by Hope

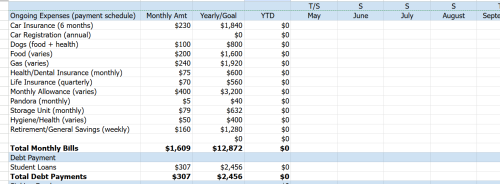

I appreciate all the feedback on my post sale budget. I’ve revised it to add more categories.

This covers the time period of May 15-the end of 2025 (eight months). And I thought that tracking whether it was a travel month, stationary month, or mix would make sense when I look back on this as that factor alone will greatly affect some of the categorial spending.

What categories have I missed? I want to get this nailed down before the sale closes so I have a clear plan on how to proceed.

Notes:

- I saw several recommendations for revisiting life insurance. I’ve added it to my to do list once I arrive in Texas mid to late May.

- I’ll have to transfer my car insurance and registration no later than the end of the year, I don’t know how much that will run in Texas so leaving insurance as it is now, and will revisit car registration when it comes time. My current tag expires in December so I have a little while.

- Obviously the gas, food, allowance categories will fluctuate based on it being a travel or stationary month. When I’m stationary, they will just build up.

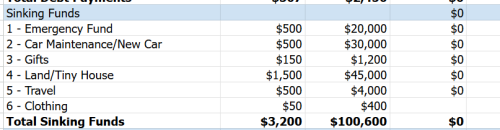

Sinking Funds

I need to have savings goals. But I did move them to sinking funds and gave myself either a long term goal or monthly goal. And I will track by month how much I contribute to each category.

I put them in order and set a monthly goal. My thought is this:

When I hit the monthly goal for that category, I will start on the next priority item for that month. For example, let’s say I make enough to contribute $500 to my EF in June, I would then start on the $500 toward the monthly car maintenance goal and so forth. And I start over at number 1 each month UNTIL, I hit the annual/overall goal. So when I get $20K in a EF, then every month I would start on number 2… and so forth.

Does that make sense?

Income

I know you want to see my income. But it fluctuates greatly. With this budget, I have to bring in roughly $2K per month after taxes and overhead to maintain, any more than that goes to the sinking funds. I think that’s easily achievable.

Some months I barely make $2K, but then with one project that jumps up to $8K. So I can’t really predict my monthly income. But I can tell you that I am laser focused on not only day to day work, but I’m working on two different passive income strategies and have been for 6 months now. Work in progress.

I’m also planning to search for a part time, in person job in Texas just to get me out of the house a bit. Maybe 1-2 evenings a week when a sibling can cover my parents. Probably more of a mental health thing, but will provide some income.

What do I need to clarify? What have I missed? (Before you ask, debt numbers are just around the corner.)

Hope is a resourceful and solutions-driven business manager who has spent nearly two decades helping clients streamline their operations and grow their businesses through project management, digital marketing, and tech expertise. Recently transitioning from her role as a single mom of five foster/adoptive children to an empty nester, Hope is navigating the emotional and practical challenges of redefining her life while maintaining her determination to regain financial control and eliminate debt.

Living in a cozy small town in northeast Georgia with her three dogs, Hope cherishes the serenity of the mountains over the bustle of the beach. Though her kids are now finding their footing in the world—pursuing education, careers, and independence—she remains deeply committed to supporting them in this next chapter, even as she faces the bittersweet tug of letting go.

Since joining the Blogging Away Debt community in 2015, Hope has candidly shared her journey of financial ups and downs. Now, with a renewed focus and a clear path ahead, she’s ready to tackle her finances with the same passion and perseverance that she’s brought to her life and career. Through her writing, she continues to inspire others to confront their own financial challenges and strive for a brighter future.

Is this post sale budget assuming ALL consumer debt is paid off with the proceeds of the house sale? I question $150/month for gifts and $1500/month for tiny home if you still have debt, even that $1500/month towards your student loans would be amazing. Looking forward to seeing true debt numbers, as it’s hard to comment on a budget without the full details.

Yes. Debt numbers publishing tomorrow.

But after house sale, the only debt that will remain are the student loans.

To me if you still owe student loans you need to wait on this tiny house. You owe money, pay it off. Who is the allowance for?

That will be amazing to get all that debt paid off!! Why not put all extra towards the student loans and knock those out before a tiny home? Or at least take a chunk out of them, say $1000 towards the loans and $500 towards savings for the tiny home.

I see at least 2 problems here:

First, you have unfortunately not had the financial discipline to make a budget work with comparable expenses to this budget until now, what’s going to be different in future? Eg. you’re thinking of saving $1500 per month towards a new ‘tiny house’, yet that is not far from the cost of your current home (including utilities, insurance, mortgage etc) that is being sold at least in part because of being financially underwater.

Second, even if the above budget does work, you have to knock out that Student Loan debt. $30K, $50K, whatever it is, you have to put more than $300 to it. If you ever have a month with $8K of income, you have to be thinking of putting at least $5-6K towards student loan principal payments. But again, do you have the track record to do that, and/or what’s different now?

You say you can easily make $2K per month, so fund this budget, and occasionally can make $8K. But have you done it? Any windfalls seems to have gotten spent, you ran up more debt, and you haven’t actually lived at a $3,500 run rate, right? [$2000 ‘new budget’ + $1500 ‘current house’ = $3500 pro-forma run rate]

I still don’t think the questions are being understood entirely.

The most important part of breaking a cycle of bad decisions is accountability. Maybe being honest about future bills is a start, but you’ve never really done a review of the previous month. Your income is variable going forward, but not the past.

Show us your “forecast” for the PREVIOUS month along with what you spent and what you made. This is accountbility and it’s the only way you should be making plans for your future as you don’t seem to have a real idea how you spend money.

I get where you’re going with this and I think it’s a step in the right direction. The general tone of my comment on the last post still stands.

400 per month of “allowance” is still a slush line and it’s excessive for your situation. Give yourself max 50/month to blow and parse out line items for everything else that you want to fit in there.

Sinking funds: I do get what you are going for, but this is not exactly the appropriate application of sinking funds with respect to gifts, car maintenance, travel, and clothing. Sinking funds are a method that turn irregularly occurring expenses into a regular budget commitment. True sinking funds belong with your bills as budget line items, not ranked among savings goals. Car maintenance, in particular, is a necessary expense and should be funded alongside the bills, not only after this monthly Efund commitment and not lumped together with new car savings.

I will also question if funding gifts and travel only after you clear bills and 1000 in efund and car savings is realistic for you. It seems clear from reading about you here for 10 years that you WILL spend money each year on gifts and travel, and a budgeted sinking fund alongside the bills is the appropriate choice. I would recommend carving those out from the “allowance” line currently in the bills.

Lastly, I think you should only proceed from funding the Efund when it has at least $6000 (or 3 months basic expenses), instead of after the 500 each month. The monthly idea is ok for more discretionary savings goals.

I had a second thought. Does the residency change affect your current health insurance? Then for next year, it’s time to start researching and planning for your 2026 coverage. Texas does not fund expanded medicaid, so you could be in danger of falling in the affordable coverage gap. You’re in that critical category of being a working adult, no dependents, and a decade+ to regular Medicare enrollment, so you’ll want to keep forecasting your MAGI for ACA subsidy purposes.

This is more comprehensive and organized, but it’s just a list of goals and expenses that are completely disconnected from a plan for paying for them.. It’s meaningless without income. When your income is variable, it’s even more important than ever to plan things out and to have a strategy for saving money from the high income months to cover the low income months. It’s not a budget unless it includes expenses AND income.

You should not save for a tiny home until you have eliminated your student loan debt. You need to stop creating so many buckets and focus on an Emergency Fund and car fund, max of 5K each and throw everything else at the student loans.

Are you currently paying your student loan payment? Or is it in deferral? Would you consider paying that off when the house sells? Seems like an albatross that is just going to keep following you for decades.

You are mixing your saving goals in with your sinking funds. Sinking funds are for categories that you don’t spend in every month, but know you will spend in sometime during the year. Everyone needs new underwear, you know you are going to spend that money. So figure out how much clothing you KNOW you need, and divide by 12. Clothing is sinking. Car registration is sinking. Car maintenance is sinking. Health insurance co-pay and deductible. Annual vet visit for the dogs. Gifts.

Things like an emergency fund and a house are savings goals. You don’t work towards all savings goals at once, you prioritize. If you don’t have an emergency fund, you should in no way shape or form be saving for or spending on “travel”. Every penny should go towards your emergency fund. Once your emergency fund is done then you move on towards the next goal. I imagine car replacement since you live in your car. Then maxing out your tax advantaged retirement savings. Then house. Only when you have these basic necessities covered do you start thinking about indulging yourself in travel.

More to the point, you can’t really make a budget for money you don’t have. Or for things that haven’t happened yet, like the house sale. You KNOW that as a self-employed person the sensible thing to do is live on last months earnings. You did it before until you fell behind and never caught up. I’d suggest taking 2,000 as your base and seeing if you can actually live on that this month. Do you have $2000+ debt payments? Will you have it by the end of the month? If you make more than $2000 put it towards next month until you have $2000+ at the start of the month. You don’t have to wait for the house to sell to do this. If you don’t make $2000, you know you don’t have the ability to give yourself $400 in spending money this month.

Does that hygiene/health include medical expenses (co-pays, deductibles, etc?) seems crazy low for someone your (our) age. I am very healthy and expenses from the usual appointments add up to more than $50/month.

Ideally, you would pay those student loans off asap. However, before you start accelerating those payments, find out what programs you are eligible for. I would never recommend paying high payments to student loans when you do not have an emergency fund.

On another note, only you know how secure your housing is with your parents. I fully support your decision saving for a tiny home if you are concerned that you will not be there a year down the road. Also, there is a part of me that says consider any likely inheritance in the long term plan. While I never want to count chickens before they hatch, if a significant income is expected there then retirement is SLIGHTLY less of a concern vs if it isn’t.

Yes, housing insecurity is the driving factor for expediting the housing savings. Even having a year worth of rental/apartment monies saved will give me peace of mind. Should something happen to my health or my parents, I would be in a bad spot for a home base or address, so building this savings is crucial to my mental health and someday housing plans. The goal is land and tiny home, but should the need arise before that, I want to be prepared. Thanks for understanding.

There will be inheritance. The whole family has had many discussions on that and all is spelled out in legal docs. But like you, I don’t plan or think about that.

Just FYI – you only have 30 days after establishing residency in Texas to change your car registration. It doesn’t matter when your current tags expire. If you sell and are planning to use your parents address as your residence you won’t have until December to figure it out.

Cell phone/iPad costs were listed on the last version but are missing here?

I agree with most people above. #1 goal pay off consumer debt, #2 goal Emergency Fund I’d say 3000, #3 throw all extra money at student loans, #4 finally throw extra money into savings. Do not save for tiny house or land when you need to finally get rid of the student loans. If you have a month you make more than the “forcast” throw it at student loan, no buts ands about it.

Tebble