by Ashley

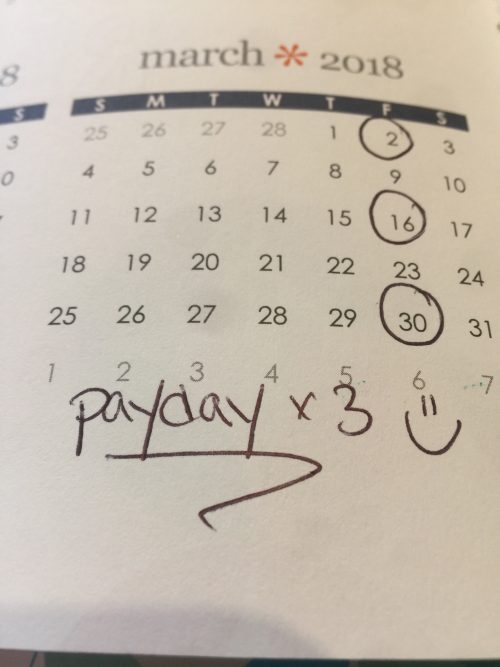

Talk about starting the month off right! March is a 3-paycheck month for me (anyone else?)

In the past, we’ve been able to put the entire extra paycheck toward debt. But right now we’re still in a situation where we’re totally out of money before the month is over, and scrambling to pay bills that are due at the beginning of the next month. We’re still working on budgeting, in general.

It’s very stressful and not very fun. So I decided that with my third paycheck, instead of making extra debt payments, I’d create a bit of a buffer in our budget by pre-paying some of our bills that are due in early April. It may not be the most fun way to spend extra money, but it makes me feel good to be starting off April on the right foot!

I logged into my bank account’s bill pay center and paid for our phone (due 4/1), Citibank credit card (due 4/4), Wells Fargo credit card (due 4/5), and childcare (due 4/10). I’ve also set a chunk of money aside because I plan to mail a large check to pay the remaining balance of our 2017 property taxes (payment must be post-marked by 5/1, but I’m planning to make the payment on 4/13).

The third paycheck month is coming just at the right time to help create some breathing room in our budget, especially with our property tax payment coming due. Usually, I get a lot of satisfaction out of making those extra debt payments, but I think this time the money is well spent in creating a bit of a buffer for us. It reminds me of when we used YNAB to live on last month’s income. It took awhile to build up the extra, but it helped alleviate so much stress due to budget and/or income fluctuations. I think this will be a goal we’ll have. Trying to get back to living on last month’s income again.

Was March a 3-paycheck month for you? What do you typically do with your third paycheck on 3-paycheck months?

Hi, I’m Ashley! Arizonan on paper, Texan at heart. Lover of running, blogging, and all things cheeeeese. Freshly 40, married mother of two, working in academia. Trying to finally (finally!) pay off that ridiculous 6-digit student loan debt!

I LOVE YNAB and am still trying to get my buffer for living on last month’s income – if only LIFE would stop getting in the way of my plans!!!!

I think that was a wise use of your extra paycheck. March was a 3 paycheck month for my husband. We used the extra money to pay state taxes and car insurance. We usually try to just stick any extra money in the savings account. But it turned out that there was No extra this time. Between the two of us, we end up with 4 3-paycheck months in a year. That really adds up!

It was a 3 pay check month for us as well. I committed those 2 extra checks to help pay down our mortgage. I’m excited because in May we will have a 5 figure motgage.

Great job! That’s right on the horizon! Way to go!

Out of curiosity, why did you guys stop using YNAB? I started using it about a year ago. I ended the year with no new credit card debt, and now I’m focusing on paying down debt and building a month buffer. It’s been a really great tool for keeping myself on track.

I think it just fell to the wayside when our budget blew out over the summer (this was right when both hubs and I lost major sources of income – me losing my part-time income and hubs’ losing his full-time income). I wanted to bring it back and do a comparison of YNAB against Every Dollar, but we’re still battling the budget bulge in general so doing a comparison hasn’t happened yet.