by Ashley

Nice start to the month! I’ve paid off my first credit card since our relapse of going back into credit card debt.

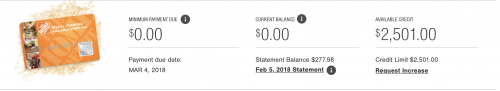

I’m planning to do a modified snowball method, and CC1 (Home Depot) was our lowest balance card. I set the payment for a few days before the end of February. And when I logged in to check things out this morning, it looks like all has cleared and our new balance is $0.00!

After my last payment of $277.98, I can officially say that Home Depot is OFF our debt list and we can move on to our next target.

Right now, our next target is our Bank of America credit card, on which we owe just under $2,000. But at some point, we’ll likely have to change focuses to our Citibank card (which was actually a balance transfer of a student loan to get it away from Navient and lock in a 0% interest rate). The Citibank card is due in full by October of this year, so although it’s been on the back-burner (again – due to the 0% APR), we’ll have to pick up payments here soon so that it’s knocked out by the due date.

Baby steps, right?

At any rate, I’m glad to have one less monthly debt on our list.

Have you recently paid off a debt? What’s a current debt you’re working on tackling?

Hi, I’m Ashley! Arizonan on paper, Texan at heart. Lover of running, blogging, and all things cheeeeese. Freshly 40, married mother of two, working in academia. Trying to finally (finally!) pay off that ridiculous 6-digit student loan debt!

Great job!

Good Job! I bet it felt great to cross one off of the list!

Glad you got it paid off before interest kicked in. Fingers crossed on the Citibank for you an hoping that Capital One card’s interest is not creeping up too badly.

well done on paying off the credit card!

Ding, dong, the debt is gone! WooHoo! Great job.

That is great news. I just started a similar process a few months ago to tackle my lower balances (not higher interest rates) first so that I can feel as though I’m accomplishing something along the way. Honestly, when I actually paid attention to how much interest I was paying a month across each card (for purchases I probably no longer had), I was shocked, embarrassed, and ashamed. I went through all the stages of grief and a few more. I can’t believe I ignored this for so long. But knowledge is power and I’m looking forward to having my first card paid off in 3 months.