by Ashely L

2019 is the first year that I am writing down a unique set of financial goals for the new year. I believe in the power of writing goals down, and since I am a visual learner, I also love tangible reminders like vision boards. For 2019, I want to identify my distinct financial goals and will post them here in hopes that you all will hold me accountable! Ideally, my goals are measurable, timely, and realistic so that I can reach them at the end of the year. I have several goals that I would like to reach, but I am limiting my primary goals to three so that I can sharpen my focus on them.

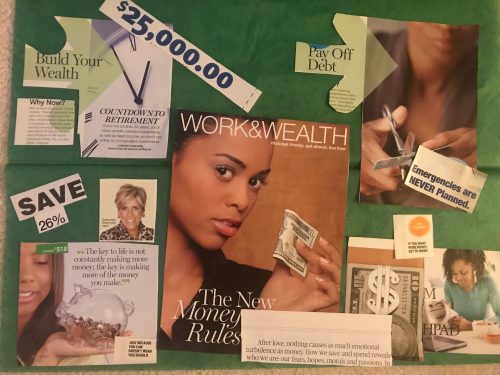

This is my financial vision board. The middle of the board has an inspiring quote:

After Love, nothing causes as much emotional turbulence as money. How we save and spend reveal who we are: our fears, our hopes, morals, and passions.

Goal 1 in the bottom right shows an approximation of my saving goal, a quote by Suzie Orman who I love, and a quote about remembering that money should work for you and not just the other way around. Goal 2 is in the bottom left corner and gives a visual reminder about working for more money. In the top right corner, a woman is cutting her credit card and it also says that emergencies are never planned. I added the reminder about retirement investing in the top left. What are on your 2019 vision boards?

Goal 1: Save at least 25% of my Income

A lot of financial advice suggests saving at least 20% of your monthly income. I did not meet this mark in 2018. My savings hit an embarrassingly low point in June of 2018 and I saved $280 out of about $2700. I believe that this decline was because of the lack of intentional plans for saving, so I recently updated my budget for the new year. I am on track to meet a 20% savings for January 2019.

Out of roughly $3,050 after-tax pay that I earned for the month, $525 goes to my $2100 Bank of America credit card balance.

Another $85 goes to pay off the interest on my student loans while I am in school. Therefore, I am saving a total of $610 of my income for January, exactly 20% of my check. I plan to try and save even more, ultimately progressing to 25% for the year.

Goal 2: Earn at least $200 in Monthly Supplemental Income

I earned almost $2000 last year in substitute teaching and this additional income was helpful. Side hustles give me a bit of extra cushion that I need. I think perhaps my mission to get a tutoring job is not meant to be because I have tried relentlessly but either cannot find one or find one that would be worthwhile. In the meantime, I will continue to do what I have done and to keep looking.

Goal 3: Plan for Debt

I struggled with this third goal. It is actually several large goals that I broke into smaller individual goals that all address debt in some way. My first goal is to 1) have my credit card paid off by April. I also want to eliminate “emergency-type” charges by 2) budgeting for all possible upcoming expenses and continuing to grow my emergency fund. This will eliminate the need to pull out a credit card the next time the mechanic tells me that if I don’t have both my front and back brakes replaced before I get on the road then I won’t make it back home. I am going to keep my credit card paid off.

My last goal is that 3) I want to pay down my student loans. I have two loans, both subsidized Stafford loans with the same interest rate. The smallest one has a balance of $1,200 and my plan is to pay that off in total.

What are your financial goals for 2019?

Ashley L, here! I am an educator in my early 30’s. I live in a southern city and when I am not working with children, I devote my time to my “doghter”, a Chihuahua fur-baby. In my leisure time, I enjoy traveling, writing, and reading.

One of my primary goals is to create financial security for myself, which has led me on a journey to pay off debt. A recent step that I am proud of taking is earning my third degree while decreasing my student loans to under $7,000. Come along with me on my journey!

What exactly are your debts? Your budget? Your income? I still feel we are missing basic information and context on you.

I agree…while these are admirable goals, we really cant weigh in on them until we have a better idea of your details. However, I do cringe at the idea of saving 25% of you income when you have any debt at all. I do believe saving is important to break out of the cycle of debt, but that is a large chunk when you are paying interest.

I think she’s saying the debt payoff is the savings. She had 2 payments which total $610, which is the amount she is saying she saved. It’s confusing way of phrasing it.

re-reading it, i think you are right…but that is not saving at all, it is just word games

yes, I understood it to mean she was using 75% of her income on life and the other 25% on paying down debt. When you get to the point of being debt free, having so much excess will set you up in good stead for retirement. But I agree, a summary of your debts and expenses would be helpful.