by Matt Fildes

Hope everyone had a great weekend and a great start to the week!

I’ve officially paid off more on my student loans than I owe! I can’t describe just how good that feels (but I can try- amazing!) but I still have a lot of work to do…approximately $55,000 of work. So…I don’t really feel much need to celebrate anything, just take a nice long look at how far I’ve come, then put my nose back to the grindstone.

Here’s what my balances look like as of the 21st (my Navient auto-debit date):

| Loan Name | Interest Rate | Original Balance- May '09 | Current Balance | Total Paid Off |

|---|---|---|---|---|

| Sallie Mae 01 | 5.25 | $27,837.24 | $24,224.78 | $3,612.46 |

| Sallie Mae 02 | 4.75 | $22,197.02 | $19,006.27 | $3,190.75 |

| Sallie Mae 03 | 7.75 | $20,692.10 | $0.00 | $20,692.10 |

| Sallie Mae 04 | 5.75 | $10,350.18 | $7,570.60 | $2,779.58 |

| Sallie Mae 05 | 5.25 | $6,096.03 | $4,276.91 | $1,819.12 |

| Sallie Mae 06 and 07 | 4.75 | $6,415.09 | $0.00 | $6,415.09 |

| Sallie Mae- DOE 01 | 5.25 | $5,000.00 | $0.00 | $5,000.00 |

| Sallie Mae- DOE 02 | 5.25 | $3,000.00 | $0.00 | $3,000.00 |

| AES | 6.8 | $9,000.00 | $0.00 | $9,000.00 |

| TOTALS | $110,587.66 | $55,078.56 | $55,509.10 |

Since last week, I’ve been doing some thinking about what I’m going to do after all my (non-mortgage) debt is gone. I know my number one goal is going to save up 1 years worth of expenses. Basing the 1 year on my current expenses, less the student loans, since I’ve lived my entire adult life on a bare bones budget, I have annual expenses around $15,000. If I throw all the money that I put onto my debt into a savings account, it should take me between 5 and 6 months to do this. I also know that after I save this money I want to catch up my retirement that I missed on this past year, which will go to a Roth IRA- roughly $5,000.

So that’s what I know I want to do for sure. After not, I’m not quite sure at all. I developed a future budget that I could use:

Since I haven’t done any spending in the past few years, I’d like to have budget lines for a future vehicle and/or repairs for my current car (which is already at 86K miles), clothing, and some travel. HOWEVER, I also want to pay 2 mortgage payments monthly and continue to save. One of my biggest inspirations to really start hammering the debt was/is Mr. Money Mustache, so I’d really like to continue living a fairly frugal lifestyle while continuing to save as much as possible. Well- I can’t have it all, so I think this budget is a good balance between spending and saving. And the good news is this is all based on my current pay, which, hopefully, I should be making more in a couple years. I also based my income on the fact I’d like to contribute 5% to our company’s 401K plan to get the most match as I can.

I’d like to hear from people in comments on what you did after you paid off debt- were you to worn out from the payoff that you went into spending mode, or did you continue the lifestyle?

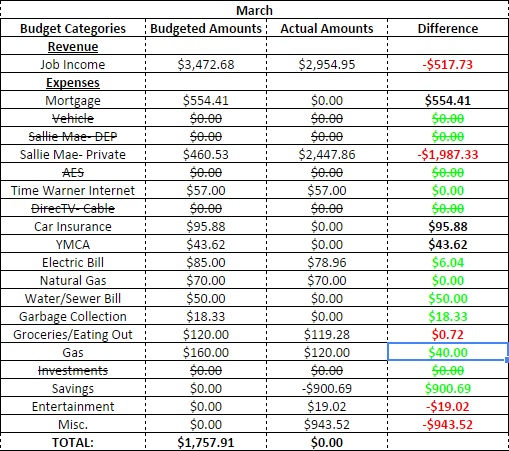

On a budget note, here’s where I currently stand in March:

There’s couple of big items that came up this month (which weren’t all that unexpected): 1) I had a crown put in at the dentist a couple weeks ago. I have insurance, but I owe %50 out of pocket for this type of work. The cost- $397.50. 2) I filed and paid my local taxes. I knew when I withdrew my government retirement account (back in September) I would owe state and local taxes on it when I filed in the new year so I knew this was coming. I paid $700 to PA last month and $310 to the city of Erie over the weekend. 3) I had to take our one dog to vet a couple of weekends ago to have them look at an ear infection and to get her vaccinations. The costs- $132.02, but me and my GF have a plan set up- if it’s “her” dog (the white one, Harlow) that she brought to the relationship, the GF will take care of the vet bills and vice versa for my dog (Bubba, the black one). Since I took Harlow in while my GF worked, she wrote me a check for the visit that I just deposited yesterday and, thus, isn’t reflected in my budget, yet. 4) I had to put down a $100 deposit for the B&B I’m taking my GF to in April to make up for my V-day gift to her (the poorly timed concert tickets :/). I didn’t expect this since I didn’t remember putting a deposit down the last time I booked a room. O well, it just means I’ll pay less when we check out.

I also spent more in the groceries/eating out category than I normally do. I had to go into work for a couple of weekends this month, so I bought breakfast for myself on the way to make it easier to go in. I also had a surprise visit from one of my best friends (who lives in North Carolina) over this weekend. Didn’t spend to much, but I treated him to lunch at Moe’s while he was passing through town. It only cost $25 and he has paid for me more times than I can count in the past, so I owed it to him.

My slush plan is fairly low, much lower than I’d like it to be:

Slush Fund= $1,129.84 (plus $132.02 when the check clears)

I have future plans to fill it back up, but I’m not going to do anything at the moment, just continue staying the course for now.

Hope everyone has a fantastic week!

Congratulations! I am just about to go over the 10% paid mark in the next month and I am so psyched! I cannot wait until I have multiple loans paid off in additional to seeing the % paid increase.

Yes it’s a great feeling seeing that debt go away! If you don’t mind me asking- how much debt do you have, and how long are you looking until it’s paid off?

Our total debt was 180,324: 126K in my student loans for graduate school, 7K on my husband’s loans from undergrad, 17K on two cars, and a 30K mortgage.

So far we have paid off 17,795 or 9.87% of our total debt since July 2014. This is all of my husband’s undergrad and we are working on the smaller car loan, hopefully to paid back by May 2015.

Our anticipated debt free date is everything but the house by Dec. 2018 and debt free by June 2019.

Wow- awesome. So you guys paid off $17,795 in…9 months? Very cool! Dec. 2018 will be here before we know it 🙂

$15k per year in annual expenses is crazy low. Nice job on keeping lifestyle inflation to a minimum. It’ll be really rewarding after paying off your debt to start paying yourself and building up some solid net worth.

Do you and your girlfriend talk about the “long term”? Where you want to be in 30 years? Do you want to shoot for early retirement, do you want to travel domestically/internationally? Maybe you want to diversify your income by owning rental properties?

You’re right- 15K is crazy low, lol. Don’t get me wrong- it’s (almost) a bare, bare, bare, bones budget. The only reason I say almost is because if I were in true dire straights and needed the money to last, I would cancel my YMCA membership and internet subscription, but the 15K includes these two items. I would love to see my net worth go above $0 for the first time since I turned 18; it’s a day I’m really looking forward.

You know, we have talked about. Nothing in too much detail, but we both know that we have different goals as far as career is concerned- she wants to open her own practice once she graduates and is licensed and I’m looking at pursuing an early (not super early, though) retirement. Of course this could change once I’m working because I want to, not because I HAVE to- big difference I feel. And one of my big goals is to be financially independent and diversified, so income property has been something I’ve thought about. We’re on the same page as far as where we see ourselves living, when and how many children we want, marriage, etc…

wow i’m impressed with how dedicated you’ve been. I think since you’ve been at it for so long you might be so conditioned to think in frugal mode that you might just keep on!

2017 is closer than you think!

Thanks! Less than 2 years!

You have been doing a fantastic job in getting rid of your loans! My goal is to get rid of my student loans by 2017 as well. I’m less than $38k but I started with $55k last year. I plan to fully fund my 401k then and possibly own rental properties.

Thanks Juju! We’ll get there soon- less than 2 years away!

Ditto on the 401K and income properties- I’d like to be on track for retirement post-debt plus having some extra income coming in on the side would be a very sweet deal.

You really are knocking those debts out one-by-one!!! Not to jump the gun or anything but you might want to “think” about wedding costs sometime in the future as well 🙂

I think the key to continuing this lifestyle is to do some things every so often you don’t do – like the trip to the B&B and treating your friend to lunch. Saving money is wonderful, but not to the point where you become a miser (not that I am insinuating you are!!!)

Hey thanks Sue!! We’re thinking about it :). The GF has 2-1/2 years left in her graduate program, which is extremely intense and goes all year long, including summers, so we’ve decided to hold off until then. But that being said, 2-1/2 years can and will creep up fast.

Speaking of wedding costs- that’s always been one thing that’s scared me. The marriage part doesn’t scare me at all- I’d be happy just going to the courthouse, but the costs of having what’s essentially a one day event (sure, memories last a lifetime) has struck me as being outrageous. The wonderful thing is that this is another area me and GF agree- small wedding with only close/immediate family and very close (i.e. best) friends, which should keep costs to minimum and give us both the wedding we want.

And I agree on the small costs- it feels like they’re sometimes the only thing that keep me “sane”, lol.

It’s funny about wedding costs. My husband and I wanted a big wedding but was just too costly. We ended up having a backyard wedding with 12 people there including us. We paid $25 for a friend of our family to marry us. My Mom took us out to dinner as a surprise and her gift to us. We didn’t even do a honeymoon. Best part is no wedding debt! It in no way changed anything about our special day and honestly the way we did it fit us.

That’s fantastic! The “no wedding debt” is really speaking to me, lol. But seriously- it sounds like you got everything you wanted out of it and came out the other side in pretty great shape, financially. I’m hoping someday, I’ll be able to say the same thing.

Great job on reaching the halfway mark! You mentioned a company match for your 401k… are you already contributing so you can get any of the match? If not, I would seriously consider making the change to do so.

Thanks Alexandra!

I am not currently contributing to a 401k. I stopped contributing back in September to put everything (almost literally) towards debt. I’ve already consulted my company’s HR manager and I can’t get back into the 401k program until either May 1st or August 1st. I haven’t quite decided which date I going to start again, though.

Gotcha… I’m sure you’ll do whatever is best for you. I hate seeing the “free money” and time for investment growth disappear, but I also very much understand the desire to go all out to clear your debt.

Btw, thanks for being a BAD contributor! I am enjoying your posts and perspective.

Congratulations Matt! This is such an awesome accomplishment. I admire the way you keep daily living expenses at a minimum. You are certainly very smart and level-headed. Keep up the great work and your debt will melt away.

Thanks TPol- I really appreciate that!

To answer your question: once we had paid of our debts we saved for an investment portfolio. For no specific reason whatsoever I always wanted to have 15k of money to invest in the stock-market, and so we saved for that. We than enlarged this fund as fast as possible to around 100k, because we realised that having capital earning money gave a tremendous feeling of freedom, of which we wanted to have more.

We never had a specific emergency fund. At first I had simply not thought of it. And later, when I had read my first books on personal finance, I had invested enough in stocks to not care anymore. Once you have a decent amount of money invested in liquid investments, a broken washing machine, or any other unexpected emergency, is at most a small annoyance. And knowing that that is the case makes you feel the freedom!

Yes, Jerome- this. You sum up my goals quite nicely. Congratulation on achieving all that you have.

One question (if you don’t mind)- how long did it take you to save up the 15k? the 100k? when you finally felt “free”? (Sorry, I guess that’s 3 questions in 1, lol.)

You’ve probably heard of Your Money or Your Life, by Vicki Robin and Joe Dominguez. If you haven’t read it, I would highly recommend it. Gives a lot of insight and ideas on that “life after debt” question you posed. From your comments you’ve clearly already thought about it though – super early retirement and when you don’t “have” to work.

Hey Rachel- I actually haven’t heard of it. One of the budget friendly things I/we do is go to the city library (Erie’s is really, really nice) so I’ll have to see if they have this book.

I have thought about, a lot (A LOT!). When you have $100k+ in student loans, dreaming about post-debt life is one of the few things that cures the depression, so to speak. What I haven’t done, though, is really think about solid, concrete plans and goals I wish to achieve. It’s one thing to dream, it’s another to set milestones and put the goals down on paper. But TBH, I think 2 years may still be too far away (maybe? what do you think?) to do this- I mean, a lot can change in 2 years, right? I think the closer I get, the more concrete my post-debt goals will become.

Definitely check out the book. You’ll love it! Life-changing stuff.

I agree with you, 2 years may be a little far out for concrete goals and milestones. Your thoughts and dreams are keeping you on a great path and sound perfectly appropriate at this stage. The plans, goals, and actions you are taking on your student loan debt in the meantime are rocking! Keep kicking butt!

We paid off a $100k mortgage super aggressively and remained frugal. The lower your required expenses, the lower your required income, which creates a tremendous feeling of freedom.

As for wedding, we got married on the terrace of a beautiful golf course. We only had to meet a $400 minimum for dinner…and did so by inviting approx 20 of our closest family members. The next day we had a picnic at a park with about 100-150 people. Brought the drinks, made most of the dishes ourselves, and had a couple items catered. Total cost of both days was under $2,000, was perfect for us, and everyone loved it – beautiful day outside, kid friendly, no need to get all dressed up, casual vibe.

Good for you! I’d love to have a paid for mortgage (alas, someday). And with the lowered expenses- not sure if you read Mr. Money Mustache, but one of his tenets (which makes a lot of sense) of keeping expenses low is that it has 2 effects- 1) the lower your expenses, the more you can save and 2) the lower your expenses the longer your savings will last, or the less savings you need to get by (which is what you’re saying). I really, really like that thought.

And awesome on the wedding- how many couples can say they only spent $2,000 for what sounds like was still a dream weekend? I doubt very many, that’s for sure.

Good job! And I’m impressed at your bare bones budgeting.. I was never able to do that, but I also didn’t have nearly as much debt as you did – not even close. But, since you asked, this is what I’ve done since becoming debt free, not counting my mortgage:

– Created an emergency fund. Initially, 6 months of take home pay, now 12 months of take home pay. This fund is for major emergencies such as getting laid off.

– Created a “slush fund,” or the minor emergency fund for car repairs, surprise dental work, etc.

– Maxed out my 401(k) contributions.

– Used a modest inheritance to buy a car with cash (and I really did need a new car – the old one was one malfunction away from scrap metal in my parking spot).

– Used the same modest inheritance to create a housing reserve for major maintenance on the condo.

– Created savings “buckets” for things like education, vacation, big ticket purchases such as furniture.

The items that have had the biggest impact on my peace of mind are the first two and creating the housing reserve. This winter was awful with ice dams. One day I measured 4 GALLONS of water that I had emptied from the buckets. FOUR+ GALLONS leaked into my condo in 24 hours!! So I know we’re going to have some painful assessments coming up to cover the master insurance deductible, and to do something to prevent future ice dams. I’m also going to hire someone to take a look at the insulation in my attic (I own a townhouse condo). The whole ice dam situation was stressful enough – but knowing I have a good chunk of cash to cover the recovery helps make it all easier to deal with.

The slush fund also helps ease my mind for those occasional financial surprises like major dental work. It can also help smooth out those heavy expense months, such as December and January when Christmas bills hit.

I don’t have a detailed financial plan for the future other than to be more deliberate in my decisions. My boyfriend and I are moving in, and we’ll probably get married at some point, so that’s making me think more about what a couple should do financially as opposed to just me. So it’s probably a good thing to be in a holding pattern of sorts.

hey there, how were you able to find that detailed loan breakdown on Navient’s website? I can’t seem to find anything other than a short transaction history or a high-level account summary. thanks!

It’s right on the main page when I log-in. I never consolidated my loans (FWIW- I had no interest in lumping all my loans together for “one easy payment a month”). This may be the main reason why I can see and pay my loans differently than others can with Navient.

Hi Matt,

I’m so inspired by you, Ashley, and Hope to get rid of the debt that I have over me. Keep up the good work!