by Hope

Before I get into my post, I wanted to share my New Years wish for each of you with you…it’s a poem I heard somewhere and found on the Chicken Soup for the Soul website:

I wish you enough sun to keep your attitude bright.

I wish you enough rain to appreciate the sun more.

I wish you enough happiness to keep your spirit alive.

I wish you enough pain

so that the smallest joys in life appear much bigger.

I wish you enough gain to satisfy your wanting.

I wish you enough loss to appreciate all that you possess.

I wish enough ‘Hello’s’ to get you through the final ‘Goodbye.’

I’m not sure who the original author is, it is certainly not me. But it does capture my wish for you and for me and for my children this coming year.

Now on to My New Budget

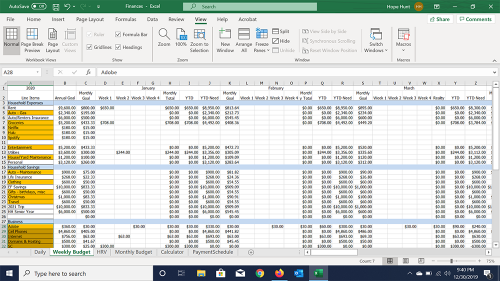

My new budget isn’t quite ready. But I wanted to give you a glimpse of what I have been working on from a financial stand point.

How I Created my New Budget

- I started with the numbers I have been tracking all year since I read Your Money or Your Life. So I know most of my numbers are spot on as far a reality goes.

- I then added a bunch of new categories, broke out expenses that I had previously grouped, added new line items for Princess school and the proposed 2021 trip.

- Then I started thinking about what I want. And not just my selfish wants. But from a financial point of view. For example, I want to double my EF from the current “almost” $10K to $20K. I essentially put every need and want into my budget. And then I broke it down from annual cost to monthly cost.

- All this gave me the monthly income number I need to make all this happen. And from that I was able to determine what I am currently able to do and how much I will need to change my income to meet all my needs and wants.

As I mentioned, I’m not quite satisfied with it. But I’m close.

This working backwards is how I work with clients. And it has worked…we determine what number they want to make with a product launch and then work backwards to create pricing sheets, advertising budgets, expected view numbers and so much more. I have decided to try it out with my own finances, work backwards and see if I can’t get to my “dream” number as far as monthly income.

Questions

I know these are not something I can get firm answers to, but let me know if you think I’m on the right track…

- For Princess’ school tuition, I have budgeted $6,000 for her senior year. I am *hoping* her tuition will still be around $3,000 for the year. Do you think adding an extra $3,000 will cover the anticipate senior year expenses? Any guidance would be appreciated.

- I’m creating the monthly goal, but dividing the annual budget amount-YTD need by the number of months remaining in the year. This allows me to balance those really good months/weeks with lower earning weeks/months. And more importantly gives me a target to shoot for in each category every month.

- I’m over budgeting certain line items in order to build a kind of cushion if you will. For instance, our rent is $650 a month and has been for the almost 3 years we have been in this house. But there will come a day in the next few years that I will move and I don’t anticipate my rent will go down too much if at all. So by adding a $150/mo cushion I am starting to build a moving budget (at least this is how it would work in my head) and getting comfortable with a higher rent situation. (Truly, no move plans on the horizon, just trying to put more forethought into my finances.) Thoughts?

Hope is a resourceful and solutions-driven business manager who has spent nearly two decades helping clients streamline their operations and grow their businesses through project management, digital marketing, and tech expertise. Recently transitioning from her role as a single mom of five foster/adoptive children to an empty nester, Hope is navigating the emotional and practical challenges of redefining her life while maintaining her determination to regain financial control and eliminate debt.

Living in a cozy small town in northeast Georgia with her three dogs, Hope cherishes the serenity of the mountains over the bustle of the beach. Though her kids are now finding their footing in the world—pursuing education, careers, and independence—she remains deeply committed to supporting them in this next chapter, even as she faces the bittersweet tug of letting go.

Since joining the Blogging Away Debt community in 2015, Hope has candidly shared her journey of financial ups and downs. Now, with a renewed focus and a clear path ahead, she’s ready to tackle her finances with the same passion and perseverance that she’s brought to her life and career. Through her writing, she continues to inspire others to confront their own financial challenges and strive for a brighter future.

Don’t build in cushion to fixed costs.

Ok, I can use this…

So for the housing piece, create a separate line item to start saving for moving expenses?

But what about my car insurance, which I know will go up when Princess gets her license in May, but I’m not sure of the cost. But I want to start preparing for it now.

I’d suggest calling your insurance company for a quote, then budget based on that. I agree with Walnut in skipping the cushion.

I will definitely do that…already added to my list to do tomorrow when they re-open.

So, if I were in your shoes, I would fund your absolutely necessary categories first (rent, groceries, minimum payments) then split the rest of your cash four ways. 25% to emergency fund, 25% to retirement, 25% to debt extra payments, 25% to “Savings to Spend” account. Use the last one for entertainment, eating out family vacations, future moving expenses, splurgy extras, gifts, etc.

Hope,

This is really good advice from Walnut…and so very simple to put into practice.

My household has variable income as well since my husband owns his own business, and this is basically the approach we take. We don’t have debt payments, so that money goes to our kids’ college funds and extra to retirement instead, but otherwise this about how it breaks out for us.

Sometimes when our emergency cash savings accumulates to to point that it feels like overkill we’ll reallocate some of it to retirement or college or even use to help fund a bigger “want,” but that is only AFTER it has reached a point well above the number we consider comfortable to keep on hand for unexpected expenses and emergencies.

It is a very low-stress way to live even with the variable income stream. I think it is okay to spend a little time at the start of the new year making a list of priorities/hopes for the year if the extra money comes through, but to itemize each want and put it in budget document based on aspirational earning is wasted time. I personally have a list of trips and home projects I’m hoping we’ll be able to do this year…but they will be paid for from the “fun money” account only if there’s enough to cover them.

You have soooo much “slush fund” built in everywhere. A huge personal and entertainment categories, but Netflix, Hulu, and Spotify also? Your fixed expenses should be separate from your discretionary spending. What on earth is up with that $400 per month cell phone bill?? Keep your business on a major provider, sure, but send all the kids to an MVNO.

If you truly identify your discretionary spending, I think you’ll find plenty of cash to meet your objectives for what really matters.

Idea on subscriptions: rotate based on what you’re watching. It’s easy to pause Hulu and Netflix and just watch Amazon Prime content for a month or two, for example. Doesn’t Spotify have a free service? Do you really need the paid service? Where on earth is your dining out expense? Buried somewhere? What category is for plane tickets for your son?

Yes, this first run at the budget had ALOT of extra in it. We actually have never had Hulu and are currently on a 3 month free trial of Spotify, I don’t know if we will keep them. The idea as I did a first run was to what it would like with everything. Again, it’s a work in progress.

Spotify is free, don’t pay for anything extra

$16000 a year for travel and a cruise but no line items for student loan payments and retirement. If you are making $3850 a month, this represents some 35% of your income. This is not a plan for creating financial security.

Also, this is not a budget. A budget takes the reality of your current and expenses and reconciles them. This is aspirational since you say it’s everything you want to do and tells you how much you need to make. It also does not provide readers with the current facts of your situation since what you actually can do is buried in the middle of everything you want.

There are additional data points not seen as this is just a screenshot…the whole list is not visible. It is still a work in progress, working on the numbers to make them work for my financial outlook for this year.

Did I read this right? You are spending $6,000 a year on auto/renter insurance. We have 2 cars, three drivers (1 is my 22 year old son) and our combined auto/homeowners insurance is around $2500 a year. Are you being robbed or what. $10,000 for a vacation that wasn’t suppose to be that much money.

If she’s still got her kids on her insurance, and with all the car accidents they’ve all had, this may be what she has to pay.

And when princess starts driving, it will only go up from there.

So, so true. Her dad and I were talking about that yesterday as we talked about the car situation.

Our auto insurance covers me, the twins, the two cars but it also includes our renters insurance which is just a small amount. And the other commentor was correct in that when Princess starts driving it will only go up. Her dad and I are starting to discuss this now. More on that later though.

I actually added some cushion to this number with anticipation of Princess being added in 4 1/2 months.

We have 3 drivers (two are the 22 year old twins,) 2 cars and it does also include our renters insurance which is a small fraction of the total.

Are the twins paying for their share of the car insurance?

Yes, History Buff pays for his cell phone and his car insurance.

Sea Cadet had enough saved to cover his portion of both bills until October, 2019, I am covering them for the remainder of his commitment – May, 2020.

Where are your debt payments, health insurance, and retirement savings? $433 seems really high for entertainment, what does that include? And where did $10,000 for the cruise come from? Especially if you’re not planning on paying for the older boys or their girlfriends, that seems really high too. You could make so much progress on your debt if you prioritized it ahead of a lot of this stuff.

They are included, this screenshot does not show everything. This budget is very inclusive of EVERYTHING I could think of. As I said, it is not done, it is a work in progress. I hope to have it solidified by the end of the week. I still need to have some conversations with other family members.

Separate out your absolute necessary expenses (rent, groceries, insurance, etc). Then separate the categories that help you meet your financial goals (retirement, emergency fund, debt payments). Then prioritize everything else below that. Have you thought about trying to live on last months income? Since your income can fluctuate so much month to month it might be a good idea for you.

I think this is a good start as a goal. But a goal are reality are two different things. You need to take the average monthly income from 2019 and allocate that money. You need to cover necessities first. Definitely need to include your student loan and retirement costs. I think you also need to prioritize the goals. The lowest priority gets funded with extra money at the end of the month. That way if your income is lower, then the important categories are funded first. That means vacation fund and anything above tuition costs are funded last. I would not include extra in the rent category. That money can be better used somewhere else. If you need to move, you can stop funding the extra discretionary categories and use the money for moving. Plus you have will have several thousand in savings to pull from if needed. I agree with the others that now is probably not the best time to fund a big vacation. The fact that you have included vacation expenses and not retirement or student loan payment in your “big picture” is somewhat concerning to me. It shows that your goals are based on your emotional wants, not your future needs. Please take that into consideration. A big vacation does not improve your financial health in in the long term. It meets your emotional want right now. Is that what is best for your future?

Actually, those are included…you just can’t see the full budget from this screenshot, it is very inclusive.

Oh, ok. Good to know. I would also like to point out that while you do control your income potential. You are limited by the number of hours you can work and still provide quality product. So you should consider a realistic income goal based on the number of hours you are willing to work without burning out.

Re the Senior expenses, consider prom, senior pictures, graduation announcements, cap and gown. I think that Senior pictures and Graduation Announcements can be done frugally, but Prom can cost a lot: tickets, dress, shoes/accessories , makeup, hair, dinner, transportation. (One way to save money would be to get a secondhand dress, so that might be something to start looking for months in advance.)

Thank you, this is the kind of details I was needing as I think about this line item.

Thankfully, all the school dances are free, and Princess is pretty low maintenance as far as the “fashionista” side of things.

We bought a pair of nude heels for her winter formal this past month and agreed that they would need to work for any remaining dances.

Can you call the school and ask them what the cost will be? There will be no surprises when the time comes to pay for that.

Also, when will Princess be starting her job? I paid all my dance expenses during my junior and senior year, along with gas/car insurance/graduation cap and gown, yearbook….

A budget should be based on what you actually make, not what you hope to make. It’s good you are thinking of a plan, but the plan needs to be based in reality.

I guess that is one of the biggest differences for me as an entrepreneur…really my income is only limited by my efforts.

That is why I decided to try this approach. Give me something to shoot for, obviously, some things will have to flex.

Hope,

Your income is also limited by the budgets and timeframes of your clients and potential clients. To put a “budget” together based on the idea that you can “just make as much money as you chose to” is reckless.

Figure out a workable budget for the essentials, plus significant savings and debt payments. Stick to it without fail for several months. Put everything else into an account and just let it sit there. Get comfortable with the idea of having the money BEFORE you spend it rather than always plotting how you’re going to spend money you haven’t earned yet.

You do not need to assign a use for every potential “extra” dollar right now. Just allow some money to accumulate in an account. Let it sit there unspent for awhile and then determine if the “fun” item is really worth more to you than paying of that amount of debt.

After a few months, use any extra money that actually accumulates to pay for the fun extras if you choose. Do not consider, even for a moment, spending on any of those items until the needs are taken care for at least three months in advance and you have the cash for the “want” item in hand. That is is the ONLY way you are going to actually get out of debt. Otherwise, you will continue to play this game of trading one debt for another.

I hope this doesn’t come off as too harsh. You have made progress and should feel good about that. But it is worrisome to see you constantly planning/hoping/dreaming/mentally spending on a list of wants when the list of debts is still so large.

Good luck to you!

This is absolutely bananas. This is a budget for a person who makes about $3,500 a month, and yet there are already over $72,000 worth of expenses in that screen shot. As you said, you’re an entrepreneur, but my husband and I are also running our own businesses. That doesn’t mean we dream up $250,000 worth of expenses or “goals” for next year. What is the point in that? Sure, we can work harder, but in reality we’re not likely to ever make more than “x” amount even if we kill ourselves working 60+ hrs a week. As the kids say these days, I just can’t even…

I’ve actually made more than $3,500 per month for the last 6 months and have contracts for additional income already signed and waiting.

As I mentioned, this is a work in progress, not a final budget. But it helps me to put everything out there. And then start the elimination and conscious decision making on priorities…

You may have made more than $3,500 a month since this summer, but unless it was literally 3-4x that amount, it’s still bananas.

For Senior Year-expenses. College applications (ask about application fee waivers due to your income, you should qualify), SAT, ACT final testing if not already done as well as charge to send scores to schools, transcript fees from high school to send to colleges, thank you gifts (small gift cards) to teachers and counselors who write recommendations (she should be approaching them by the end of the year with her resume so they can do this over summer), travel to visit final school choices if you have not yet done so, Prom/Ball/Homecoming-ticket cost, dress, shoes, make-up, hair, transportation, flowers, dinner beforehand, after party, party bus etc. My suggestion is to give her a total budget for each dance and she can then save for anything over that amount. Senior Trip (if they take it) both official and unofficial, senior photos and announcements (you can easily do your own, the ones they provide are not required to be purchased usually), cap and gown and cord (might be provided), accepted students day at colleges (not required usually), Orientation weekend at college (usually required), college deposit for both enrollment and housing (assume a few thousand), yearbook (may be included at your school), Class Gift contribution to school (if your school does that), graduation event dresses (baccalaureate, actual ceremony, awards night, etc). I would start asking around about the senior year activities and expectations and then you can add them in to your budget and give her your expectations as to her contributions to these items. This is also the time for her to be looking at ALL scholarships of any amount for which to apply. Her school college counselor should have great info on this. There are SO many smaller scholarships that could help cover smaller expenses. If you use Naviance at your school, she should be searching it weekly for new additions. Hope this helps!!

If Hope is bringing in over $3500 a month in money why would she qualify for college applications?

That is still only $42,000 a year, I am assuming that is low income anywhere in the country for a single parent with 2 minors and 5 household members would fall on anything under $60,000. I live in San Francisco which is a very high cost area so may be off on that but I know in my area households with low to middle incomes (up to well over $150,000) are offered free applications.

There aren’t 2 minors, gymnast lives with his dad. One of the twins also no longer lives at home.

gotcha. She had posted that both boys technically lived at home since one is only temporarily away in an earlier post and I wasn’t sure what her youngest living situation was “officially” so he could still be counted as a household member, especially if they resided in her home part of the year in 2019. But I would imagine even with a household of 4, $42,000/year would likely be low enough income to get assistance in college applications and testing fees. Like I said, I live in a very high cost of living area so I could be off.

Technically, both twins still “live” at home. Sea Cadet is volunteering for 10 months, but his residence and his bills are still here.

But you are right, Gymnast now lives with his dad, at least while school is in session.

What was the point of the screen shot if we can’t see the whole thing?

From what you have let us see you have $5,480 a month in categories. That amount is a bit away from $3,500 you have made consistently in the last six months and my adding up of $5,480 doesn’t include those business expenses or those pesky things like the student loan and retirement funding

You need to shop for new auto shop insurance. A purchase of an older car would have saved you a boatload of money when it came to insurance. This is the reason I drive and share a 2003 car with my 20, 21, and 23 year old. You can undo the mistake of buying that car

She has $10000 in her emergency fund so I suspect she has been putting her excess there. $6500 over 4 months tracks to $1600 extra after $3800 so I suspect that is where she picked $5400 from. My larger issue is that I don’t see the car payment or student loan payment in this snapshot. Her last budget had the car at $700 and her recent post suggested that she was increasing her student loan payment to $833. That’s over $1500. That leads me to believe she is hoping for $7000 a month after taxes. We’re talking her planning for a six figure year. I can see a million ways that is bound to end in disappointment even if she works really hard. As an independent contractor she has more of a tax obligation than many of us since she is required to cover both her and employer costs for social security and Medicare if I’m not mistaken. 84,000($7000×12) + 15% for taxes set aside is almost $100,000. Super ambitious.

Putting “flex costs” into all of these categories is absolutely setting yourself up for continued failure. Each of these items should be as close to actual costs as possible and things like future moving costs should be separate from rent. By putting extra money into each item (like $45/month for streaming services you say you aren’t even registered for, on top of a huge entertainment budget), your giving yourself permission to voluntarily overspend in every single category. By setting it up this way, you can justify almost every single purchase to yourself. Having an extra $150/month for the rent can easily be ‘oh this new Christmas tree is for the house and there’s plenty of budget left!’ Or ‘getting a car wash and wax is really a part of the car which is also in the insurance amount, so it’s definitely in the budget!’ Or ‘Princess really wants to watch Handmaids Tale, and there’s lots of money for streaming services, and I want to watch on a second or third device, so unlimited Hulu, just for this month and next month, are covered!’

Do not think this way. It creates more problems than solutions.

I think that with an emergency fund at nearly $10K it is time to focus that money toward your debt. Rather than growing your emergency fund by $10K this year, commit to knocking out $10K of your student loan on top of your minimum payments.

You are padding costs for future payments but if you didn’t have debt, then when you know something is coming up in a few months you could just save for those few months.

You mention that this list includes all your needs and wants for the coming year. Here is the thing about blogging away debt, you should be slashing the wants! This budget is for your ideal life, are you living your ideal life carrying around this debt?

Student loan? Car loan? Do you really spend $400/month on cell phones? I think a $10K vacation is bananas when you still have those debts.