by Ashley

It’s happening…

I decided to focus on the car in our current debt repayment strategy. That means it is going to be the recipient of our monthly snowball (fyi, the snowball was $1055, but that’s added on top of the existing car payment of $411, making the minimum monthly car payment = $1466, which I’ve just rounded up to $1500). We will also pay additional monies toward the car if we end up having money leftover at the end of each month. Since we’re now living on last month’s income and pre-budgeting our entire month, I don’t anticipate that we’ll have large surpluses at the end of the month. However, I do try to err on the side of caution when planning the budget (particularly in reference to utilities or other variable expenses) so I do hope to have at least a couple hundred leftover at the month’s end.

Aaaaaaanyway….

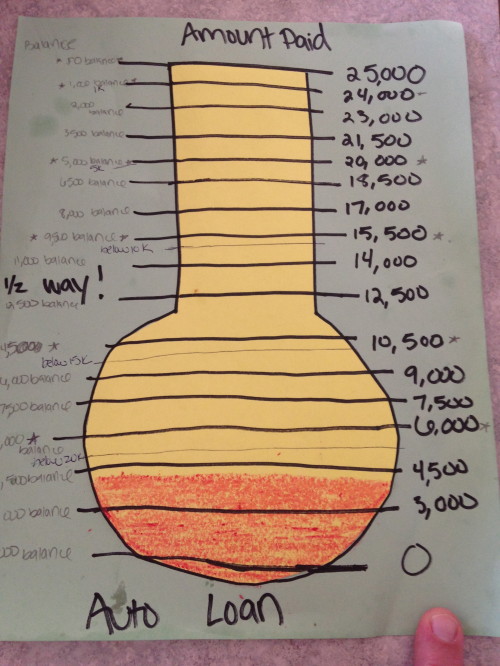

I decided to make another one of THESE bad boys to help with the motivation.

I apologize for the unsightly food splatter. The thermometer lives in our kitchen and it appears it has been splattered once or twice with food or water. Ick!

I had made this thermometer back when I made the one for my Wells Fargo credit card, but its been growing so, so slowly. Now that we’ll be making larger payments I can’t wait to watch the red grow! We do have a good amount of debt to cover, but if we really buckle down I’m sure we’ll get there in no time. After all, when I started my Wells Fargo thermometer we still owed $7,000 on it and we managed to pay it off in just two months!

Can’t wait to pay off the car ASAP!!!

Is there one debt you CAN’T WAIT (or couldn’t wait) to pay off? My first big one was the Wells Fargo card. The car is definitely the next in my line of fire!

Hi, I’m Ashley! Arizonan on paper, Texan at heart. Lover of running, blogging, and all things cheeeeese. Freshly 40, married mother of two, working in academia. Trying to finally (finally!) pay off that ridiculous 6-digit student loan debt!

Umm, I can’t wait to pay off all my debts! But right now I’m focused on my furniture loan (projected to be paid off in September!) and then my lowest balance store card (projected to be paid off October/November!). Can’t wait to eliminate these two monthly payments and finally get teh snowball rolling!

That’s awesome! It feels great to finally get some “wins” under the belt! Good job!

I’ve been pretty silent but wanted to say JUST DO IT!!!! And, it gets better. We’re pretty excited because my son is starting K at an excellent public school in a few weeks, which drops our daycare rate from $775 to $450/month. Hang in there!

Wooo!!! What a help I’m sure that savings will be!! Good luck with your son’s first day at school!

Hi Ashley-

I think this has been mentioned before but just in case it has not: make sure that the bank is applying your snowball payment to the principal of your loan and not just forwarding the date of your next payment (like student loans tend to do). I am excited to see a new thermometer and will be cheering you on as you fill it in!

Cheers,

Meghan

P.S. I know Adam and Emily had to much on their plate to be regular bloggers but I know Adam has remained active in the BAD community, with Jim gone and Steph on hiatus would Adam consider giving us an occasional (say once a month) update? I would love to hear if you got your food budget under control, any debts get completely paid off, how the tenant in your guest house is working out, have you updated the goats shelter, any success with your vegetable garden, etc. 🙂

Meghan,

I emailed Jeffrey a couple weeks back offering to do an update or two but did not hear back.

Goats now have a good shelter and the new poultry coop is almost finished. we have 5 chickens and plan to get a few ducks. veg gardening is slowly growing but in this texas environment we have a hard time getting things to grow. very difficult.

My Direct Loans (4 loans originally $42k) are now paid off. next loan should be gone in february, and still on track to pay everything off by the end of next year.

Food budget still evades us but we have started paying our bills out of savings so whatever gets direct deposited to checking is ours to spend, so we control our spending that way.

rental house is working out nicely, tenant just renewed for another year. 2 rental houses in indiana are full and cash flow about $700-800/month. took a while to fill up one unit so it was breakeven for a while but now we’re doing good.

If Jeffrey wants me to do a couple of updates here and there i’m happy to, but thanks for asking.

Adam – email me your post and I’ll throw it up on Tuesday like a total rogue Tuesday-stealing thief! mwhahahaha!!!!

For real though, glad to hear the good news updates! That’s great progress!! : )

Adam, glad to read you’re doing well.

I too would like updates on your debt situation every now and then.

Adam that is such great news! I am glad you are doing fine. I was wondering about the goats too:)

I love that visual motivation you have made for yourself. When I started to really hit my student loans hard, I had already paid off a significant amount of consumer debt and had spent two years building up a sizeable emergency fund (along with moving cross-country using cash) I hated that I had one loan outside of my consolidated loans: Wells Fargo. One day, after consulting my husband, we wrote a check for $5,000 and killed that sucker. It felt great to get that high-interest loan out of my life. There was also something wonderful about having the money to just take care of something worry-free.

I am so on board for an Adam & Emily update – or any of the previous bloggers. I am glad to see how active Adam has been on BAD since leaving as a blogger.

I would also like to know how Claire is doing. She had so much on her plate with two children, an apparently uncooperative/unsupportive ex-husband, a possible stepmother to her children, a new apartment, etc., etc. She did at least have a high income, so it seemed like she would be able to be successful in getting rid of her debt. I hope she is continuing to make progress.

Yes, I am also hoping, Claire is doing well & gets to kick debt in the butt!

I’d like to have another blogger or two. Ashley is doing great and Hope is coming along. Stephannie is taking care of business (appropriately). I’d like to see Matt and perhaps a new blogger-perhaps a retiree or someone without student loan debt a different stage in life (no offense to anyone, just a different demographic).

Agreed!

Ashley, have been following along with your journey and just wanted to come out of lurk mode to say you are doing SO WELL! it must be so encouraging to look back and see where you were then, and where you are now. You go girl, and keep going with the terrific work!

Thanks Eviva! I appreciate the kind words!