by Hope

I’m very proud of myself. Here’s why…

Debt

| Debt Description | October, 2023 Total | Interest Rate | Minimum Payment | Current Total | Payoff Date (Est) |

|---|---|---|---|---|---|

| Student Loans | $22,121 | 2.875% | $307 | $19,036 | |

| CC - Apple** | $500 | $0 | May, 2025 | ||

| CC - Frontier | $3,857 | 29.99% | $0 | $0 | May, 2025 - Closed |

| Dad - New Furnace | $2,600 | 0% | $0 | $0 | May, 2025 |

| CC - USAA | $5,000 | 19.15% | $0 | $0 | May, 2025 |

| CC - Sam's Club | $0 | May, 2025 (again) | |||

| CC - Amazon | $0 | May, 2025 (again) - Closed | |||

| CC - Southwest | $0 | May, 2025 | |||

| Painter | $0 | May, 2025 | |||

| CC - AMEX | $894 | 29.24% | $0 | $0 | Mar, 2024 - Closed |

| CC - Sams | $1,106 | 29.99% | $0 | $0 | April, 2024 |

| Personal Loan #1 | $2,500 | 0% | $0 | $0 | July, 2024 |

| Personal Loan #2 | $2,500 | 0% | $0 | $0 | August, 2024 |

| CC - Wander | $1,630 | 29.24% | $0 | $0 | August, 2024 - Closed |

| CC - Amazon | $1,497 | 29.99% | $0 | $0 | September, 2024 |

| Total | $44,206 | $307 | $19,036 |

I paid $1,925 to debt in July. (June’s debt update.) For the first time in 3 decades, I have under $20K in debt, no credit card debt, rather no other debt. My car is paid off and in good shape and I am in a great place mentally.

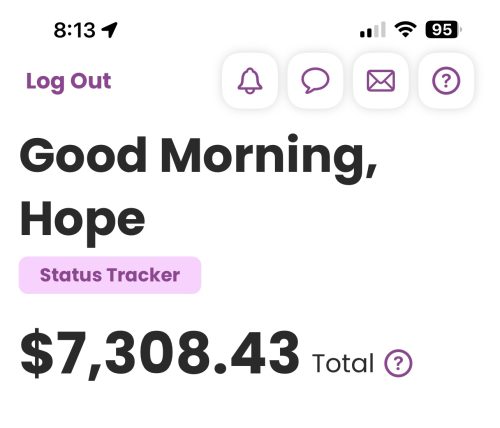

There is a light at the end of this very long tunnel. On top of that, I have money in the bank!

Savings

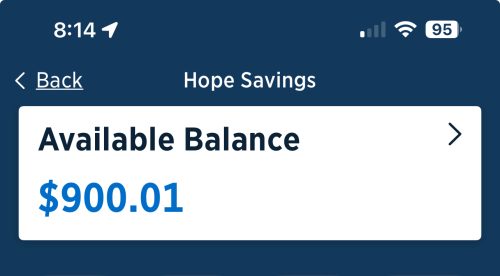

I have more money in savings than I’ve had in DECADES. And not only that, but I’m not touching it. I have no immediate plans for it (you’ve seen my Budget and the Buckets I’m using in Ally). I have literally not touched my Ally account since I initially opened it with $5,000 from the house sell.

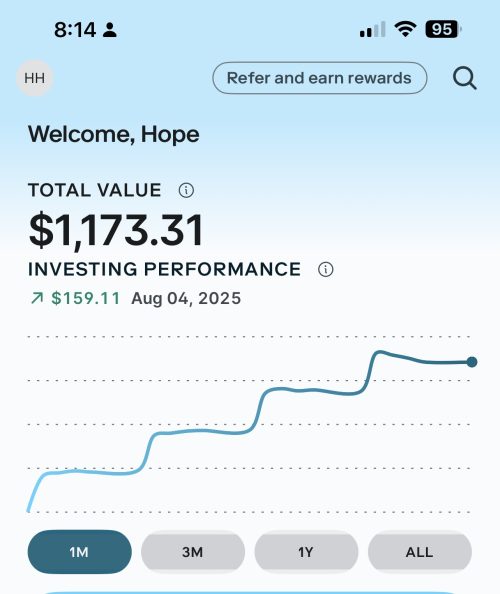

I have WEEKLY automated deposits going to both my Ally account and my investments account. (For the record, these screenshots are from the end of July.)

Summary

Listen, I know it’s not where I need to be at my age. I get that. Truly.

But I can’t go back. I can go forward though, and I am. And I am proud of myself.

My attention is split…debt and savings. Maybe not the most efficient way to do it. But I am doing it. Debt is dropping steadily, savings is growing rapidly.

I literally went from $0 in savings, living on a shoestring to having close to $10K in savings accounts in just over 2 months. And as my income grows, my savings and debt payoff goes more quickly.

This Month

Now this month, I will spend some money. Princess and I are throwing Beauty a bridal shower. I budgeted $1,500 – most coming from my monthly “allowance” that I haven’t really touched. I’ll share the details on how that goes later as I’m still trying to figure everything out. As of today, I’ve spent the following:

- $33 for invitations. I designed them on Canva and then had them printed there. I used stamps I had so not counting that expense.

- $50 to hold the event space. I will pay another $200 before the event. The event space includes tables, chairs, table cloths, and serving ware.

- $11 for my flight to and from ATL – yes, more points.

- $196 for table decorations (flowers) and supplies for an activity.

I know I’m going to supply some food. And another game or too – thinking of the toilet paper to make wedding dresses. I’m honestly just feeling my way as I’ve never had a bridal shower or attended one. But it will be fun to experience this with my girls and celebrate Beauty!

Hope is a resourceful and solutions-driven business manager who has spent nearly two decades helping clients streamline their operations and grow their businesses through project management, digital marketing, and tech expertise. Recently transitioning from her role as a single mom of five foster/adoptive children to an empty nester, Hope is navigating the emotional and practical challenges of redefining her life while maintaining her determination to regain financial control and eliminate debt.

Living in a cozy small town in northeast Georgia with her three dogs, Hope cherishes the serenity of the mountains over the bustle of the beach. Though her kids are now finding their footing in the world—pursuing education, careers, and independence—she remains deeply committed to supporting them in this next chapter, even as she faces the bittersweet tug of letting go.

Since joining the Blogging Away Debt community in 2015, Hope has candidly shared her journey of financial ups and downs. Now, with a renewed focus and a clear path ahead, she’s ready to tackle her finances with the same passion and perseverance that she’s brought to her life and career. Through her writing, she continues to inspire others to confront their own financial challenges and strive for a brighter future.

So, what do you think ?