by Jim

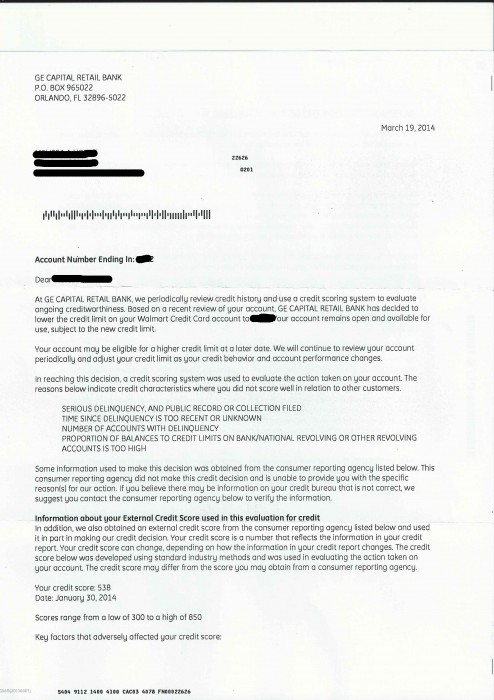

And here is just one of the ramifications of the house going into foreclosure. This is our third letter from this credit card company. And this is just the one card. Most of the time they lowered our credit score and bumped up our APR. It seems every time I pay a good down, they lower it to an amount a few dollars more than the current balance. Now I don’t really care, since I haven’t used this credit card in over a year… But a reason I hate it is, that my income to debt ratio isn’t getting better. It is saying that the credit balance is like 99% maxed.

There is no way to get my wife’s credit score to become better if they keep lowering. Remember how I said we got her score to about 750? Well it took about six months of the ex not paying on the mortgage to get it to about 650, and then after the foreclosure started it dropped to this minuscule number.

As stated in my introduction, this is a priority of mine to get both of our credit scores back up into the mid 700s. Guess I have to do some studying again. :-/

I had that happen a couple of times in the past; I also had my interest rate increased. All because of stuff that had nothing to do with the companies that enforced these actions. I cancelled those cards without looking back and I never do business with those companies again. When asked if I want to open an account or whatever, I tell them “no” and I tell them why. Since closing accounts supposedly lowers your credit score, it’s good to do it while it’s low already. When you get your debt paid off and your scores start to go back up you can have the satisfaction of knowing that you won’t be back to get kicked by these companies that prey on people. Good luck to you. It’s an uphill journey, but well worthwhile.

Thanks Connie,

I never thought of it like that, to cancel while the credit score is down. This is great advice, thank you very much!

Yes, it is frustrating to see your hard work go down the drain through no actions of your own. But I think you are misguided with your focus to “get good credit”. You have a stable roof over your head, a vehicle, and are swearing off credit cards once they are paid off (hopefully). Since it is out of your control I think you should just focus on debt reduction. If you turn into a debt=averse Jim then your credit won’t mean a thing. You have admitted yourself that trying to improve your credit scores has actually had a NEGATIVE effect on your life. It convinced you it was better to charge items on credit cards even when you had the cash. If you’re doing the right thing paying off your credit cards and bill payments on time the credit score will rise up on its own. I think its time you just let it go. It will free up your mental energy for more positive efforts.

I think Angie’s right. What are you currently using credit for? Is it your emergency fund/safety net? Is it the gamification angle? Are you looking to move or buy a house or car? Because you’re okay at the moment–yeah, your car loan is expensive but people said you have little other debt and it could be paid off within a year. You seem to have a workable amount of money coming in.

Your wife’s ex and extricating yourselves from his financial drama should be a priority, since his actions affect your credit score. But it’s already trashed and you have little hope he’ll get his act together before it goes down further.

I want to make this a priority, I just don’t know how to even begin.

I agree with both of these posters. You have a mortgage that has been in arrears for at least 7 months – I think its too late to magically get your good credit back.

Now your job is to get rid of this mortgage with the lowest possible cost and in the shortest possible timeframe to you. Do not believe a word the ex says and only worry about you and your family. Let it get foreclosed if you have to, but do not spend any more money or time on it.

If you really believe in your heart that a short sale or modification is possible (this is less bad than a full foreclosure) AND you are reasonably certain the ex will not derail it, then go for it. And go for it full-tilt to get it done as quickly as possible. Otherwise, let the house go and move on. Don’t put anymore money into mortgage payments, fees, fines etc. The sooner it is done, the sooner you can accept the consequences and move on to establish new credit.

Best of luck to you!

Thank you Scooze. The modification has been approved and starting the beginning of next month is the three trial months. I agree to let it go, but now he brought it back from the grave. There was going to be an auction for the foreclosure, but he stopped it.

You are so right Angie!!! This comment really opened my eyes, so thank you!

I’ve never had an issue with credit score. I don’t believe it is as important in Canada (certainly I never see articles about it here unless they are in US publications.)

I do accept the US seems obsessed with it.

So I think both Connie and Angie’s posts are very wise.

Since you have no intention of using credit cards, ditch as many as possible NOW while they can’t do much damage to your credit rating and get yourself out from under the power of the card issuers.

Giving yourself control over your future is very empowering. I operate outside the system as much as possible (never had a business loan, ditched personal loans asap, self insure for a lot of things) which gives me the power to say blow off to anyone who doesn’t want to do business with me according to my terms. It is a wonderful feeling to say NO to anyone offering me a ‘deal’ since, at a glance, it is easy to see how these deals are designed to make me dependent on others.

I really love the idea of self insuring. I am really looking toward that part of my debt journey.

I feel for you guys!!! This happened to us when we first moved to Tucson and had our credit completely maxed out. As soon as we’d start making little dents in paying down our CC debt, they’d lower our total available credit. We were stuck in the terrible cycle for a loooong time (of course, we weren’t gazelle intense at that point, so it stretched out longer than it should). Just last month we FINALLY dipped below the 50% debt-to-credit ratio threshold. Still not ideal (I’ve always read that 20% is the best – from the credit score company’s perspective), but a lot better than it used to be. It’s tough! : (

It’s really tough. It doesn’t bother me, since I don’t plan to use them, but it does bother me ya know?

Hey Jim – I just wanted to leave a quick note to make sure your account info is secure. Please black out the numbers on on the bottom of the letter or crop the photo. I don’t think it’s related to your account, but just in case!

I will do just that thanks ECD!

CanadianKate- here in canada credit scores are HUGELY important. You’re credit score determines whether you can get a loan (car, personal,student, line of credits) mortgage, credit card and what the interest rate will be that you pay.

Jim- you can try as hard as you want to get your credit score up but is it worth it since as long as the ex is around it can plummet due to the mortgage in you’re wife’s and his name.

You are right, I am not going to make this priority until we get the house taken care of.

I agree credit-worthiness is important but I don’t know anyone in Canada who knows their ‘credit score’ number or is actively working to change it. My son has no idea of his (if that sort of number exists here), but was shocked when he went to get a credit card that his paying utility bills and rent (to a major corporation) for 3 years didn’t count towards his credit worthiness. All the credit card companies would consider was his salary and as far as they were concerned he had no credit history (because he shared a credit card with me and bought his car with cash.) The card companies wouldn’t tell him what his score was or should be, they just looked at history.

As well, none of my kids have been asked to give access to their credit history when applying for a job but I’ve heard that is done in the US so one’s credit score counts beyond getting mortgage or lease or credit card.

BTW: I have no idea what my score is. It certainly isn’t on my Equifax credit report and I don’t have a clue where I’d find it. Don’t need it (I referred my landlord to my financial adviser for a reference when my employment income wasn’t enough to cover my new apartment – of course it wasn’t, I’m semi-retired, but the $400K from the sale of the house will cover the rent for a year or two or 25 so I told them not to worry about my employment income and to talk to my financial adviser if they needed confirmation of assets.)

Your credit score is important but providing financial stability for your family is more important. In your shoes I would be focused on building an emergency fund, increasing income, cutting expenses to the bone and paying down debt. The credit score will eventually come but don’t be focused on it at this point in the journey.

You are so right Juhli. This is our first month adding to our emergency fund and running on a budget. Let’s hope everything works out

I agree that you shouldn’t worry about your credit score right now. You aren’t planning on needing credit anytime soon so just focus on gettin rid of the house if you can and pay down debt. If this mortgage modification doesn’t work just let the house go to foreclosure. Yes that would suck but at least you would be rid of the headache.

If I understand correctly, the only reason your wife signed the loan modification papers is because she wants a good house for when your daughter stays with her father. Do you have a formal custody agreement with the ex? If not, I would suggest that you get one drawn up and tie the house to the custody. If ex doesn’t keep up the payments, he loses custody/visitation until he gets a suitable place to live. Then there is no reason to worry about house payments or where your daughter will stay.

I agree completely. It’s time to stop catering to this jerk and start fighting fire with fire. He sounds manipulative and bitter, and as if he’s been calling all the shots so far, which has got to stop. He’s a bully, and bullies will continue until you stand up for yourself. Stop playing his game and get really pleasantly, but remotely, firm. Don’t ever let him see you get emotional in any way, and don’t react to his antics except by legal means. People like that feed on your reaction, which is exactly what he’s been trying to do so far.

Review the custody agreement, and see if you can get it revised to include the house. You need to get a (much better) attorney involved. The longer you let this fester, the worse it will get, and the worse his behavior will become.

It’s funny thinking of him as a bully, since he looks like a scrawny nerd, haha. But you are right about this, and I never saw it like that till you pointed it out. I never backed down from a bully and I don’t plan to start.

You know what it is funny, my attorney I hired just made DA of our county.

Very true. We have a formal custody agreement stating that there is a 50/50 split custody. We have to talk and agree on all things medical and educational as well, which almost resulted in our daughter not starting kindergarten on time. Not so sure if we can tie the house to the custody, since custody is domestic relations and the house is a civil matter. I will have to do research on this.

Yeah, don’t do that. If he’s got a known history of jerking people around and you are trying to take one of his primary jerk tools (the house) away, he’s going to retaliate through what he’s got left (the daughter). I’d keep treating it as separate matters.

The entire credit score thing just drives me crazy! I am older and remember a time when credit scores did not even exist. I really think it is one of those scams perpetrated on the American public by the banking industry. I have actually heard people say their goal is to have a credit score of zero. Essentially they mean that they want to have a mortgage paid off, no car loans and pay cash for everything else. My husband and I took this step when we downsized our home to something we could pay for with cash, paid off our car loans, and now live very simply in a home about one third the size of our former place. When I look at some of the interest rates here on credit cards, it just makes me angry! Who else gets to make this kind of interest?

Now, I feel we can just say to the banks and credit card companies, “Get lost.” Jim, I have to agree with what people say. Focus on the debt, and someday the credit score will improve, if it is even important to you then.

Haha, I was just reading a few articles of the “0” credit score, and was planning on making an article here about it. Thanks Kiki for the kind remarks!

We went through a short sale in 2012. Well technically just my husband, but it was worth doing in our case. His credit took a hit, but not even a full two years later and he’s already back up to the 700s and has been able to open new accounts. Sometimes you need to look at the bigger picture and not worry about your credit score. I remember receiving the credit card letters as well. It’s overwhelming at first. I’d suggest trying a short sale instead of a foreclosure. You’ll bounce back a lot quicker in terms of credit scores. First Step (comment above me) has a good point about a custody agreement though.

The matter is, I am going to somehow have to force this guy to sell. I am not sure I can afford to go through another legal battle.

What if your wife contacted an agent to see what the house would list for? As co-owner she certainly has the right to do that. Maybe the thought of money coming in (or being released from mortgage payments or in his case, non-payments) will be enough to interest the Ex in selling. Sometimes it is just a matter of hearing from an outsider what might be a good course of action, rather than someone who seems to be harping.

I agree with previous posters to not worry about your credit score at this time. Get your financial house in order, and the score will recover.

Regarding the ex – a friend gave me good advice “you can’t fix crazy”! So don’t try and “reason” with him about a safe/nice house for your daughter, don’t try and play his manipulation games (crazies will always win those because that’s what they enjoy) and don’t allow his poor behavior/decisions affect your future. Get a good attorney, be clear on what outcome you want (total detachment of finances), and free yourself. He will continue to play on your concern about your daughter’s welfare and if that’s a concern you need to get social services/custody involved. I bet the minute you do that he will cave.

Also, keep a diary/record of all your interactions with him regarding your daughter and house. It may come in handy down the road.

Thanks for the great advice Den!

I have been loving this blog since the change to multiple bloggers! But Jim, your woe is me attitude is not my favorite to read. I want to see you win! I’m a believer that we attract things to us based on our attitude and who we surround ourselves with. You spent the money on the credit cards and you signed the modification (or didn’t stand in the way of your wife) so stop whining about the ramifications. Now is the time for action and to win! I would love to see you doing creative things to earn more money and paying down your debt rather than complaining. I have been on the get out of debt journey for a little over than a year myself. I honestly wish the best for you and am hoping for a happy ending for your family!

You might take these posts as the way you are reading them, Ashley. It wasn’t until I started to blog here, that I did have the attitude that I have bad luck. I have since destroyed that idea. Basically this post tied in with my last post, which was bringing everyone up to date with my financial journey. What caused everything to happen and how my thought process is. So I can see where you are coming from.

Hopefully there won’t be much of these kinds of posts in the future, for now we are to the present day.

I know it’s been said before, but I just want to add my “like” to all the comments that I really hope you can put the whole credit score thing aside for now. Speaking from experience, I had A LOT of debt, and I decided to focus on paying it off and when I was done (YEARS LATER), I went to apply for a mortgage and found out that I had excellent credit. Just getting your financial house in order will make it move, and like others said, hopefully in the end you are credit averse because you’ve paid off your debt and have CASH to pay for most everything. Put that letter in the file, and just get back to work. You will dig yourself out of this. Best of luck to you!