by Ashely L

My monthly budget for the first month of the year has been updated to reflect some of my goals and also my passions and pursuits. I believe this illustrates the quote on my 2019 financial vision board, which explains that the way people spend and save money is a reflection of their beliefs and desires. My January budget shows my goals to save 25% of my income, plan ahead for any possible expenses, and my personal (non-financial) goal to value my health.

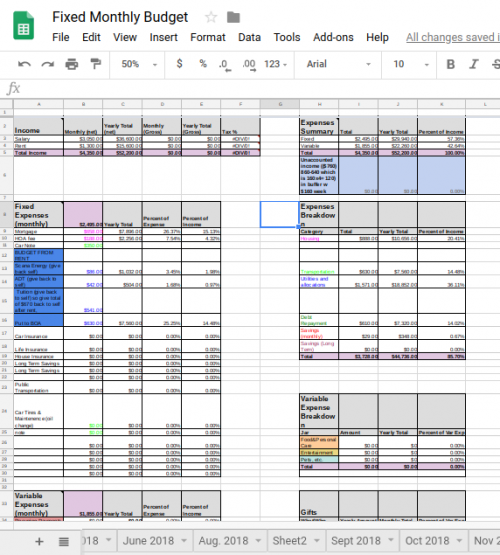

The budgeting strategy that works best for me is to have a weekly budget and a monthly budget. My weekly budget is simple, as I allot $110 to weekly expenses with $25 to gas, $20 to personal/household use, $50 to food, and $15 to any cheap dining out. My monthly budget was a bit more complex and I needed to find a great tool. After experimenting with several budget planners, I found this one that I absolutely love and have used it since. It separates fixed and variable expenses as well as debt repayment and it easily shows the monthly total, yearly total, and yearly percent of an expense. I downloaded both my weekly template and this monthly template from this site with lots of great templates http://templatelab.com/budget-worksheets/.

Savings

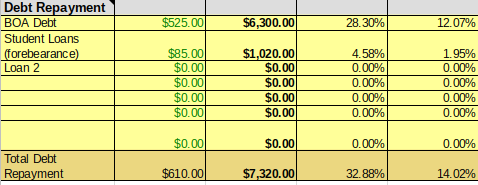

I have $3050 of income for the month of January. I saved 20% of my income as it shows above in the debt repayment section of my budget. $525 is going to my Bank of America credit card balance and $85 is going toward my student loans. (Although Excel is showing my debt repayment to be only 14%, I also include my rental income for one of my houses here so it skews my total income.)

Non-Recurring Expenses

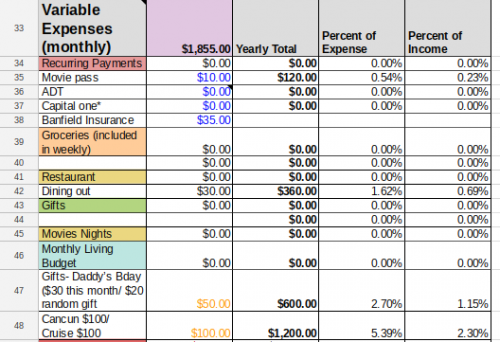

I am also planning ahead for any possible expenses. There are some expenses that I can easily plan for on a monthly basis. This budget planner lists my small recurring expenses such as my wellness plan for my dog ($35 monthly). I am also budgeting for an upcoming trip ($100 monthly for the past few months) and a birthday party that I am planning for my dad ($40 monthly for the past year).

My goal for the new year is to be better prepared for non-recurring expenses. For example, I was on the road a lot for the holidays and I know that my car will need some work soon ($90 one-time payment). I am also staying on top of my wellness and although I am not sure if I will need to, I have allocated money for a doctor visit ($40 one-time co-pay). Any surplus amount from these funds will go back to my debt reduction.

Me-Money

Lastly, I have budgeted money strictly for myself. I believe in frugality but also believe people should do the simple things to keep them happy and maintained, whatever those personal things may be. This month, $50 is budgeted toward my nails. Sometimes I play with this number. For example, in the winter months I can stretch pedicures and I also never get a manicure, only polish changes. I also get gel nail polish because it lasts a full month. This simple mani/pedi time was satisfying for me this month.

I’m looking forward to staying both my weekly and monthly and will keep you posted!

Ashley L, here! I am an educator in my early 30’s. I live in a southern city and when I am not working with children, I devote my time to my “doghter”, a Chihuahua fur-baby. In my leisure time, I enjoy traveling, writing, and reading.

One of my primary goals is to create financial security for myself, which has led me on a journey to pay off debt. A recent step that I am proud of taking is earning my third degree while decreasing my student loans to under $7,000. Come along with me on my journey!

I feel it is seriously misleading to say you saved $500+ when you really made a debt payment of that amount. That money is no longer available, therefore it is not saved.

I agree. That should be called a debt payment. Savings is money you, well, save. It is nice to finally get actual numbers.

What on earth is a wellness plan for a dog?? 35 per week for household and eating out? Nails? Tons for vacations, birthdays, etc?

Wow. Doesn’t seem like you’re too motivated to pay off that credit card debt.

Why is car maintenance in fixed expenses? Is the $90 car expense an oil change or something else? Is there a car note in your fixed expenses but not listed as a debt? If you’re single without dependents, why are you paying for a life insurance policy?

Movie pass, ADT, Capital One with an asterisk, Banfield insurance?

Am I missing a cell phone bill in here?

Might want to read about Hope’s no spend January and consider something similar. I’d also love to see a detailed line by line explanation of the budget. Frugslwoods and Six Figures Under are good examples of this.

What’s the status of your emergency fund? And why are you mixing terminology with savings and debt?

This probably comes off harsh, but lots of questions here because I don’t recall any of your back story.

That Banfield wellness plan basically covers preventative care for your pets. The minimum plan is $155/yr. It looks like Ashley has the Cadillac plan that’s $420/yr. At that tier, it covers dental cleaning, which may be the only reason it’s worth it (if your pets need a yearly cleaning..a lot don’t. But some dogs need more.).

And that’s leaving out the fact that you should never use Banfield.

Ah! That makes sense. Ashley- it would be worth doing a careful analysis on if this policy is saving you any money. My experience is that they don’t cover big ticket emergency surgery type things and shopping around for vets and dental procedures can lead to lower out of pocket costs.

I use a no nonsense vet for my giant breed dogs and it’s truely amazing what the price difference is when I’ve used an alternate vet in a pinch when mine was closed. The procedures they insisted were critical yielded eye rolls from my regular vet. Much of this can be breed dependent, so ymmv.

One of the major complaints about Banfield is that they upsell and overcharge compared to local vets. The other HUGE drawback to this wellness plan is that once you’re in, you must pay the duration of the contract. There is no cancellation option—your pet can die and you still have to pay. So at this point, the best thing to do is probably ride out this contract and simply not renew it. Makes no sense to pay $35/mo for something and not utilize it at all.

Walnut,

I believe that you may be thinking of an insurance plan as well as a wellness plan jointly. I am referring to an individual wellness plan, so no they do not cover emergency type surgeries because it focuses wellness and preventative care. I looked up some info before purchasing and this site breaks down the difference https://www.aspcapetinsurance.com/research-and-compare/compare-plans/competitors/banfield/

A wellness plan has always been important to me to make sure that my dog has preventative services and may be something to look at it if someone only has insurance, but I will definitely shop around. It’s interesting that this topic came up because I drafted a post about me getting dog insurance and was planning to post next!

Also you said that your comments probably sound harsh and I want to say that I’ve been successful in my debt reduction and continue to work toward it. I stated this briefly in my original post, but I make sacrifices as well as yields. It is evidenced by me working on my 3rd degree and having only 8k in debt, having a plan to pay off my current CC by spring, and sacrificing my comfort by having 3 roommates. However, I make yields like $40 a month for a party for my father because I’m blessed to say that, for me, my parents are definitely worth that. Hope this gives some clarity!