by Hope

As I am fully engaged in 2019 planning both personally and professionally, I am brought back to the age old tradition of resolutions. It got me thinking back to the years where I would write down a list of measurable goals I wanted to accomplish each year.

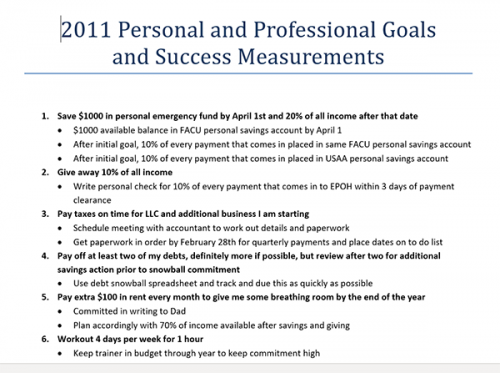

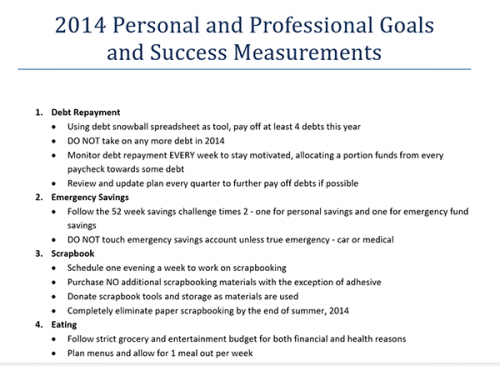

And the truth is, I failed miserably to stay committed to them or even accomplish them at all. I found two of my previous year lists in my records and thought I would share…

Yes, we can all agree I failed pretty miserably on both counts. In fact, for the last decades I have been failing at this type of thing.

BUT…

I feel like I’m truly in a different headspace now. So much has changed now.

- I really am making headway with my debt…finally!

- I do have a $1000 EF and have maintained it for almost 6 months without touching it.

- I have lost over 30 lbs since this summer.

- I am meal planning every week.

- The kids are older, more independent and I’m not homeschooling anymore…well, kind of.

So I’m thinking about spending the time to create a quantifiable goal list for 2019 that I can publish here on January 1st and then regular check ins to keep me accountable. I’m also thinking that this will help me in really evaluating the long term plan of my debt payoff. Your recommendations on my last two posts: debt update and winter budget have really given me some food for thought!

What about you? Do you set yearly resolutions or goals? How good are you at sticking to them? Do you think it’s worth the time and effort to do it?

Hope is a creative, solutions-focused business manager helping clients grow their business and work more efficiently by leveraging expertise in project management, digital marketing, & tech solutions. She’s recently become an empty nester as her 5 foster/adoptive kids have spread their wings. She lives with her 5 dogs in a small town in NE Georgia and prefers the mountains to the beaches any day. She struggles with the travel bug and is doing her best to help each of her kids as their finish schooling and become independent (but it’s hard!) She has run her own consulting company for almost twenty years! Hope began sharing her journey with the BAD community in the Spring of 2015 and feels like she has finally in a place to really focus on making wise financial decisions.

Hope I’d encourage you to set ONE goal. When you achieve it you can set another.

ONE goal at a time. Focus. Complete. Reset.

Also, blog owners? There are some seriously inappropriate and invasive ads popping up all over my screen when I read from mobile. Which is the only way I read.

PLEASE for the love of all that is holy sort that out and just go back to the old banner ads. I don’t think anyone here wants to see pop ups for Kettle Chips or credit cards. The holiday budget one is insanely huge and completely blocks the screen!!!

I agree with you, Malady. I often think people make far too many goals at one time and then wonder why they don’t achieve any of them. As for the ads on this site, they are one of the reasons I don’t visit near as often as I used to. The ads are beyond annoying and often make reading near impossible.

I agree with commenter above- one or perhaps 2 goals.. Then set another one.

I agree with everyone else, focus! Don’t spread yourself too thin across a bunch of different items. Maybe one financial goal, one exercise, one food, etc, but don’t try to throw your money at 5 different financial goals at once. You won’t see any progress.

From your last debt update, you have so many relatively quick wins available! The collections numbering was unclear, you mentioned collections 1, 2, and 3 but the chart only showed 2 and 3. Those combined were only $1500. At your current awesome progress rate, they could be gone this year or for sure in January. Attack that credit card with its awful interest rate and it could be gone in spring/summer next year. Then you’d be down to just the student loans and car. Wouldn’t that be amazing?! Stop throwing extra toward the car, bits toward savings, small amounts at student loans… Use ALL your extra funds to hammer the smaller items – collections and credit card. They’ll disappear, along with tons of mental and emotional stress. $1000 EF should cover the most likely emergencies, and as soon as these smaller debts are gone, your monthly obligations will go down, and you’ll have more freedom to save or handle any bumps life throws your way.

Someone did the math in an earlier post and even though the credit card interest is so high the student loans are generating more interest each month because the balance is so high. I think throwing a small amount at the student loan just to keep the balance from going higher isn’t a bad idea.

Hope I also think you should knock out your small debts first, then focus on building an emergency fund, which is important for a single self employed person, and paying the credit card and student loans. Stop paying extra on the car, that money can be better utilized elsewhere.

Hope, I pray my original comment came across as intended. I meant to be encouraging and helpful. Your progress lately has been awesome! Huge congratulations to you on so many fronts! A reader can tell you are in a different headspace because your posts have a completely different tone and feel. Above all else, I admire you for being true to yourself and being an amazing mom to your kids.

In your debt update, the chart showed collections 2 and 3 but your narrative was about 1 and 2. I thought you had paid one off but I wanted to make sure I didn’t omit anything so I mentioned it. I stand by my comment that those sum up to only $1500 and paying them off would be a quick win, ego boost, and stress relief.

I’d personally attack the credit card after that. At $3500 balance there is a light at the end of the tunnel and would eliminate 17% interest rate. The student loans are a long haul at a low interest rate; the car balance will also take longer and the interest burden is much lower. While the higher balance of the student loans makes the total interest high and raises the balance if you don’t cover it, the financial argument is still in favor of paying the credit card first. I’m simplifying a lot of math here:

$35,000 student loan x 2.88% = $1008 interest accrued in a year

$3,500 credit card x 17% = $595 interest accrued in a year

BUT if you paid off the credit card – $595 interest savings in a year

if you paid the $3500 toward the student loans instead – $3500 x 2.88% = $101 savings in a year

Even if you chose not to focus on the credit card, eliminating the collections would still have your debt list down to 3 items. Pretty cool, right?!

My point about focusing was brought on mainly by three things. 1. Your statement here that you “failed pretty miserably” on these huge goal lists. 2. I’ve read everything you’ve posted over the years here, and you’ve changed directions and often couldn’t find traction. You’ve gone through a LOT of challenges these last years so I mean absolutely no shame or blame! Only suggesting that I would find a focused direction easier to follow and stick to. 3. Motivation. I would find it easier to follow a path where whole debts are disappearing. Watching the car balance go down by an extra $80 per month, the student loans stay the same (by covering the interest), savings go up $100 per month (or whatever amount)…wins and big progress would take too long. I couldn’t do it.

cwaltz does have a lot of great points about you being a single income family, self-employed, needing security and stability, being prepared for challenges and emergencies, etc. We only have a peephole view of your life. You know the balance in your bank accounts. You know how many clients you have. How stable and consistent they are in paying. If your work is regular and long-term or intermittent. Whether one cancelled project turns your life upside down or is a minor hiccup. It seems like you’re doing well enough right now that you could handle a hiccup or two with ease, but not an overall business downturn. Only you know every detail involved in this. It wouldn’t be unreasonable to prioritize bulking up your savings and even make that the main focus for a while instead of debt.

It all comes down to what will motivate you, help you sleep at night, make you feel good, and keep you committed. Everyone is different. My suggestions are based on what I thought would motivate me.

She was able to deal with collection 1 already during her debt journey. I disagree with your premise of pay one thing and one thing only and don’t focus on several things. In my opinion finding a financial balance between saving and spending is incredibly important if you ever want to get past a cycle where you always are taking on debt to pay for things. Hope, in addition, is an independent contractor. There is no severance or unemployment for her if a contract ends or a customer doesn’t pay. She essentially is her own safety net. That makes savings very important. Hope already knows this though since last year she was forced to live on the $10,000 she managed to save while employed and fighting for her unemployment benefits(she was employed by the firm before they tried to make her a contractor and pull a fast one to get out of covering her unemployment.) That isn’t saying that Hope shouldn’t focus when it comes to paying her debts. Her student loan is larger this year than it was in 2014 when her estimated payoff date was 2017. Her deferrals while helpful to her budget while undergoing hardship have hurt her long term. Putting off making those payments even at a low rate have come at the cost of thousands of future dollars. Hope needs to find balance. She needs to set up a budget that allows for saving towards things like a safety net so she does not need to put things on her card if a contract ends or end up taking on a car loan when the car she is paying for now finally breathes its last breath. She needs to understand her student loan is going to be a long term endeavor that will take years not months to pay off absent a lottery win. She needs to understand that wants may need to be put to the side or budgeted for instead of financed. During that time period things may happen financially that will set her back if she does not prepare for them. Debt is a cycle. She needs to break that cycle by being realistic about where her budget is and looking at her needs are and what wants are and how to prepare for them. It sounds easy on paper but the truth is that it is not easy to tell yourself no for years.

Hope be proud of yourself. Even though your student loan has gone up in the year I’ve been here I’ve watched you weather a job loss and pay down collections and credit. You haven’t handled things perfectly but you have handled them well. If you can hold on to your clients I suspect that this year you will be able to put to bed the collections and potentially the car or credit card(the car is a potential $400 back to the budget.) With a $300 payment to IBR you will be looking at $200 going towards the principle each month. That’s $2400 a year just by paying regularly without extra payments. In the meantime start to save. Save for your next car. Save for times when you may need to cover your $2500 a month costs because a client didn’t pay on time or cut back. Don’t let people tell you that you should just choose one, save or pay down debt. The reality is you’ll need to do both with the amount of debt you have right now.

+1 on saving. The 10k emergency fund made a world of difference this past year.

I’m a fan of paying off the collections accounts and putting some cash to the emergency fund.

Agreed, this is really good advice.