by Elizabeth S.

Pointless Comparisons

I often compare myself to others who buy clothes and household junk weekly or monthly and think I’m pretty frugal. I am starting to see that really isn’t the case. Data collection on my spending for the month isn’t quite complete, but I’ve been able to draw some early conclusions. I know this won’t be news to most of you, but I was bowled over with a realization: My purchases are largely impulsive.

Things I Don’t Need

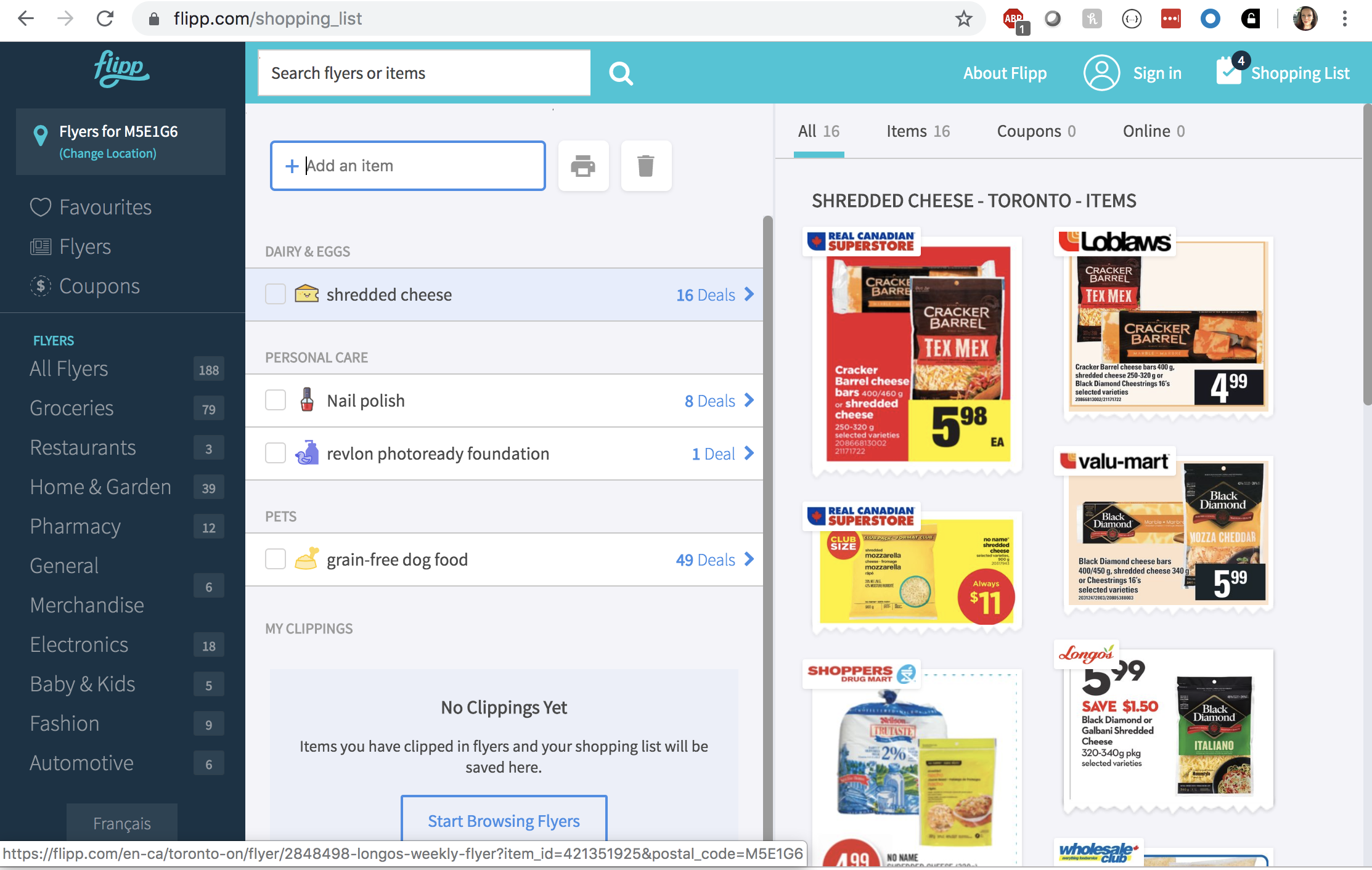

Almost everything I spend money on pops into my head within 48 hours of purchasing of it. I’ll see a recipe in a magazine or on a blog, or I’ll decide to buy some trinket that’s going to make my life so much better. This morning, I thought about how I have only a couple bottles of crusty, old nail polish. I almost went down to the pharmacy below my office on the spot. Yikes! While I used to be a perfectly-manicured fashionista, my priorities have changed. I work in a casual office and outside of work, I’m usually digging in the garden, doing DIY projects around the house, or playing with my rough-and-tumble dogfriend. I don’t need nail polish! That’s an item that can be added to my “nice-to-have” list and I can keep an eye out for a clearance sale.

The Himalayan Salt Lamp

I suppose my recent splurge could be related to finally having some cash in my savings and to put towards my credit cards after so many sleepless nights and tears. Guys, a year ago my credit score was TRASH. It was in the low 500s. I had panic attacks about it. I ended up buckling down for about eight months and getting it up to a “good” rating and then stopped all financial improvement.

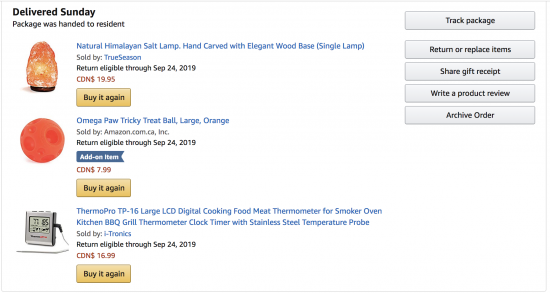

I’ve had a salt lamp in my Amazon cart since February. They’re $20 and I’ve just always liked them. I had one when I was a teenager and I was nostalgic for the warm glow. But I am not for want of lamps in my house, and I don’t believe the woo out there that says salt lamps are good for your “energy”. For some reason, I finally pulled the trigger last weekend, and for the first time ever, I felt spending regret. This purchase was purely nostalgic and aesthetic. Along with the lamp, I got a fancy in-oven meat thermometer and a treat puzzle for my dog. I looked in to returning these items, but I would have to pay $7.99 for shipping and then there’s the additional carbon footprint (I try not to do same-day deliveries and I group items together over weeks or even months for less impact on the environment).

Going Forward

I have the Flipp app on my phone and computer for searching sales, and I learned today that it has a shopping list feature! Instead of leaving things in my Amazon cart, waiting for my next moment of weakness, I can leave them in Flipp. There are wayyyy more apps like this for Americans, by the way. Canadians are apparently less app-savvy for savings!

Flipp doesn’t eliminate the need for impulse control. I don’t want to buy unnecessary nail polish at full price OR on sale. But leaving my wanted items in a list somewhere gives me some peace of mind, and taking them out of my Amazon cart with all it’s one-click-same-day-delivery magic should help a bit.

Anyone have other tips for impulse control with spending? How do you decide when you’ve “earned” something? Maybe after I hit my next savings goal, I can treat myself to some beauty and self-care items under $50. Hmmm.

Elizabeth is a single woman in her early 30s, working as a manager at a software company and living in the most expensive city in Canada. She hopes to blog about her journey to eliminate debt and build savings for home ownership someday. Whenever she has taken two financial steps forward, she’s always taken a step back with a bad credit card purchase (we’re looking at you, unnecessary iPhone of May 2019). Elizabeth lives alone with her fur kids, a dog and cat, and when she’s not in front of the computer, she enjoys running, camping, reading, and baseball.