by Hope

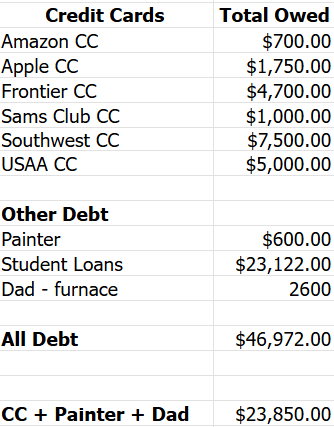

Thank you for all the notes, definitions, constructive criticism. Without further ado, here’s take 3 of my post sale budget.

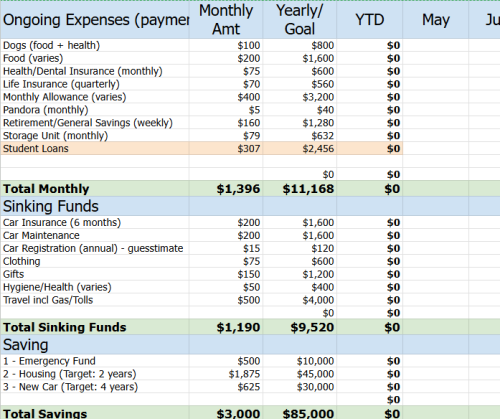

Notes: Monthly Bills

I will revisit the life insurance after I get settled in Texas, but for now it remains.

Yes, I am giving myself a $400 monthly allowance. I have no clue if/what I will spend that on. But I am giving myself permission to have some sort of social life and explore this area where I’ve never lived before. Not to mention, this gives me the means to take a break from the house/caretaking every week which will be very much needed for both mental health and because the internet at my parents’ home is terrible for the most part.

Someone did ask about my phone/hotspot line item which was in Version 1, but not in Version 2. I have moved those to my business budget again now that my business is making enough money to cover those expenses. I will share that budget at a later date.

I don’t think there are any other line items that need any explanation.

Notes: Sinking Funds

I think I’ve moved all the correct categories from monthly bills to sinking funds. Thank you to whomever defined sinking funds so clearly in the comments on one of the previous budget posts. Do I have right now?

These numbers are based on 8 months (remainder of 2025) and bill dates. I won’t know my auto insurance renewal rate until August so this is based on anticipated numbers. But I’d rather over budget than under budget.

I will have more clothing costs this year so that number is about $200 more than my typical annual budget. This is because 1) wedding and 2) moving to somewhere VERY hot, and I have lost over 30 pounds recent with more to lose. (Did I tell you that not only am I the mother of the bride, but Beauty also asked me to be the Matron/Maid of Honor? I feel so honored and the note she wrote and words she said brough me to tears.)

Because my travel will be sporadic, especially over the next 8 months, I moved gas/travel to a sinking fund. My guess is that for the first 3-4 months, it will be like GA where one tank of gas lasts a month. Then come September-November, I will have some travel expenses. So the sinking fund makes sense, right?

Note: Savings

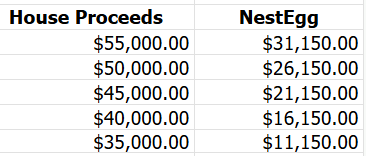

My savings goals are more long term rather than 8 months. Obviously, I want to completely fund my EF as quickly as possible which will begin with the house sale.

But the other two goals: housing and new car are more long term and I put a target date to reach those numbers there.

Car Savings

My car has over 100,000 miles on it and I the plan is to put a substantial number of miles on it over the next two years. It’s in great shape, well maintained, and a Honda. With all those thoughts in mind, my goal is to be able to purchase a newer, new to me car when needed, but hopefully no sooner than 4 years.

Housing

My goal is to cash flow land and a tiny house beginning in 2 years. There were lots of comments about not saving for this line item until I’m debt free. Here’s the deal though. I am about to be houseless. It’s my choice and I’m excited about the adventure and opportunity this gives me. But it’s not a long term plan.

If something should happen to my health or my parents, which will be my homebase for the next two years, I need to have the means to get housing for myself. This line item covers that contingency plan should I need it sooner rather than later.

Alright, I’m ready. Give me all the notes and feedback. I feel like I’m getting pretty close here.