by Hope

Before you all come for me. Although, I imagine my last post triggered some of you and you’ve already let me have it in the comments. My budget in the last post was an IDEAL WORLD, not my reality and certainly not currently. Right now, it’s basics and debt.

However, there are two things I haven’t shared with you about my current finances. And based on the subject line, you can probably guess what one of them is.

I am saving for Christmas.

Saving Plan for Christmas

You will all remember that this past Christmas was a real struggle for me. But I ended up being really proud of what I was able to do with my $2.

Right after Christmas, I knew that I did not want to be in that position ever again if I could possibly help it. And I started interviewing for this new role right after the new year so I was pretty full of hope for this year.

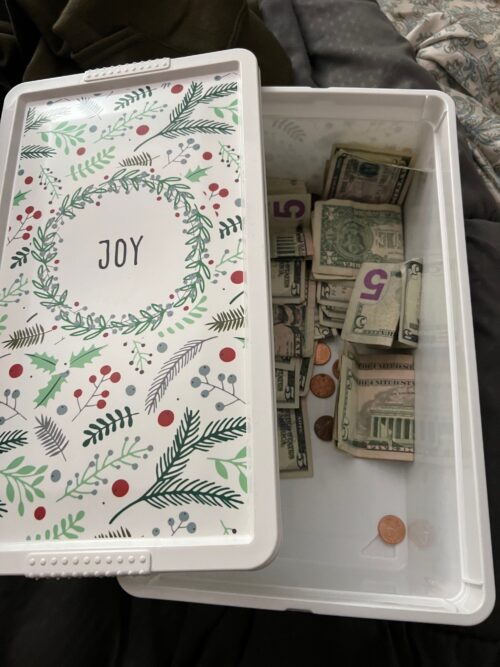

I’ve written before about my Not Spending $5 Bills.

That is how I’m saving for Christmas this year – change and $5 bills. All go into a shoebox in my closet.

Again, I know this won’t sit well with the BAD Community. So I want to caveat this with two things:

- I don’t have cash very often so this is not a mass amount.

- Playing games like this helps keep me motivated.

We shall see how it turns out come the end of the year. But I wanted you to know that I am doing this. (This is one of those things that make personal finance, personal.)

I will share the other thing I haven’t shared yet in a week or two. I am hopeful it will make at least a few of you happy with me. But you never know.

Hope is a creative, solutions-focused business manager helping clients grow their business and work more efficiently by leveraging expertise in project management, digital marketing, & tech solutions. She’s recently become an empty nester as her 5 foster/adoptive kids have spread their wings. She lives with her 5 dogs in a small town in NE Georgia and prefers the mountains to the beaches any day. She struggles with the travel bug and is doing her best to help each of her kids as their finish schooling and become independent (but it’s hard!) She has run her own consulting company for almost twenty years! Hope began sharing her journey with the BAD community in the Spring of 2015 and feels like she has finally in a place to really focus on making wise financial decisions.