by Sara S

Time for another debt update. There’s one thing that’s been on my mind since our fourteenth anniversary a few weeks ago: from our wedding in 2006 to now, we’ve only known one year of being debt free. ONE year.

During our first honeymoon months, we were paying off the student loans from my undergrad. We got those done quick, so then we had one free year of bliss where I was working full-time and he was a student working part-time. We owned our old cars, had no credit card debt, and had no mortgage. We sure didn’t have much, but we were in a good place.

But then he started grad school in 2008 and that alllll went away. We took loans out that first semester, and then it went deeply downhill from there. So, so deep.

Current Numbers for Our Debt Update

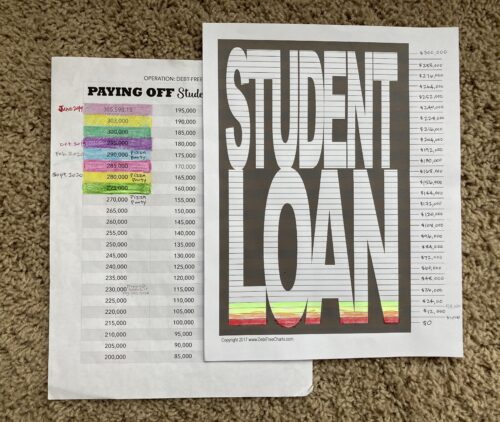

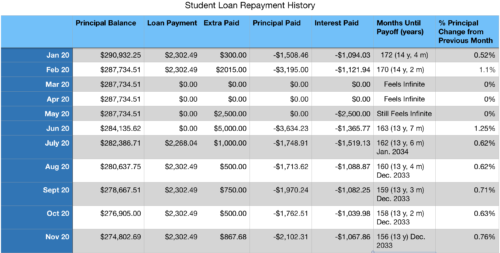

So where are we now? We’ve gained some momentum since my last debt update in September. In November our debt principal got down below $275,000.

That means in 2020 so far we’ve paid off

– $17.635.28 of principal

– $11,879.83 of interest

We wanted to pay off at least $30,000 of debt principal in 2020, but I guess sometimes pandemics happen. I would love to get to $20,000 by the end of the year, but I don’t see how we can pay off $2,361.98 of principal alone this month.We’ll at least pay $500 extra, but over $2,000 is a pipe dream.

That’s only a 6% change to our principal for 2020 so far, and in 2019 we had a 12% change. Friggin’ COVID. However, for a very long time we had a 0% principal change, so I guess 6% is something. And looking back, in November of 2019, our debt principal was $294,000 and in November 2018 it was $334,810. Baby steps.

Making Extra Payments

I’ve been able to pay some extra lately thanks to a small tax refund (as a result of our business audit), an insurance rebate, and my side hustles. Unfortunately, one of my freelance jobs just ended, and it will be hard to replace. The people were great to work with, it didn’t require a lot of time, and it was really rewarding.

Fortunately, my husband will get to work at his side hustle again next week. He hasn’t done that since the beginning of the year because of the Coronavirus, so it will be nice to have that extra again.

Another additional increase comes from the Ally savings account we set up in October. We’ve already yielded $17 in interest! It’s easy to think “$17… woop-di-do!” but considering our normal savings account was giving us cents at a time, that’s an amazing increase in just two months. Why didn’t I do a high yield savings account sooner??

But I do wonder if we should just keep those yields in the Ally account so they keep accruing, or if we should put it towards our debt payments from time to time. Any thoughts?

So the gist of our December debt update is slow but steady change. Despite having 13/14 years of our marriage be debt-oriented, we are digging ourselves out of the hole. We even managed to shave off 7 months of our debt payoff timeline, even during this insane year.

So I’m hoping to end 2020 strong. Strong-ish. As strong as 2020 allows. 😉

It must be nice to see progress being made, even with such an unpredictable year.

You’re doing awesome. It may not feel like it but it is awesome that you managed to get the debt under $275,000 considering you had a period where you essentially were shut down.

It’s hard for me to appreciate sometimes, but we are making progress. Thank you!!

I think the interest question depends on your bigger picture. Is this your 6-9 months living expenses? Or a smaller emergency fund? If you’re trying to save to a certain level, I’d let it build. If you have a reasonable cushion, use it on debt. Or just let it ride this first year and see what unexpected costs come up, see what you end up with at the end of the year, and revisit it then.

That’s a good call. It’s an emergency fund that’s not quite 6 months, so growth would be good.

Reading your posts, I always feel like you’re too hard on yourself. Not that you shouldn’t do what you’re doing to pay off debt – that’s great. But it always seems like you’re kicking yourself for the fact that you and your husband took out debt to go to grad school. We all have done things that we regret or could have handled better, but it sounds like you both made reasonable decisions, albeit not always frugal ones, and now you’re on a path where you’ll pay off your debt and he’ll have an established medical practice. Give yourself some credit for all that!

Thank you so much. Being hard on myself is my default, and I need reminders to lighten up.

I thought all student loans were on a zero interest grace period right now? Is that just federal loans and maybe these are private?

I agree with poster above that you are too hard on yourself. You and your husband took on a lot of debt, but it resulted in a well-paying profession. So it was worth it and you WILL get that debt paid off. You are making good progress – just hang in there.

Thank you so much. I truly appreciate the support.

Graduate students can’t take out subsidized loans

Really? Is that new?

All my student loans are from grad school and they were about 1/4 subsidized and 3/4 not or something like that. But I definitely have/had subsidized loans for grad school

Hope,

Phased out in 2012 it looks like

https://www.nerdwallet.com/article/loans/student-loans/subsidized-loans-graduate-school

If I recall, they refinanced the loans to private and got a much, much lower interested rate. Of course, this was before anyone new that federal loans would be 0% interest.

I wish! We’re refinanced our loans Aug/Sept of 2019. We got a way better rate when we went private, but now we’re missing out on the zero interest. Sigh…

60K in principal in 2 years, one of which insanely disruptive, is great! Remember that ratio of principal:interest keeps shifting in your favor so hang in there. You’ll be under 250K next year, 200k 20 months after that, 150K 16 months after that, etc etc.

That does give me hope. Thank you for your kindness and support!

If I remember correctly your savings was 3-6 months expenses in case your business shuts down again? I’ve been keeping almost twice as much cash on hand this year than I ever have before. Seeing how we’re going into a dark, uncertain winter, I’d keep the cash on hand. I think the security will be well worth whatever gains you’re missing out on for the next year.

Besides we are at the highest the market has been, so while you’re missing on some gains, there also could be a big dip again right at the time you need it. Last “shutdown” time in March is when the market dipped 20-30%, I’d hate to need to pull money then.

That’s good advice. Cash on hand is probably what we all need for now. Thank you!