by Ashley

Last Car Payment

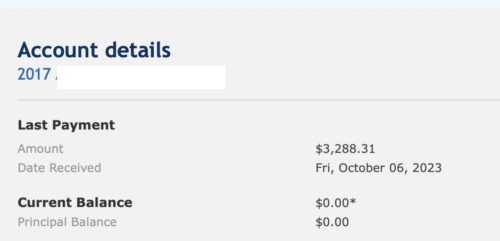

Guess what, friends! I did a thing! In one fell swoop, I paid off my 2017 car loan. My balance is now $0!

This is my big win to report, as this was my only “consumer debt.” My only remaining debts are my student loans and our mortgage.

Student Loan Drama

I’ve mentioned before that I’m putting my student loans on the back burner. While I’ll be making monthly payments toward my loans as required, I’m not planning to put anything “extra” toward them right now. Instead, I’m officially enrolled in PSLF and plan to ride that out until my remaining loans are forgiven. That said, the government and loan service providers have made the process “clear as mud.” The last time I mentioned my student loans back in February, I reported that the online platform indicated I had 44 qualifying payments to go.

Somehow, today, I logged in and saw that 2 of my loans indicate only 15 payments remaining….while 2 of my loans show 0 eligible payments (thus, 120 payments to go). Like….what? Absolutely nothing has changed in the interim between February and now, so I don’t know why the online platform is telling me such disparate information. It cannot be accurate. I called my service provider, Mohela, to try to talk to a customer service rep and gave up after a full hour on hold because I had a meeting I had to jump into.

I pretty much loathe these loans and allllll the interest I’ve already paid. And the servicers do not make it easy to get information. Long wait times, rampant misinformation, etc. Ick. Unfortunately, this is something I’ll have to tackle another day. Moving on…..

New Financial Goals

When we had our coffee date, I mentioned being unsure how to proceed after my car is paid in full. This is a “blogging away debt” blog. But I’m now feeling my priorities shift more toward saving and investing. My husband and I do pay extra on our mortgage, but not with the steadfast determination with which I paid off my car.

Instead, I’m thinking about shifting to more savings/investment options. My open enrollment period opens very soon. I’d like to increase my savings/investments in several categories. Here are my thoughts:

| CURRENT in 2023 | NEW for 2024 |

|---|---|

| HSA: $5500/year | HSA: $7750/year |

| FSA: $700/year | FSA: $1000/year |

| 403B: $125/check | 403B: $175/check |

| 529: $50/child/month | 529: $60/child/month |

If I’m doing my math right, the total amount of investments annually from this table would amount to $14,740 (FYI: I’m paid biweekly. I have 2 kids, and each has their own 529).

That also does not include my normal retirement investments. By default, I invest 7% of my salary toward retirement, which is matched by my employer dollar-for-dollar for the full 7%. In other words, I have 14% of my salary automatically invested into retirement (my husband has a similar situation with his salary, too). Then I’m proposing an additional $15,000/year in investments and savings spread among HSA, FSA, 529, and 403B.

This change is approx. $4,000/year higher than my contributions for 2023. A difference of $153/paycheck. But is that enough? Or should I be aiming to increase this even more?

Pulled in a million directions

I have lots of other shorter-term savings currently stored in CapitalOne360 savings accounts. By nature, I’m a “splitter” versus a “lumper” when it comes to savings. This is why I have different savings accounts for so many different things. Currently, I have savings accounts for:

- student loan savings. My original plan was to save a little each month until I had enough to pay off one of the 4 student loans in full. But I just dipped into these savings to help cover the overage from my car payment. Also, I’m not sure if I even want to pay “extra” for my student loans….

- car repairs or new car

- emergency fund

- travel/Christmas/fun. I save a little each month so I can always pay cash for anything “big” or “extra” we might do as a family. This is mostly used for travel but could be used to help fund Christmas gifts and experiences, or anything that would be over and above to where it would blow the monthly budget… I have savings just for that! 😉

- annual fees. Examples: life insurance, car insurance (paid bi-annually), HOA (paid quarterly), etc.

After all my recent home repairs, folks have also suggested budgeting and saving specifically for home repairs, so that might be an account to add (or maybe change my student loan savings to “home repair” savings…..)

Another idea I’m considering is to open a money market account – something that’s not necessarily long-term savings, but something that will yield a higher interest rate than my current savings. While this might be impractical for the annual fees I regularly use and restock, it might work great for things like the Emergency Fund and New Car savings. Yes, I know I literally just paid off my vehicle. And I plan to keep it for quite a while. But I’d LOVE to be able to buy my next car in 5-ish years with cash fully debt-free! That seems better kept in a money market vs a savings account.

This said, I honestly don’t know where to start! I’ve never had a money market account before. Only retirement accounts, the investment vehicles listed above (e.g., HSA, FSA, etc.), and normal old savings accounts. I’d want one with low-to-no fees, but a decent rate of return. Any recommendations? I have longer-term (retirement) investments with Fidelity and Vanguard already. Should I see about opening up a Money Market account?

What are your thoughts? What should be my next big goal or focus for savings and short- and long-term investments?

P.s. Editors note: If you are reading this and having some trouble paying off debt, consider checking out The Money Principle’s article on a ten point framework for getting out of debt, its worth a read.

Hi, I’m Ashley! Arizonan on paper, Texan at heart. Lover of running, blogging, and all things cheeeeese. Early 40s, married mother of two, working in academia. Trying to finally (finally!) pay off that ridiculous 6-digit student loan debt!

Have you checked out Frugalwoods.com? She will do reader case studies regarding financial goals for free if you allow her to post her recommendations on her blog. You should check out other case studies on her blog to see if you would be comfortable with this.

If only 2 out of 4 loans were forgiven, would you wait the other 2 out for forgiveness or pay them down?

I would say maybe increase your retirement? while you wouldn’t be getting a match above that 7%, bumping it up a little could help a lot long term.

My first goal is to get all 4 forgiven! After writing this I called back again (it was a 90minute hold time!) and was told I could refinance the two “ineligible” loans into an eligible loan and all past payments would count…. so I’m currently working on that.

We have a regular old brokerage account with Fidelity. We invest the cash portion in a money market fund (emergency fund) that has some amount of consumer protection (not FDIC, but similar). Beyond that we invest it in whatever has a low fee. We consider it a “savings to spend” fund and consider it a large hedge against whatever life throws at us. We still save for categories, but all the cash sits in one pot. Usually in months we’d plan to dip into it (vacation, etc.) we also do a no spend month and see how much normal cash flow we can flow up so as to not have to sell and transfer.

As a bonus, the 2% cash back rewards from the Fidelity credit card auto deposit monthly into the account.

Isn’t this a wonderful position to be in? No big debt hanging over your head and living within your means with money left over to invest. Great job!

Since it sounds like you’re in good shape with retirement savings, I recommend adding more to the 529s. College is expensive and the younger they are while you are investing the better. Although you’ll take a tax hit, you can use that money for something else if it isn’t needed for higher education. It’s not a use or lose thing.

Congratulations on the car payoff!

I had a similar problem with Mohela and PSLF not showing my correct amount of payments. I was actually able to get it resolved over email rather than calling! Not all email customer service is the best, but it actually worked in this case so I’d recommend trying it!

Most banks have a money market account available so looking at your current bank is the easiest route. They’re all within the same realm of returns (around 5% currently). But if you’re looking for the absolute top, you can contribute to a money market mutual fund VMFXX in Vanguard or SWVXX in Fidelity. I’ve found the fidelity one pays out a little less. The only caveat I’ve seen that way is that if you need to withdraw you can’t do it immediately. Like you’ll have to “sell” the money market fund one day. And then transfer the next. Not a huge deal in my opinion.

The typical bank money market accounts you can do same day transfers but they pay maybe .5% less. Have you thought about keeping your savings buckets all in one account, but just tracking the amounts in some other way? I use mint so my savings buckets are in rollover budgets. But then keep all the money in the same account. A spreadsheet would also suffice. It cuts down on a lot of transferring back and forth of funds and then you can maximize how much you have in your money market account.

Congrats on paying off your car Ashley!