by Hope

I return to Texas within the week. Caring for my daughter and her fiance has been a very different experience then caring for my parents. Aging is place seems like a buzzword. But as I get more and more familiar with the care available (or not available/accessible in many cases) to seniors, it just makes so much sense. But it definitely does require planning and fore thought.

Our Story

We kind of fell into it with my mom. When she was originally diagnosed with Lewy Body Dementia and then that was changed to Parkinson‘s almost a year later, the gradual decline made it possible for us to talk through options and make plans as she went down hill. My family has taken EXCEPTIONAL care of her for the past 8 years. There are definitely advantages to having 5 kids and 3 of them living within 20 miles!

We took family photos in 2018 knowing it would most likely be my mom’s last time. Her memory and physical capabilities were fading fast. I’m so grateful we had these done.

Hospice was called in almost 3 years ago now. At the time, they didn’t expect her to last a month.

Now we watch every day, never knowing what it is to come. The long goodbye is definitely an accurate description of this debilitating disease. Her breathing is labored and raspy. It continues to get more and more laborious to feed her and prompt her to open her mouth and swallow.

But if anything my family sticks. My parents are truly examples of those often forgotten marriage covenants they made to one another over 50 years ago now.

Preparing for What’s Next

I feel very blessed to be here for this chapter in their lives and mine. I realize this is a privilege not many are given.

And I’ve realized that for now, being present for those that need me is exactly where I need to be.

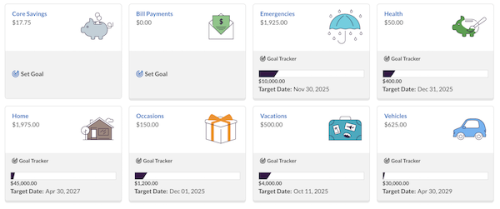

And before you jump in the comments with the negativity or foreshadowing of some thing…I am sticking to my financial plan, saving and continuing to pay off my student loans. But I don’t know what or when my next chapter will come. And for the first time, that’s okay. Being present for my parents (and my kids) while they need me.

Hope is a resourceful and solutions-driven business manager who has spent nearly two decades helping clients streamline their operations and grow their businesses through project management, digital marketing, and tech expertise. Recently transitioning from her role as a single mom of five foster/adoptive children to an empty nester, Hope is navigating the emotional and practical challenges of redefining her life while maintaining her determination to regain financial control and eliminate debt.

Living in a cozy small town in northeast Georgia with her three dogs, Hope cherishes the serenity of the mountains over the bustle of the beach. Though her kids are now finding their footing in the world—pursuing education, careers, and independence—she remains deeply committed to supporting them in this next chapter, even as she faces the bittersweet tug of letting go.

Since joining the Blogging Away Debt community in 2015, Hope has candidly shared her journey of financial ups and downs. Now, with a renewed focus and a clear path ahead, she’s ready to tackle her finances with the same passion and perseverance that she’s brought to her life and career. Through her writing, she continues to inspire others to confront their own financial challenges and strive for a brighter future.