by Elizabeth S.

Pointless Comparisons

I often compare myself to others who buy clothes and household junk weekly or monthly and think I’m pretty frugal. I am starting to see that really isn’t the case. Data collection on my spending for the month isn’t quite complete, but I’ve been able to draw some early conclusions. I know this won’t be news to most of you, but I was bowled over with a realization: My purchases are largely impulsive.

Things I Don’t Need

Almost everything I spend money on pops into my head within 48 hours of purchasing of it. I’ll see a recipe in a magazine or on a blog, or I’ll decide to buy some trinket that’s going to make my life so much better. This morning, I thought about how I have only a couple bottles of crusty, old nail polish. I almost went down to the pharmacy below my office on the spot. Yikes! While I used to be a perfectly-manicured fashionista, my priorities have changed. I work in a casual office and outside of work, I’m usually digging in the garden, doing DIY projects around the house, or playing with my rough-and-tumble dogfriend. I don’t need nail polish! That’s an item that can be added to my “nice-to-have” list and I can keep an eye out for a clearance sale.

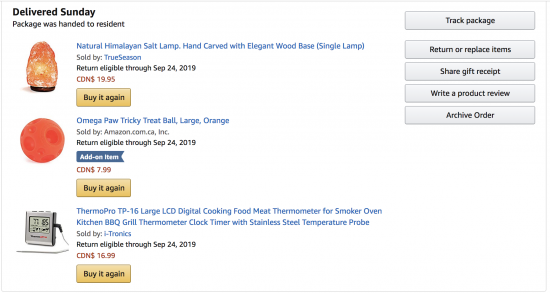

The Himalayan Salt Lamp

I suppose my recent splurge could be related to finally having some cash in my savings and to put towards my credit cards after so many sleepless nights and tears. Guys, a year ago my credit score was TRASH. It was in the low 500s. I had panic attacks about it. I ended up buckling down for about eight months and getting it up to a “good” rating and then stopped all financial improvement.

I’ve had a salt lamp in my Amazon cart since February. They’re $20 and I’ve just always liked them. I had one when I was a teenager and I was nostalgic for the warm glow. But I am not for want of lamps in my house, and I don’t believe the woo out there that says salt lamps are good for your “energy”. For some reason, I finally pulled the trigger last weekend, and for the first time ever, I felt spending regret. This purchase was purely nostalgic and aesthetic. Along with the lamp, I got a fancy in-oven meat thermometer and a treat puzzle for my dog. I looked in to returning these items, but I would have to pay $7.99 for shipping and then there’s the additional carbon footprint (I try not to do same-day deliveries and I group items together over weeks or even months for less impact on the environment).

Going Forward

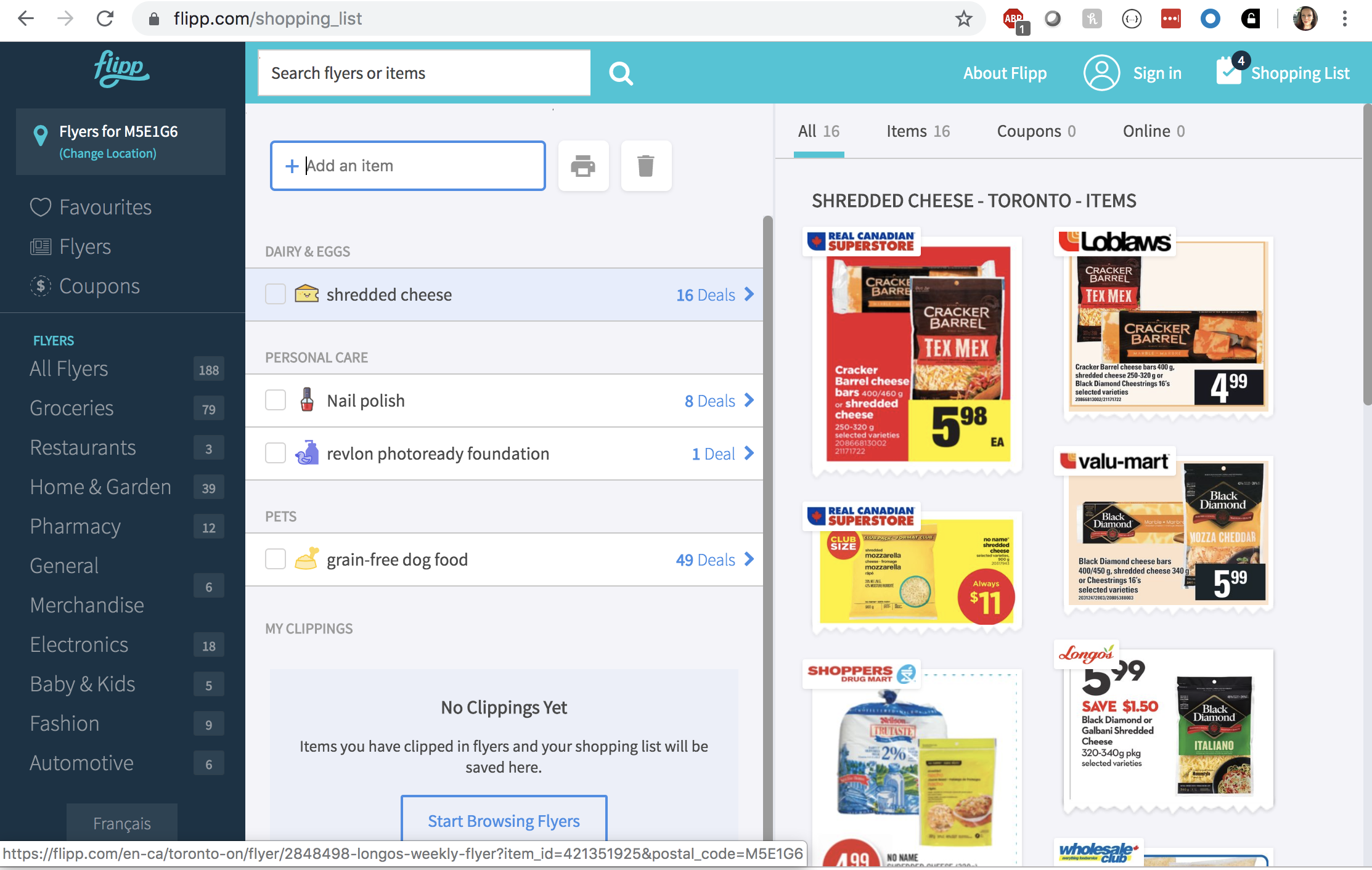

I have the Flipp app on my phone and computer for searching sales, and I learned today that it has a shopping list feature! Instead of leaving things in my Amazon cart, waiting for my next moment of weakness, I can leave them in Flipp. There are wayyyy more apps like this for Americans, by the way. Canadians are apparently less app-savvy for savings!

Flipp doesn’t eliminate the need for impulse control. I don’t want to buy unnecessary nail polish at full price OR on sale. But leaving my wanted items in a list somewhere gives me some peace of mind, and taking them out of my Amazon cart with all it’s one-click-same-day-delivery magic should help a bit.

Anyone have other tips for impulse control with spending? How do you decide when you’ve “earned” something? Maybe after I hit my next savings goal, I can treat myself to some beauty and self-care items under $50. Hmmm.

Elizabeth is a single woman in her early 30s, working as a manager at a software company and living in the most expensive city in Canada. She hopes to blog about her journey to eliminate debt and build savings for home ownership someday. Whenever she has taken two financial steps forward, she’s always taken a step back with a bad credit card purchase (we’re looking at you, unnecessary iPhone of May 2019). Elizabeth lives alone with her fur kids, a dog and cat, and when she’s not in front of the computer, she enjoys running, camping, reading, and baseball.

I use Keep, a simple google list app. It can be a holding place for links, for my grocery list, for potential gifts for others. All of that is helpful for remembering but also helpful for saving money but avoiding impulse purchasing.

I don’t completely avoid impulse purchases but I keep them in check by giving my spouse and I an “allowance.” In the beginning of our house down payment and debt pay down journey it was $ 20 every 2 weeks(enough money for a Starbucks coffee every week and a book every two weeks.) We’ve done okay for ourselves and now basically have a car and mortgage left (the total for both is under $120,000 and I presently pay my mortgage to reduce it to 20 year instead of 30 year with a little over 15 years left) and now get $60 every two weeks. If I hit my monthly benchmarks I add $30 which means $150 in “blow money” each month. Additionally we each get $ 100 of the bonuses my husband gets with the rest being divided between debt and savings(I’m toying with dividing it further so some savings is not spent on our home because……..ride on lawn mower, pressure washer…….you get the idea.) Anyway this works for us and prevents resentment when hubby wants something and it isn’t necessarily a necessity and vice versa. Once I write the money out of the budget each payday it’s gone and neither one of us gets to criticize what the money is spent on or saved for. Your situation is a little different but the idea of a set amount of money for splurge still might be better than purchasing all the things simply because there is money in the bank.

I keep a list of items that I need versus items I want. One of my go-to tricks regarding reducing carbon-footprint for me is to do the online shopping at Target for my household items such as laundry detergent and so forth. There is a target that is on the way home. It keeps me out of the store in general. I use Amazon to purchase school books and other items, but generally, I have really good control.

When I was getting in the habit of frugality, I had a 30-day list. If I wanted some random thing, I’d add it to the list with the date I thought about wanting it. If I still wanted it 30 days later, I could get it.

I like the idea of giving yourself an “allowance”, especially when you’re first starting out. Going from the “treat yo’ self” mentality to “no spend weeks” is just not going to last. Just like a food diet, slow and steady… give yourself a set amount and use it on whatever you want, no guilt. But then when it’s gone, no more spending. Even though it seems counterintuitive to encourage spending on frivolous things, in the long run it will definitely keep you from going crazy and buying whatever you want

I don’t put things directly in my Amazon cart. I use the wish list feature. I have several different wish lists for different purposes and I make them all private. Maybe a Needs list and a Wants list would work for you. They automatically note what day you added the item and you can add your own comments. I usually include a comment of how much the item was when I added it. (Amazon tells you when the price goes down, but not when the price goes up.)

Return the stuff you don’t want!