by Hope

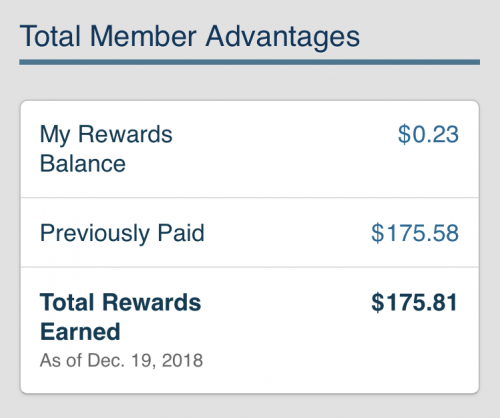

I mentioned a couple of times that my only credit card offers cashback rewards. And I have it set up to deposit the rewards into a standalone savings account every time those rewards reach $20.

As I have been working through my plans and budgets, I took a look at how those rewards added up this year.

Not too shabby for a little bit of passive income. I’m not designating it towards anything at this point, just pretty much ignoring it and hoping to be surprised as it grows.

I am also continuing to save my loose change and $5 bills. Gymnast pulled the $5 out a couple of months ago and counted it. It was $120 at the time. But I’ve left it alone since then.

I realize this blog is not about saving, and I am focused on my debt. But these gimmicky savings plans just give me a small piece of added security.

Do you have a passive savings source? Or an account that you just let grow unsupervised?

Hope is a resourceful and solutions-driven business manager who has spent nearly two decades helping clients streamline their operations and grow their businesses through project management, digital marketing, and tech expertise. Recently transitioning from her role as a single mom of five foster/adoptive children to an empty nester, Hope is navigating the emotional and practical challenges of redefining her life while maintaining her determination to regain financial control and eliminate debt.

Living in a cozy small town in northeast Georgia with her three dogs, Hope cherishes the serenity of the mountains over the bustle of the beach. Though her kids are now finding their footing in the world—pursuing education, careers, and independence—she remains deeply committed to supporting them in this next chapter, even as she faces the bittersweet tug of letting go.

Since joining the Blogging Away Debt community in 2015, Hope has candidly shared her journey of financial ups and downs. Now, with a renewed focus and a clear path ahead, she’s ready to tackle her finances with the same passion and perseverance that she’s brought to her life and career. Through her writing, she continues to inspire others to confront their own financial challenges and strive for a brighter future.

sorry to rain on your parade but those passive savings are being eaten up by the interest you are paying on your balance. i would like to see a side by side comparison of “passive savings” vs interest paid monthly. it seems odd to me that even after all these years on this blog you still seem to be living in la-la land when it comes to money. there are people here who have given you excellent advice about this credit card which you just simply ignore time after time. also sorry that this seems so harsh but it is reality. i keep reading here just hoping that you will eventually wake up.

I assumed Hope was paying to zero every month so not carrying a balance/paying interest. Is this not true?

Her last debt update had a $3,700 balance on the card. I took it to mean she was just paying off what she charged every month and not touching the outstanding balance right now. Haopefully she clarifies.

Actually it was a $3,500 dollar balance. Still it looks like she is carrying a hefty balance on the card and paying more in interest then she is getting in rewards.

https://www.bloggingawaydebt.com/2018/12/hopes-debt-update-december-2018/

When she lost her job in February she was pretty much forced to pay minimum payments and ask for deferment on her student loan. Since that time she has had a balance. Her last debt update had the balance at $3500. Since she has stated she is using the card and paying it my assumption is this is her previous spending from the time she was playing catch up. Many of us have tried to get her to pay the card down because the interest is so high but Hope has been steadfast in the position it makes more sense to pay down her other debts first. I think her thought process has been to eliminate her higher payment debts. For example eliminating collections 2 returns $246 to her budget. Her decision in that case is not horrible because her student loan repayment is set to restart in March and if it is like before will cost her around $300 a month. That being said many of us are also concerned because she has only had $1000 in her savings and she is self employed. One lean month could knock her back on her heels. Unfortunately, I tend to think that Hope sees her debt journey as a sprint when she really needs to look at it as a marathon. She needs to figure out a nice balance between debt pay down and putting money away for future spending and emergencies. It’s my hope that one day her life and budget will be boring because she’ll be able to say I have $600 for a trip because in January I put together a budget that allows $50 each month for travel and here it is December and that money is there to spend. Or her car will be ready to quit but it won’t matter because Hope put $100 a month away for 3 years and has a sizeable emergency fund and now she can pay $7000 in cash for a car and skip the whole entire car payment thing. As it stands her budget sometimes feels like a game of whack a mole. She pays down one thing and then ends up financing something else because all her money went to expenses and paying down that one thing. Anyway sorry to ramble. I’m a little worried at what a new budget with delaying that 2nd collection while beefing up the ef means. I’m hoping it is me worrying about nothing and just Hope not wanting to see that student loan climb to $35,000 and being mindful that the $10,000 she had in savings last time saved her from having too much trauma after her job loss and not a downturn in business.

I guess I am confused why this can not become an extra debt payment….then your cashback program create money for you twice….once by the actual cashback and once by the interest saved.

That was a nice surprise! Still, it would make sense to take that money and use it as an extra credit card payment or toward the collection debt … or next month’s student debt payment.

You are on a good trajectory…but the cash back is more than eaten up by the interest you are paying keeping a balance on your credit card. You are better off paying off the card completely off and then only charging what you can pay off as you charge it, THEN the cash back will actually be passive income/extra money. Keep rocking-you are getting there!!

I’d good that got some extra money however math says you really haven’t “saved” with the credit card. Why? $ 3500 with 17% interest works out to around $595 dollars a year in interest. So technically your card is costing you $420 a year right now(subtracting that $175 in earnings). Why not take that $175 and put it towards your credit card balance you’d be pulling your yearly interest down? Once you get to the point by where you are able to pay as you go that extra income will be extra income. You aren’t there yet.

I agree with everyone else. The cash back doesn’t matter when you carry a balance. Interest is costing you more than you earn. I also have a USAA credit card(I believe that is what you have) and the rewards would not pay off if I wasn’t paying it off, in full, every month

Learning to save is an important part of managing your money. So kudos on that! I do agree however that you should take the savings and pay down your debt. It will do you more good as a debt payment then just sitting in a bank account or a box of $5s in your closet. Maybe wait till you have $200 built up and pay something down and do it again. Remember that the ultimate goal is to pay off all debts and stay that way! i think you are headed in the right direction. Sometimes it takes small incremental steps to reach our goals. You are having to re-train your brain when it comes to money. Savings games are one step to the goal of planned savings. And paying down debt is one step to the goal of debt free. Keep going!

Credit card rewards can be a nice little source of extra income (as long as you pay off the balance every month). Whenever my rewards balance reaches $20 I withdraw it and make an extra student loan payment.

When you are struggling to get out of debt, it can feel really good to have SOME sort of positive balance somewhere. And when your debt is gone, this can be a painless way to save a bit of money over a year, perhaps as birthday/christmas budgets, or for school supplies. But the others are correct. No reward card is worth it if you carry a balance.

If you must carry a balance, you would be far better off to find a no-reward card that has a lower interest rate, because the rewards are paid for by the company from the revenue of those higher interest rates/fees. Look at it this way. You carrying a balance pays for my rewards which are outright gains for me since I never carry a balance. Its a bit of penny wise and pound foolish.

Well, Hope doesn’t HAVE to do anything we advise, but I understand the frustration others feel. There is another blog I visit on occasion that is supposed to be a get out of debt blog, but that persons debt load is enormous and they show little effort and no real sacrifice in paying down the debt. I still go by and check in time to time because it’s a train wreck and I can’t look away.

I made the suggestion long ago to forget the collections until your credit card debt it gone. But you allude to this as tax debt so if you have the feds on your case, you may not have the option to delay payment. If so that information would have been enlightening.

As for the current situation and debt, you have $50 for kids, $150 for clothing/entertainment, $100 for student loans (which I understand are not in official repayment), and an extra $80 you are putting on your car. If you took ALL of that and applied it to this collections in addition to the $246, you would have that paid off in, what, two months? And then take all that and apply it to the credit card that would be gone in what 6-7 months? You’ll have to start paying your loans in the spring but at least you’d get some traction. And We all know, you’ll do anything for your kids, but you have NO MONEY for extras. Entertainment is a deck of cards and the library. What clothes you MUST have, get from a thrift store. It will only be temporary.

My concern is that you have student loans coming up. And doesn’t the Medicaid get a relook at some point soon? How will you pay for insurance? Never mind any savings for retirement. We all just get frustrated because we know it doesn’t have to be like this, what you do to yourself.

Best of luck.