by Ashely L

My monthly budget for the first month of the year has been updated to reflect some of my goals and also my passions and pursuits. I believe this illustrates the quote on my 2019 financial vision board, which explains that the way people spend and save money is a reflection of their beliefs and desires. My January budget shows my goals to save 25% of my income, plan ahead for any possible expenses, and my personal (non-financial) goal to value my health.

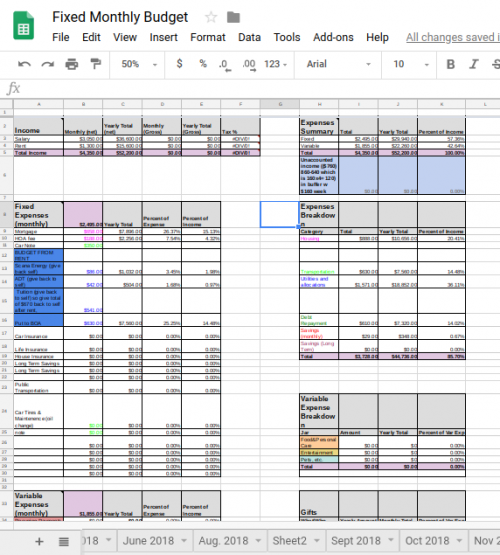

The budgeting strategy that works best for me is to have a weekly budget and a monthly budget. My weekly budget is simple, as I allot $110 to weekly expenses with $25 to gas, $20 to personal/household use, $50 to food, and $15 to any cheap dining out. My monthly budget was a bit more complex and I needed to find a great tool. After experimenting with several budget planners, I found this one that I absolutely love and have used it since. It separates fixed and variable expenses as well as debt repayment and it easily shows the monthly total, yearly total, and yearly percent of an expense. I downloaded both my weekly template and this monthly template from this site with lots of great templates http://templatelab.com/budget-worksheets/.

Savings

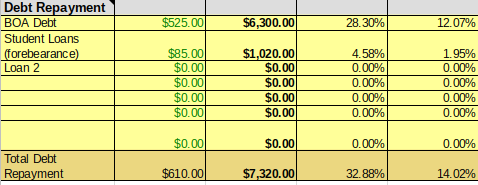

I have $3050 of income for the month of January. I saved 20% of my income as it shows above in the debt repayment section of my budget. $525 is going to my Bank of America credit card balance and $85 is going toward my student loans. (Although Excel is showing my debt repayment to be only 14%, I also include my rental income for one of my houses here so it skews my total income.)

Non-Recurring Expenses

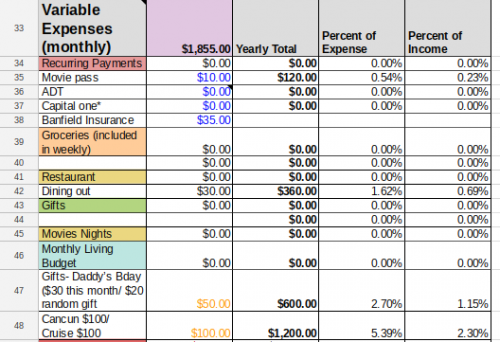

I am also planning ahead for any possible expenses. There are some expenses that I can easily plan for on a monthly basis. This budget planner lists my small recurring expenses such as my wellness plan for my dog ($35 monthly). I am also budgeting for an upcoming trip ($100 monthly for the past few months) and a birthday party that I am planning for my dad ($40 monthly for the past year).

My goal for the new year is to be better prepared for non-recurring expenses. For example, I was on the road a lot for the holidays and I know that my car will need some work soon ($90 one-time payment). I am also staying on top of my wellness and although I am not sure if I will need to, I have allocated money for a doctor visit ($40 one-time co-pay). Any surplus amount from these funds will go back to my debt reduction.

Me-Money

Lastly, I have budgeted money strictly for myself. I believe in frugality but also believe people should do the simple things to keep them happy and maintained, whatever those personal things may be. This month, $50 is budgeted toward my nails. Sometimes I play with this number. For example, in the winter months I can stretch pedicures and I also never get a manicure, only polish changes. I also get gel nail polish because it lasts a full month. This simple mani/pedi time was satisfying for me this month.

I’m looking forward to staying both my weekly and monthly and will keep you posted!

Ashley L, here! I am an educator in my early 30’s. I live in a southern city and when I am not working with children, I devote my time to my “doghter”, a Chihuahua fur-baby. In my leisure time, I enjoy traveling, writing, and reading.

One of my primary goals is to create financial security for myself, which has led me on a journey to pay off debt. A recent step that I am proud of taking is earning my third degree while decreasing my student loans to under $7,000. Come along with me on my journey!