by Elizabeth S.

This post is not my favorite.

Financial Progress

So, how am I doing?

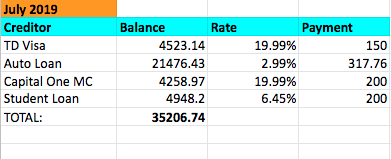

Here’s where I was in July:

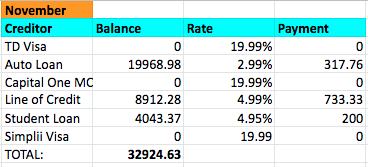

Here is where I was last time I gave you totals (November):

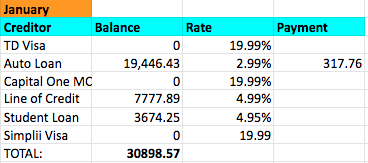

And here is where I am now:

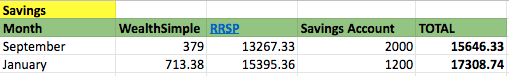

As for my savings, I started giving you totals in September. Here’s where I am now:

Takeaways

I’ve only paid off $4308.17 of debt since July. I’m not happy with that at all. I really did think it would be a higher number by now.

Back in July, I started tracking my savings with about $12k of RRSPs. I had $0 in my savings account and no WealthSimple (my fun investing account with is returning 12.4% today). In that sense, I’m doing better. I’ve said over $5000 since then. But I could have saved a lot more.

Wakeup Call

I’m hitting the books today to make a plan. The only way I seem to be effective at paying off debt and saving money is to automatically deduct things. Clearly, I can’t be trusted with cash in hand. With that in mind, I’m off to figure out how best to manage to keep my money from myself until I can be more responsible with it.

Thank you to the readers, both friendly and critical. I am reading all of your tips and thinking hard about what to do next.

I’ve been bad. Let’s end this with a picture of a Very Good Girl.

Elizabeth is a single woman in her early 30s, working as a manager at a software company and living in the most expensive city in Canada. She hopes to blog about her journey to eliminate debt and build savings for home ownership someday. Whenever she has taken two financial steps forward, she’s always taken a step back with a bad credit card purchase (we’re looking at you, unnecessary iPhone of May 2019). Elizabeth lives alone with her fur kids, a dog and cat, and when she’s not in front of the computer, she enjoys running, camping, reading, and baseball.

I feel a little sad for your extra paycheck…

Am I reading this right that you didn’t make any payments on your LOC in January? I think you’re still in the stage of getting in the right mindset to crush the debt. Any blockers you can put in place to NOT spend your money seems like the way to go right now. As you seem to have lots of temptations still. I liken it to procrastination or having a deadline. You need a little panic/push to do the right thing.

Have you thought about splitting your paycheck so it gets direct deposited into separate accounts (1) debt payments and (2) spending money. That way you know you’re hitting the debt payments you want/need and you don’t “see” this money. You can set up an alert in your calendar to send a payment the day after payday or just make it automatic! And you can still operate in a panic mode to cut your spending because your checking balance will show low.

I think for your own good you need to break out the food spend again. Groceries/Alcohol/Toiletries/Dinners out/Drinks(at dinners out). Then you can see where your main temptation is.

I contributed $533 to the line of credit in January. The payment that comes out is $133 and I added another $400 manually.

Have you tried writing down every single expense? You might do well with hand logging your spending to force you to spend some time reflecting. Do you feel good? Bad? Embarrassed? You could post the list weekly here and maybe the peer pressure effect will help?

January was the first month I tracked every. single. expense. – even $2 expenses! I posted about that in my second last post breaking down the categories. Feel free to peer pressure me! I couldn’t screenshot the spreadsheet as it includes personal categories and accounts that I would rather leave a bit anonymized I have but I might create a sanitized version for sharing in the next couple of weeks.

more posts like this please and less talking about what you “plan” to do. This is for ALL the bloggers not just you. can you make this a monthly feature? First of the month you present these numbers just as you did today.

I think it’s good accountability for you and might make you question decisions you make during the month if you know you have to come report at the end of the year. For us readers, it’s a little more interesting (since we are all here for debt elimination) and i think it’s easier for us to provide better suggestions if we see things more consistently.

That is all hard. It is hard to look at our shortcomings and really get honest about what it will take to address them. I know I wouldn’t find it easy to write mine up and press publish. I hope that your disappointment in how this month went gives you the motivation needed to make cuts. You have to want the savings more than the dinners out and that is a hard thing to want enough to choose over and over. The abstract future freedom over the tasty meal with friends.

Am I remembering right that the line of credit had a low introductory rate that would change? If so you need to pay that off ASAP.

Hi Laura,

I have the intro rate until November. At this rate, it will be paid off by early summer. I pay extra every month.

Have you thought about deleting apps like Uber and Facebook from your phone? If you don’t have the option to call an expensive ride home from an evening of drinking, and you don’t see photos of all your friends out partying, maybe you won’t “need” to go out as much. If your friends are genuine, missing out on 6 months of fancy meals and clubbing will mean nothing, but the debt you pay off will have lasting impact. If you lose those friends because you didn’t go out with them or pay for things, your life is better for it, and you learned that lesson now and cut the fat that will bring you down in the long run.

Hi Laura,

I appreciate the feedback muchly!

I only go out at absolute most twice a month, so I’m not looking to cut that back right now. I spend considerably more on entertaining at home! I don’t use Facebook and I wouldn’t say I go “clubbing” – I guess I have gone out dancing three times in the past six months when I am dragged out for special occasions, but I am not a part of any clubbing scene at all. I get up at 5am every day so going out ruins my schedule. Sleep takes priority over everything for me, lol.

I do go to concerts once in a while, though I don’t have any lined up for this year until June and that ticket was $30 all in.

January was a crazy month with vacation spending and giving myself justification for celebration but most months, I go for a night out once a month and spend $100 including Uber. That’s a number I’m comfortable with. There is usually a dinner out once a month for another hundred (again, including Uber). The dinner out I can easily do without. Sadly, my spending is so bad that the $200 from those monthly events really doesn’t begin to cover the spending overages I face each month.

I REALLY need to focus on cutting the unneccessary fancy entertaining options at home and cut the impulse online buys that have crept up lately. That’s what I am gearing up to do now.

There is no way that this is on track to repay by early summer. You’ve only paid down your LOC around $1200 from July to January. You need to make around $900/month payments on the LOC to have it paid off in November. Please stop kidding yourself.