by Hope

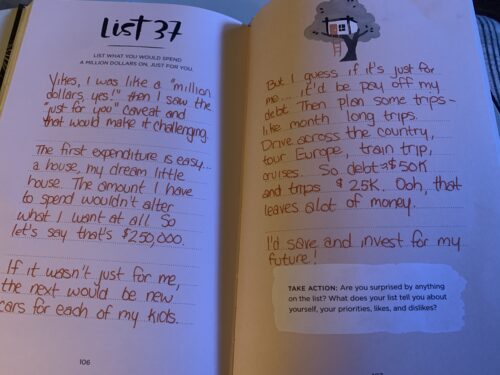

“List what you would spend a million dollars on, just for you.”

That was the question I was presented in my weekly journal the 52 lists project. <=this is an Amazon link (not affiliate) to the book I am using, there are several versions if you are interested

It was the second part of that prompt that had me stumbling.

And after I finished answering it, I had another realization. I’m still not prioritizing my debt the way I should. (And yes, I realize this is just an exercise, but it was still eye opening.)

You can see from my answer…that paying off debt was not my first thought. And if I’m honest, it wasn’t my second or third, even though my response makes it look like it was. It was actually an afterthought that went more like “oh, and I should put paying off debt.”

And this made me realize that my mindset is still not where it should be. This has been my biggest downfall…all this time!

I haven’t been selfish enough with my personal finance. I have made my decisions based on what I wanted to provide for others, i.e. my kids, not what was best for me and my future (and consequentially the kids.)

The follow up to this list was to review what making this list revealed about yourself, your priorities, etc. These were my takeaways:

- My greatest longing, like bring me to my tears, spend hours sketching and dreaming longing is a home of my own. But I’ve done literally nothing about it. Why?

- Right after my house, I would have purchased cars for my kids…(couldn’t use that one since it wasn’t for me,) but really my debt should have been right here on the list, if not before the house. This spoke volumes to me. And is a clear picture as to why I am still in debt. I have got to be more selfish with my finances. (Selfish has a negative connotation, but it’s the only word I could think of that fit.)

- I am really not a spender. By that, I mean material things, shopping, those really aren’t something I struggle with or even desire on any level. (That has really created interesting conversations with my boyfriend who has a serious shoe habit.)

I’ve still got ALOT of mindset work to do. I’m getting better. But I’ve still got a long way to go.

If you are looking for some journalling exercises, I highly recommend the 52 lists project series. It’s a once a week prompt that really encourage you to dig a little deeper into yourself. I have gotten a lot out of it.

Hope is a resourceful and solutions-driven business manager who has spent nearly two decades helping clients streamline their operations and grow their businesses through project management, digital marketing, and tech expertise. Recently transitioning from her role as a single mom of five foster/adoptive children to an empty nester, Hope is navigating the emotional and practical challenges of redefining her life while maintaining her determination to regain financial control and eliminate debt.

Living in a cozy small town in northeast Georgia with her three dogs, Hope cherishes the serenity of the mountains over the bustle of the beach. Though her kids are now finding their footing in the world—pursuing education, careers, and independence—she remains deeply committed to supporting them in this next chapter, even as she faces the bittersweet tug of letting go.

Since joining the Blogging Away Debt community in 2015, Hope has candidly shared her journey of financial ups and downs. Now, with a renewed focus and a clear path ahead, she’s ready to tackle her finances with the same passion and perseverance that she’s brought to her life and career. Through her writing, she continues to inspire others to confront their own financial challenges and strive for a brighter future.

The good thing is that you see where you are going wrong and are trying to alter that mind set.

And shoes aren’t the worst things to have a fetish for. My ex husband collected expensive cars. *eye roll* Sure we could afford them and it was nice to ride in style. But honestly, how many f’n cars do you need? You’re only one person!

My list would like like this.

1. Debt is always first.

2. I would buy some more real estate. More than likely an apartment building of some sort to build on my assets and bring in another form of income

3. Maybe look into buying a small business that has been established already to keep it moving. One that isn’t going to cost me an arm and a leg to run.

4. Take a vacation. I don’t even care where just somewhere to clear my head.

5. If there’s anything left, save and continue to live comfortably. No need to spend all the money all at once.

Ha, thank goodness, it’s shoes for us then! I’ll take it.

I love your list.

So your second wish, after a house, would be to gift kids with the responsibility of new cars? I hope in retrospect, you realize this would be saddling your kids with high insurance premiums…. Much like the HRV has done to Princess and her $300/month insurance. Cars have always been your downfall yet you seem to idolize them.

Yes, I don’t know it’s that I idolize cars as much as my greatest fear, long-standing, is not having reliable transportation. So I would want to resolve that issue for my kids.

I don’t like these types of exercises at all. It makes you dream of big things and then get discouraged because you are nowhere near there. Its why poor people waste so much money on lotto tickets, they think hitting it big is their only hope.

Its good that you know you want a home, and got that takeaway. Next step is to get a 5 year plan to get there. Maybe it works out your debt is totally paid off in the first couple of years, then all goes towards emergency house fund and down payment, and then, BOOM. But not until. Make a long term plan. I would like to see you do that and it gives you goals and targets.

I can certainly appreciate that perspective.

And I definitely appreciate this advice, it’s time I put my “money” or at least my effort behind my dreams rather than just talking or crying about them. Something to put on my to do list for sure!

If I were you I would pay off all debt and then invest for retirement. I don’t know if you have anything saved but buying cars and and expensive vacations doesn’t make sense. I think I read somewhere the average Social Security check is only $1390.00 which isn’t a lot at all. My husband is retired and we own our home so we would probably buy me a small car to just drive around, pay off my daughter’s mortgage, help my son and make sure our four grandchildren have money for college. If enough buy another home and sell the one we have.