by Ashley

I’ve been keeping a secret from you all. But I want to share an important family update. We have added a member to our family! We got a new dog!

Backstory

It all started during the second semester of last school year (anyone else think in academic years rather than calendar years? Just me? Cool, cool.) My daughter was inducted into the National Junior Honor Society and one of the requirements was to get volunteer hours in the community. We both went through the process of becoming volunteers for the local animal shelter. It’s actually quite a long training process – requiring watching multiple training videos, completing quizzes, and introductory information sessions before you can even start volunteering! So far, we’ve only volunteered by reading to dogs (which is done from outside the dog’s enclosure). If we progress to actually handle the animals, the training is even more rigorous!

At any rate, we began reading to dogs several months ago and I should’ve known it was all over from Day 1. We took a tour of the animal shelter and there were so many adorable dogs and puppies just begging to be taken home! At first, we talked about the possibility of being a foster family. But talking about it more, it didn’t make sense. If we’re going to open our home and our hearts to a new animal, housebreaking them, training them what they can and cannot chew on, dealing with the possible destruction of property, etc. Why would we do that over and over again with different dogs? Why not just adopt a dog, train it up, and have it be ours? At least, that was my argument in discussions with hubs. <3

Finding the Perfect Dog

It took a few months, but hubs finally got on board with becoming a TWO dog family! We were patient in our search. We had a very specific type of dog we were looking for. I have always wanted a lab, so that was high on my wish list. And ideally we wanted a dog that was already housebroken, but was still relatively young. I wanted a male dog. And a sweet, friendly personality and temperament was of the utmost importance. We actually met a couple of dogs that we decided were not a good fit based on personality. But when we met our Shadow, we knew he was the one!

Meet Shadow

Shadow is 11 months old and we’ve had him now for about 6 weeks. Still very much a puppy in terms of energy and excitement! But old enough that he did come housebroken (thank goodness!). Aside from that though, he was basically a blank slate. He’d never even walked on a leash before! There was about a week “warming up” period between him and our other dog, Biscuit. Biscuit was quite jealous at first and became ultra needy of love and reassurance when we first brought Shadow home. Luckily, Shadow is the most laid back lab pup there could be! He quickly and easily found his place, happy to let Biscuit be the “boss.” Biscuit also has some back and hip issues and Shadow very quickly learned to be gentle and careful with her.

Although he definitely still has some puppy tendencies (ahem, he can be a bit destructive if not closely observed), he’s very eager to please. He wants to be a good boy so badly, he just doesn’t know all the rules yet. Above all, he’s the sweetest and most loving dog I’ve ever had. He got his name “Shadow” because he follows me around the house like my Shadow. Even when lying beneath my desk while I’m working, he lays his head on my foot. He constantly wants to be touching.

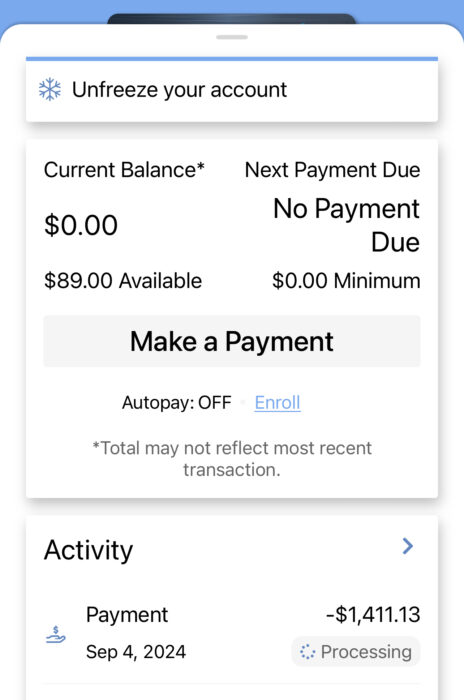

Costs

Of course, a new dog means more costs There were the normal costs of establishing vet care and going through twice as much dog food. But since we “rescued” him from a shelter, he was actually incredibly cheap. We just paid the cost of registration! The most expensive thing so far was paying for dog boarding when I went on my recent trip to Wisconsin. With our older dog, Biscuit, she was able to just stay home while Shadow had to be boarded. I mentioned the boarding costs when I wrote my post about that trip, but I didn’t explain the cost in detail. While my husband was at home at the time, he works very long hours outside the home. We have a doggy door so Biscuit is fine to stay home since she can get in and out to use the restroom, and husband can feed and fill her water in the evenings when he gets home.

That wasn’t going to work for the new puppy, however. He still hasn’t learned what he’s able to eat (and not), and neither of us felt comfortable leaving him home alone for long periods of time. As it is, if I leave for a couple hours he has to go in his dog crate, because otherwise he will find something to chew on that he’s not supposed to. It would be too long for him to be in his crate for the entire day while my husband was at work, and even with hiring someone to come play with him once or twice during the day, we can’t trust that he won’t eat our furniture or something super destructive while home alone. So even though it seemed weird to board a dog while husband was technically at home (only in the evenings), that was the best option for the couple of days that I was away.

At this point, Shadow has already become an integral member of the family! It’s crazy how quickly he found his place in our home and in our hearts. I’ve had 3 dogs in my adult life (admittedly not a ton), but he’s the first who I have loved so fiercely this quickly! I just know as he grows and continues to learn the rules and right from wrong, he’s going to be the BEST dog. Even Biscuit has grown to be quite fond of him. When he was gone at boarding, she would whine and sleep in his crate, like she missed his scent and wanted to be close to him. When we brought him back home, she was so happy, with her tail wagging like crazy as she ran up to greet him. They’ve got such a sweet and special bond!

Are you a pet-person? How many animals do you have? What is the max number of animals you would consider? I think two dogs is good for us right now.

Hi, I’m Ashley! Arizonan on paper, Texan at heart. Lover of running, blogging, and all things cheeeeese. Early 40s, married mother of two, working in academia. Trying to finally (finally!) pay off that ridiculous 6-digit student loan debt!