by Ashley

Hi all, Happy Friday!

I submitted my final grades yesterday, today is our department’s holiday party, and next week I’ve got two totally open days on my schedule that I can use to catch up on some academic writing, household chores, holiday prep, etc. It’s always a fun time of year when classes end and it feels like the “real work” begins. Oh, academia. 🙂

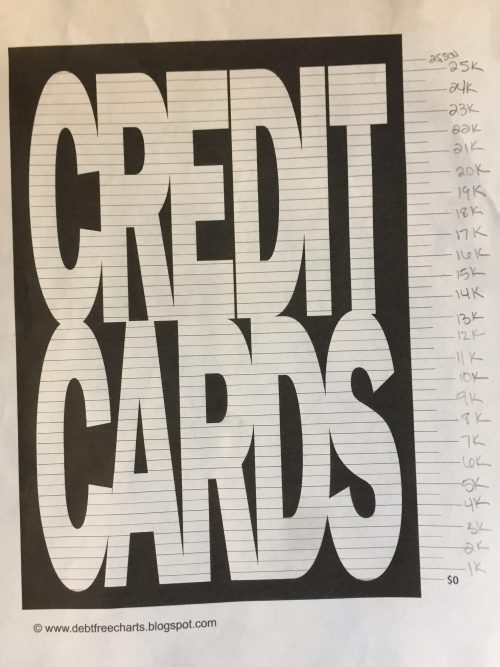

Since, as you saw on my last post, I’m basically starting over with our credit card debt, I wanted to do something to help it stay really visual and to keep me motivated.

I’ve made homemade debt thermometers in the past (see here or here), but I wanted to try something a little different this time.

And somehow in my searching of the interwebs, I came across these totally nifty little debt trackers! Best part, it was totally free on the website (linked here), along with several other options (e.g., student loan, mortgage, debt free, etc.)

Admittedly, we’ve got a long way to go. We’ve re-dug this huge hole and feel like we’re at a start-over point. Instead of bringing our entire debt load into the picture, we’re really just going to focus on the credit cards for the time being. It will take some time, but we’re determined to get it done all over again.

Editors note: if you’re looking for more debt tracking worksheets, consider getting Lauren Bowling’s free debt tracking template.

What debt are you currently focused on eradicating?

Hi, I’m Ashley! Arizonan on paper, Texan at heart. Lover of running, blogging, and all things cheeeeese. Freshly 40, married mother of two, working in academia. Trying to finally (finally!) pay off that ridiculous 6-digit student loan debt!

It looks like you might not want to offer any explanations about this credit card debt, and that is certainly up to you. I think if this were I, I would just want to throw in the towel. I can’t even….. You really are at a start-over point, but what you must do is throw away the shovel and stop digging. Vicariously, this is painful to witness after watching you slug your way out of debt as you have the last couple years. All the charts and graphs in the world will not do anything unless YOU decide to do it. (I’m sorry if this sounds a bit harsh.) Someone mentioned in your last post that this is a lot like seeing an addict fall off the wagon and backslide big time. There is nothing to do but fix this mess. I wish you luck, Ashley, as we have all said many times already!

Pretty nifty chart. Hope it helps. Have you determined the priority/order of payoff yet?

Yes, we’re going to snowball the debt. Lowest balance first.

Sounds like you are going to pay it off the “Dave Ramsey” way. I’d also encourage you to watch/listen to some of his podcasts for encouragement.

I still think you should consider paying that cap 1 before b of a card. They are pretty close in balance and one is about 10% more in interest. This coming year I will be hopefully paying $3750 in accrued debt off in increments of $350-$400 a month. I’m also hoping to put away $200 a month in savings in addition to paying cash for struts,shocks and tires(there goes our tax refund.)

Hi Ashley,

Best of luck paying it off.

How long will it take you assumably?

Why don’t you sell your house? You can’t afford it until DH is done with school. With your taxes, insurance and HOA, it is way more expensive than your rent.

Unless they’ve accidentally built up a large amount of equity, selling the house would cost a lot. I don’t know how much her house is worth or how much it cost, but realtors fees alone would likely be $10,000-$20,000. That’s money they don’t have.

I’m not sure it would be that much on their house, but yeah realtor fees are usually 6%, so selling so soon after buying would likely mean they would have to bring money to closing. Which would cause more debt. A lot of people just look at the mortgage when they buy a house and don’t take into account insurance, property tax, and the fact that you can’t call a landlord when something goes wrong. It’s too late for Ashley but anyone buying should think about those things and have the $$ to cover it.

I would like to hear more about the why behind the increased debt. 25K is a lot of debt to add in just one year. My hubby and I are also digging out of a mess and while we did recently add 4K (medical) to our debt, we have still paid off over 9K this year and that includes factoring the 4K.

Proud of you for coming clean. I’m also cheering you on. Debt sucks.

Oh, and…”What debt are you currently focused on eradicating?” Last payment on the washing machine (an emergency purchase with a new account discount and 0% interest) will be made in January (early payoff). Last payment on my vehicle loan is in March (sooner if we can swing it). Saving for a major home project.

Sorry to hijack, but is anyone else experiencing a high level of annoying ads on this site? The pop-up one on the bottom is especially distracting. I get that a site needs to generate income, but this is beyond excessive.

On my mobile the add at the bottom is quite small and doesn’t bother me too much .

Thanks. I’ll give the mobile site a try.

hmm. i don’t even get any ads. maybe it’s a random thing. Hey Ashley, Lots of good questions on your prior post – do you plan to address in a separate post? You’re usually pretty good at responding to comments.

Ashley – I sincerely hope you have gone through the ugly, painful, come to Jesus process of pulling all of the credit card statements and reconciling every last penny of that debt. There’s nothing quite so eye opening as sitting down with an excel spreadsheet and logging each penny.

This quantity of debt isn’t a result of eating out since I can’t imagine you’re taking toddlers out to $250 dinners. This also isn’t just dropping too much money at Target, because surely you would run out of things to buy after spending hundreds of dollars per week for six months.

I will also encourage you to take a hard look at any clothes that may still have tags or purchases that have not been used and return those items. I’m well versed with how much money can be spent at Home Depot on house projects. I also know those house projects usually come with piles of wrong sizes or wrong products that might be hanging out around the house/garage/store room.

Hi Ashley! I just want to say YOU CAN DO IT! You’ve done it before and you can do it again. But I know you must be banging your head on the wall saying, “WHY!!!! NOT AGAIN!!!”. I completely understand. I have been on the debt-free journey since gosh, really I am not sure what year to put down. In 2011 I was saving (to pay bills during my internship) and trying to pay off credit card debt. Then I got through my internship and started saving and trying to pay off debt and then I got a job in a different state. So there went savings and I started my journey over again. Here it is and it is almost 2018 and I am still on my journey. Just this past year I was really getting focused on paying off debt. I have paid off one school loan and several credit cards. And each time I paid off a credit card I canceled the card and shredded the card. I am also tackling my debt with the snowball effect. If you are taking a page out of the Dave Ramsey book then you know you first have to CHANGE your spending habits. I say that with love because I am right with you. Changing spending habits is a daily battle. For example, just the other day I went to TJMaxx and saw the CUTEST little purse. I wanted to buy it but instead I walked away. That was a small victory. But every small victory adds up. Just keep your head up. I added that small victory to my hope sheet. During the summer I created some charts based off the Dave Ramsey plan and would like to share them if you think they might help. They are My Hope Sheet and Get Mad (Motivated About Debt) sheet. I will gladly email them if they will help you in your journey. Keep your head up and just keep chipping away your debt one little bit at a time.