by Sara S

I typically set a few goals at the beginning of the new year, and this past January was no different. Except this year it was tough. I had a hard time thinking of what I wanted to focus on. I couldn’t think of where I wanted to go, or what I wanted to accomplish. I just couldn’t set a clear vision for 2020.

Perhaps the universe was preparing me??

Thinking back, it’s crazy to me how much has happened. Back on New Year’s I had no idea what “quarantine” and “murder hornets” really meant.

Setting Financial Goals

We did end up making some financial goals for the year for our family. One of them was to pay off $30,000 of our debt this year.

In 2019, we paid off almost $42,370 of our student loan principal, so $30,000 seemed very doable. We weren’t confident on what our tax return would be this year, and my husband wanted to get back to contributing to our retirement later this year. But $30,000? We could work hard and do that. I was taking on more freelance work and our business was growing.

However, I think my Magic 8-Ball would say, “Outlook not so good.”

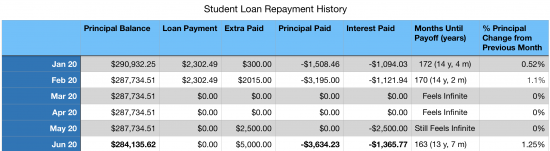

The pandemic and resulting loss of work really messed with our goals. It definitely slowed our momentum. Like I mentioned a few weeks ago, we took the forbearance from Earnest for our student loans, so we made zero payments in March and April. Those little skips really set us off course. Interest stacked up and the principal went no where. I made a $2,500 payment in May that didn’t even cover all our interest.

Tracking Our Debt Payoff

Thanks to the BAD community, I now see we accumulate about $1,100 of interest a month (or about $37 a day… gag). We decided we could pay $5,000 from our tax return towards our debt (the rest of the tax return is going into savings just in case we have to shut down our business again).

That payment went through yesterday, and I legit whooped and hollered when I saw it on my screen:

See that drop in the June entry? That’s progress!

After months of sitting at $287,734.51, our principal finally dropped to $284,135.62. That’s a 1.25% change! I know it’s silly, but it’s just so much better than 0%. Seeing progress is so energizing.

Resetting Our Financial Goals

It’s undeniable that we have to reset our financial goals for the year. It’s nearly half-way through 2020 (hallelujah), but we’re far from meeting our debt payoff goal (wah-waahhh). And—this is a terrifying thought—we still don’t know what the rest of the year will bring.

But I don’t want to give up on our goals quite yet. So at least I can say that as of today, we’re on our way: we’ve paid off $6,796.63 so far this year, and there’s still time to catch up a bit more. My latest freelance job will pay more, and we’re getting a bit of cash back here and there, like a preschool reimbursement because we couldn’t go the last 3 months.

I think we have to give ourselves some grace this year, but I’m not ready to quit yet.

Do you have a set amount in your budget that is allotted to this? I approach big numbers by giving myself an amount I want the remainder to be at by year end. For example, my mortgage by year end I am hoping to be at $85,000 or lower and to get there I set my principle with this in mind. With $1100 in interest fees, it seems to me my first goal would be to be below $280,000 by year end. That would mean contributing $1100 (Your interest) + $690(principal of $4140) or around $1800 a month towards school debt.

Is that doable with your budget? If I remember right that was your old loan payment at one time.

Thanks for commenting, Cwaltz!

That is very doable, and we’re well on our way. Our required monthly payment is $2302.49, but we received a 4-month forbearance when we weren’t able to work. Our next required payment will be in July. We do try to add extra payments every month that we can, but it doesn’t happen every month. So by the end of the year, we should pay off at least $7200 more of our principal.

So while I hoped to get down below $260,000 by the end of 2020, it will most likely be more like $275,000.