplying each balance by the number of days you carried it, then combining them and dividing by the total number of days in the month:

($500 * 15 days) + ($1,000 * 15 days) = $22,500/30 days = $750 average daily balance

Using the daily periodic rate above, you’ll be charged $6.75 in credit card interest that month:

$750 * 0.0003 * 30 days = $6.75

(now adding my own math to the end)

If you used a no balance card to charge those new $500 of charges, they would be given a grace period and as long as you paid them off by the due date they would incur no interest. You’d only pay interest on the old $500, so your average daily balance would be $500 instead of $750, or

$500 * 0.0003 * 30 days = $4.50

Now–if you’re truly paying off every new purchase right away (ie, not waiting for the bill and then paying it), then it’s probably not bumping your average daily balance up by very much and not having as much impact. And I think having additional extra credit available as temptation when you’re in a precarious situation is risky as well, so opening a new card may not make sense.

But the above is why it’s always better to pay towards your credit card as early as you can if you carry a balance over, even if you pay the same total amount in a month. The earlier the payment goes in, the more it lowers your average daily balance.

Obviously I can’t count–I forgot the student loans. 4. Start paying on the student loans since they are accruing over $80/month while payment is deferred.

Question about the car loan having a two month deferment. I know you were paying extra on it each month. Was your bank simply applying the extra toward future payments instead of going to paying down principal?

If that is the case then the extra car payment money each month may be better utilized toward the higher interest credit card. Putting the $800 toward the high interest credit card would make a difference. I understand the psychological value of knocking out the smaller debts as well. Just my thoughts.

They are applying the extra to principal. And this deferment pushes back my “paid off” date 3 months. I had anticipated it being paid off January, 2020, this pushes it to April, 2020. But my final payment due in April will be $162. This is if I continue paying my $400 monthly versus the $308.

And I’m definitely enjoying paying monies toward other debts that have been a little stagnant. But I definitely need to buckle down with a plan soon rather than just paying “willy nilly” like I am.